U.S. Consumers Are Feeling The Pinch Of Higher Prices

Image Source: Pexels

MARKETS

The S&P 500 soared to yet another record high on Tuesday, fueled by a stunning surge in Nvidia shares. The chip maker leapfrogged Microsoft to become the most valuable U.S. company for the first time, as traders bet that potential Federal Reserve rate cuts will keep the bullish momentum alive.

However, the economic data released on Tuesday added some shades of gray to the rosy market picture. U.S. retail sales rose less than expected in May than the previous month, signalling a slowdown in consumer spending. This lacklustre performance in the week's only major macroeconomic release continues the data trend hinting at a deceleration in U.S. economic activity. While the jobs report, which is now being considered an outlier, showed strong headline numbers, the broader economic data points to growing challenges for consumer spending in real terms.

Conversely, industrial production exceeded economists' forecasts, showcasing robust activity in the manufacturing sector. This contrast between retail sales and industrial production highlights the ongoing puzzle in interpreting the U.S. economic landscape, where different sectors show varying levels of performance month after month.

The disappointing retail sales figures should underscore and amplify the narrative of an economic slowdown, supporting a more cautious outlook. April’s weak retail sales had already hinted at a sluggish start to the second quarter. May's underperformance strengthens the evidence that consumers are feeling the pinch of higher prices, potentially leading them to keep tightening their purse strings.

Time will tell if Nvidia can truly deliver on its sky-high expectations, as its staggering $3 trillion market value leaves no room for error—or even a minor glitch. Yet, Nvidia’s meteoric rise has shone a spotlight on the indispensable role of semiconductors in today’s economy, buoying the entire semiconductor manufacturing sector along with it. It’s like watching a rising tide lift all the silicon ships.

Meanwhile, things were a bit more chill in other market corners ahead of the Juneteenth holiday. The Dow inched up by about 57 points, or 0.2%, closing at 38,835. The S&P 500 nudged up 0.3%, while the Nasdaq barely moved the needle with just a fractional gain. Outside of the tech sector's flights of fancy, it seems much of Wall Street decided to take a breather and enjoy the calm before the next storm.

In summary, while the stock market—particularly tech shares like Nvidia—continues to reach new heights, the underlying economic data suggests a need for caution. The potential for Federal Reserve rate cuts remains a key factor in sustaining both market and economic optimism.

FOREX MARKETS

The euro has found some stability at the start of this week, hovering just above the 1.0700 mark against the US dollar after dipping to a low of 1.0668 last week. Similarly, the 10-year yield spread between French and German government bonds experienced a modest increase of 2 basis points (bps) yesterday, a calmer move compared to the sharp 16 bps rise in the final two days of last week. Currently, it is around 80 bps, and this spread has significantly widened since French President Macron called for a snap election, up from nearly 48 bps and reaching its highest level since February 2017, when it peaked at 79 bps. Surpassing this peak would push the spread to levels last seen during the eurozone sovereign debt crisis of 2011-2012.

This recent widening has understandably drawn more scrutiny. ECB President Christine Lagarde remarked that officials are "attentive to the good functioning of financial markets," yet their vigilance remains cautious. Similarly, ECB Chief Economist Philip Lane downplayed the need for immediate intervention in the French government bond market. While emphasizing that the ECB cannot allow market panic to disrupt monetary policy and highlighting the importance of the Transmission Protection Instrument (TPI) for the monetary union, Lane characterized the current situation as "market repricing, and not disorderly dynamics."

NVIDIA LEADS THE MAG-7 PACK

Nvidia’s (NVDA) market capitalization skyrocketed to an impressive $3.34 trillion on Tuesday, leapfrogging Microsoft's $3.32 trillion and claiming the top spot among U.S. companies. Apple, trailing close behind, clocked in at $3.27 trillion. It’s like watching tech giants in a high-stakes game of leapfrog, and Nvidia just nailed the landing.

Nvidia shares jumped 3.5% on Tuesday, while Microsoft stumbled with a 0.5% dip, and Apple slipped 1.1%. Recently, Nvidia joined the exclusive $3 trillion market cap club, a feat previously reserved for only the mightiest of tech titans.

