XAG/USD Rally Hits Pause As US Says No To Tariffs On Critical Minerals

Image Source: Pixabay

Silver price (XAG/USD) trades over 2% lower to near $90.40 during the Asian trading session on Friday. The white metal struggles to extend its rally after posting a fresh all-time high near $93.90 on Wednesday.

The asset has come under pressure as the United States (US) deferred tariffs on imports of critical minerals. On Thursday, US President Donald Trump ordered Trade Representative Jamieson Greer and Commerce Secretary Howard Lutnick to "enter into negotiations with trading partners to adjust the imports of critical minerals so that such imports will not threaten to impair the national security of the economy”, Reuters reported.

The statement indicates that the US is insufficient to become self-reliant for its needs of critical minerals, which is used in various industries.

Earlier, the Silver price rallied as traders loaded it significantly in fear of the imposition of tariffs on its imports.

Technically, the scenario is favorable for the Silver price in the long run, as it highlights its necessity by the US.

Additionally, firm expectations that the Federal Reserve (Fed) will hold interest rates steady in the policy meeting later this month have also weighed on the Silver price. Theoretically, a pause in the Fed’s monetary easing campaign weighs on non-yielding assets, such as Silver.

Silver technical analysis

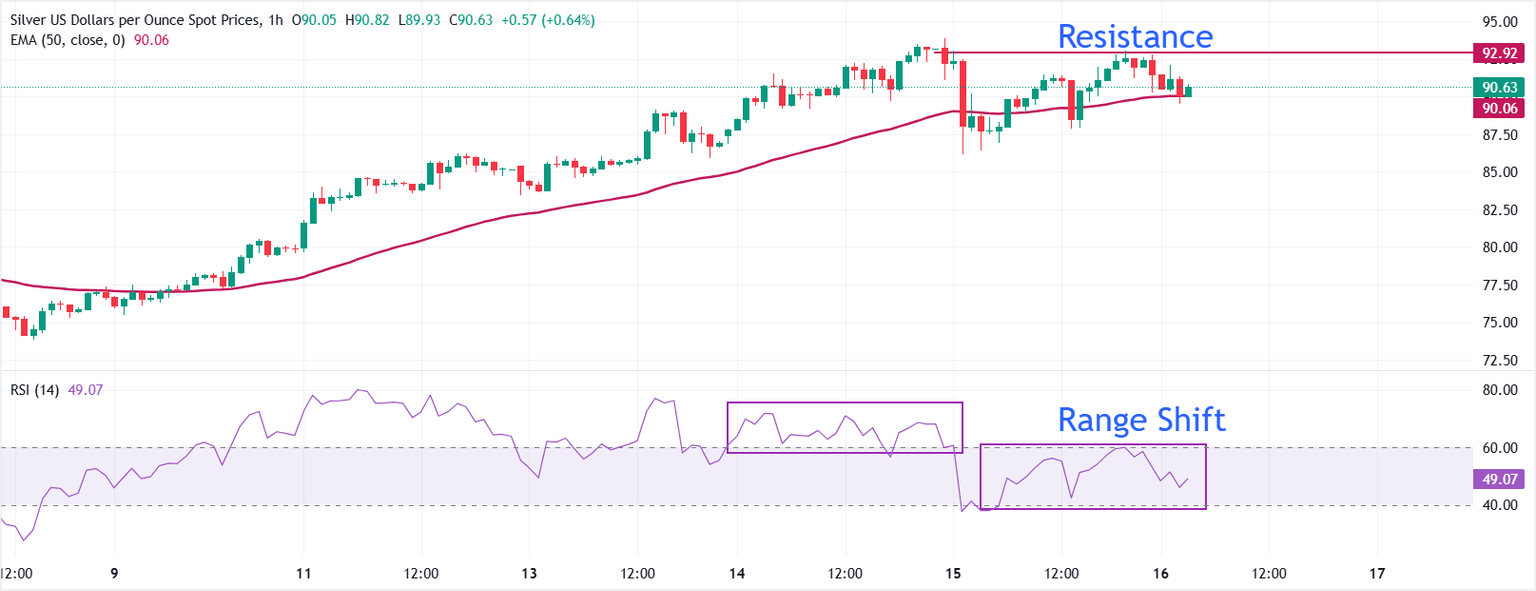

XAG/USD trades lower at $90.63 as of writing. The 50-hour Exponential Moving Average (EMA) rises and sits at $90.06, supporting the short-term uptrend as the price holds above it. The 50-hour EMA's upward slope underscores an improving trend-following support.

The range shift move by the 14-hour Relative Strength Index (RSI) from the 60.00-80.00 zone to the 40.00-60.00 area suggests that the bullish momentum has terminated at least for now.

Going forward, the all-time high of $93.90 will remain a key barrier for the Silver price. On the downside, the price could fall to the January 13 low of $83.62 if it breaks below the January 15 low of $86.19.

More By This Author:

Pound Sterling Rebounds Slightly As UK GDP Returns To GrowthUSD/INR Expects Cautious Start On Friday As Oil Price Cools Down

Pound Sterling Trades Higher Ahead Of Key UK GDP Data

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more