Two Trades To Watch; GBP/USD, DAX

Photo by Colin Watts on Unsplash

GBP/USD rises as wages & unemployment rise. DAX looks to German ZEW economic sentiment data.

GBP/USD rises as wages & unemployment rise

GBP/USD is rising after mixed UK jobs data. On the one hand, unemployment unexpectedly rose to 3.6%, up from 3.5%, employment fell to 75.5% and the claimant count rose by 3.3k, defying expectations of a fall of 12.6k. These figures suggest that cracks could be starting to appear in the UK jobs market.

However, wages also rose at the fastest pace in more than a year, gaining by 5.7%, up from 5.5%. The news will concern the BoE as rising wages add to inflationary pressures. However, the rise in wages is still well below the UK’s double-digit inflation, suggesting that the cost of living crisis is deepening.

Looking ahead, US PPI data could help lift the pair further. US PPI is expected to tick lower to 8.3% YoY in October, down from 8.5% in September. PPI is often considered a lea indicator for CPI, and so a cooler PPI could suggest that CPI could also fall further.

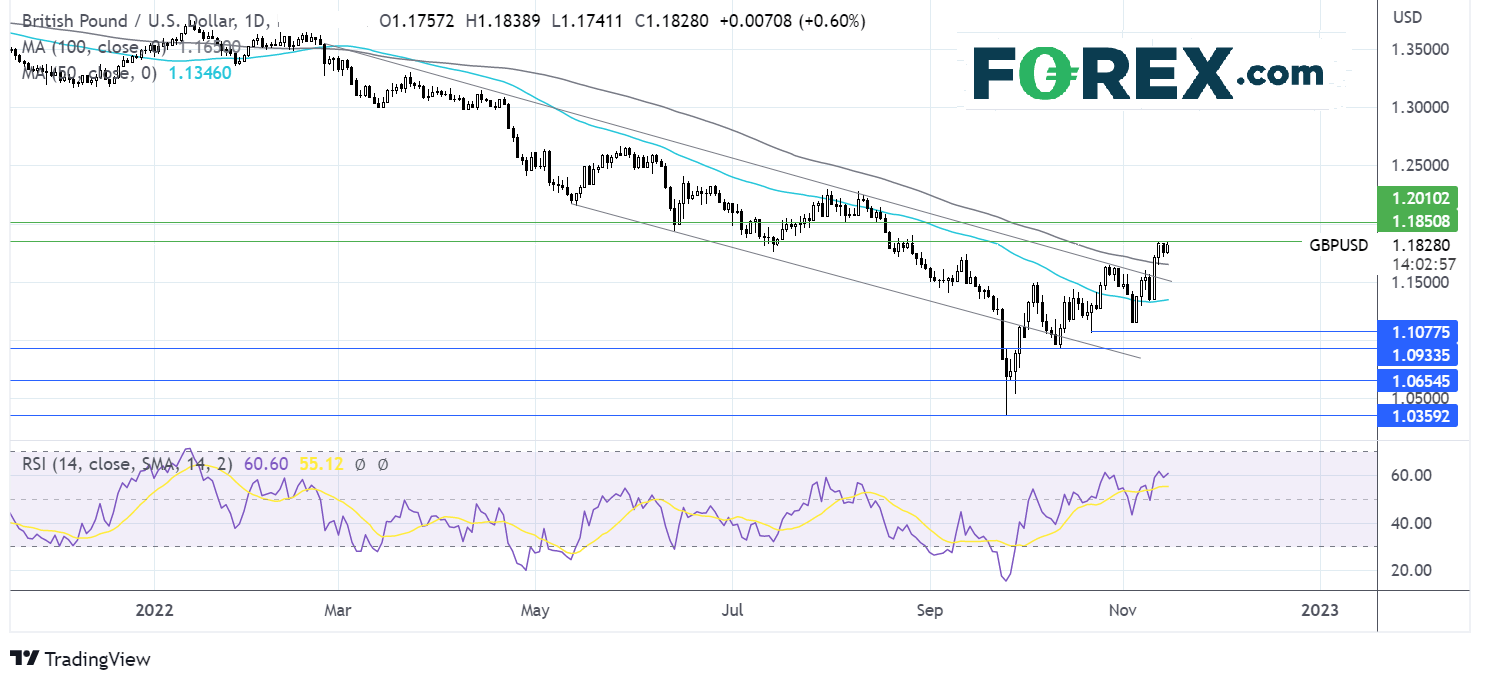

Where next for GBP/USD?

GBPUSD has pushed above its 50 & 100 sma and holds above 1.18. This, along with the bullish RSI, keeps buyers hopeful of further gains. Buyers will need to rise over 1.1854, the November high, to extend the bullish trend towards 1.20, the psychological level.

Sellers could look for a fall below 1.2650 the 100 sma, which opens the door to 1.15, the falling trendline support. A break below here exposes the 50 sma at 1.1350.

(Click on image to enlarge)

DAX looks to German ZEW economic sentiment data

The DAX is set to open higher, tracking gains in Asia, after an encouraging meeting between President Biden and China’s Xi Jinping. The bar was set low, so the fact that they have agreed to resume talks of key global matters is a step in the right direction.

Attention is now turning to Eurozone GDP data, which is forecast to confirm the preliminary reading of 0.2% growth. The eurozone is expected to contract in Q4 of this year and Q1 in 2023 before recovering in Q2 next year.

German ZEW economic sentiment is also set to be released and is expected to improve in November to -50, up from -59.2 in October. Support from the government towards households and small and medium-sized businesses could be behind the expected improvement in morale.

Where next for the DAX?

The DAX has surged above the 50 & 200 sma and pushed above the 14000 round number to trade at a 5-month high. The RSI is well into overbought territory, so caution should be exercised when placing long positions.

Buyers would need to rise over 14450, the November high, to bring the 15000 psychological level into focus.

Sellers could look for a move below 14000 to expose the 200 sma at 13575, with a fall below here negating the near-term uptrend. A break below here brings 13000, the falling trendline resistance into target.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: FTSE, EUR/USD - Monday, Nov. 14

Two Trades To Watch: GBP/USD, DAX - Friday, Nov. 11

Two Trades To Watch: Gold, DAX - Thursday, Nov. 10

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more