This meteoric rise isn’t just a flash in the pan. Over the past year and a half, Nvidia’s stock has been on a relentless upward climb, powered by its unmatched processors that fuel artificial intelligence systems, including the ever-buzzworthy generative AI like OpenAI’s ChatGPT. It’s like Nvidia handed out energy drinks to its stock – it’s up roughly 174% for the year, making it the S&P 500’s star performer in 2023.

Under the savvy leadership of CEO Jensen Huang, Nvidia has usurped Microsoft in a dramatic showdown for tech supremacy. Just last month, Apple briefly basked in the glory of being the most valuable U.S. company following its flashy Worldwide Developers Conference, showcasing new generative AI features for the iPhone. But Apple’s time at the top was short-lived, slipping back below Microsoft just a day later.

In a move that added more fuel to its rocket, Nvidia completed a 10-for-1 stock split on June 7. And to keep things interesting, the company reported another blockbuster quarter last month, with a jaw-dropping 262% increase in revenue and a 462% surge in profits year-over-year.

So, as Nvidia continues to ride the AI wave, it’s clear this chipmaker isn’t just playing in the tech sandbox; it’s building the biggest castle. With the tech giants in a constant shuffle for dominance, one thing’s for sure: in the battle of the behemoths, Nvidia is holding its ground and then some.

BANK OF AMERICA FUND MANAGER SURVEY

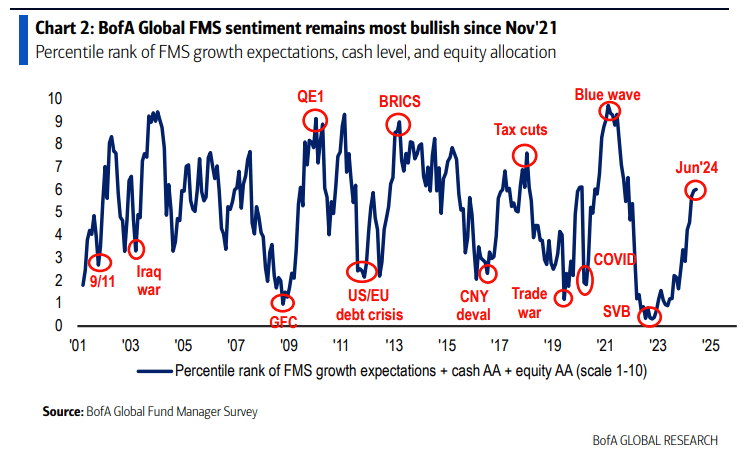

Fund managers are displaying the highest levels of bullishness since the peak of the so-called “everything bubble.” This insight comes from the June installment of Bank of America's widely followed survey, which polled over 200 professionals managing a combined $640 billion in assets under management (AUM).

(Click on image to enlarge)

The survey's key metric, which aggregates cash levels, stock allocations, and growth expectations, shows a significant shift in sentiment. Here are the main highlights from the survey:

-

Cash Levels: Fund managers have reduced their cash holdings, indicating increased confidence in the market and a willingness to take on more risk.

-

Stock Allocations: There is a notable increase in equity allocations, reflecting a strong belief in continued market gains, particularly in sectors such as technology and growth stocks.

-

Growth Expectations: Optimism about economic growth has surged, driven by factors such as cooling inflation, potential Federal Reserve rate cuts, and resilient industrial production.

This aggregated sentiment suggests that fund managers are gearing up for a sustained bullish market environment. The combination of lower cash levels and higher equity allocations points to a consensus that the market will continue to perform well despite mixed economic signals.

Implications for Investors:

-

Positive Outlook: The heightened bullish sentiment among fund managers can be seen as a positive signal for individual investors, suggesting confidence in the market's future performance.

-

Risk Appetite: With fund managers reducing cash and increasing stock allocations, there may be more volatility ahead, but the overall trend appears to be upward.

-

Economic Data: While fund managers are bullish, it's crucial to remain aware of economic data, as mixed signals (like the recent retail sales vs. industrial production reports) can still impact market dynamics.

More By This Author:

Rate Cut Optimism Drives U.S. Indexes To Fresh Record Highs

Rates Traders Are Now Fully Expecting Two Cuts This Year

As France Teeters On The Political Cliff Edge , U.S. Stocks Rally