Two Trades To Watch: Gold, DAX - Thursday, Nov. 10

Image Source: Pixabay

Gold holds steady ahead of CPI data. Can the DAX hold the above key support?

Gold steady ahead of CPI data

Gold is treading water ahead of today’s CPI data, which could set the market direction over the coming weeks ahead of the FOMC in December.

Expectations are for CPI to cool to 8% YoY in October, down from 8.3% in September and a peak of 9.1% at the end of the summer.

Attention could arguably be more focused on core inflation which rose to 6.6%, a 4-decade high in September but is set to tick lower to 6.5% in October.

As energy prices are falling at a slower pace and food and shelter prices keep rising, there is a good chance that inflation could top estimates.

Hotter than forecast inflation, particularly core inflation, could fuel bets that the Fed will remain aggressive with rate hikes, potentially lifting by 75 bps in December. This could boost the USD and drag non-yielding, US-denominated Gold higher.

On the other hand, cooler inflation could raise the likelihood of the Fed slowing the pace of hikes to 50 basis points in December, which could pull the USD lower and lift the price of Gold.

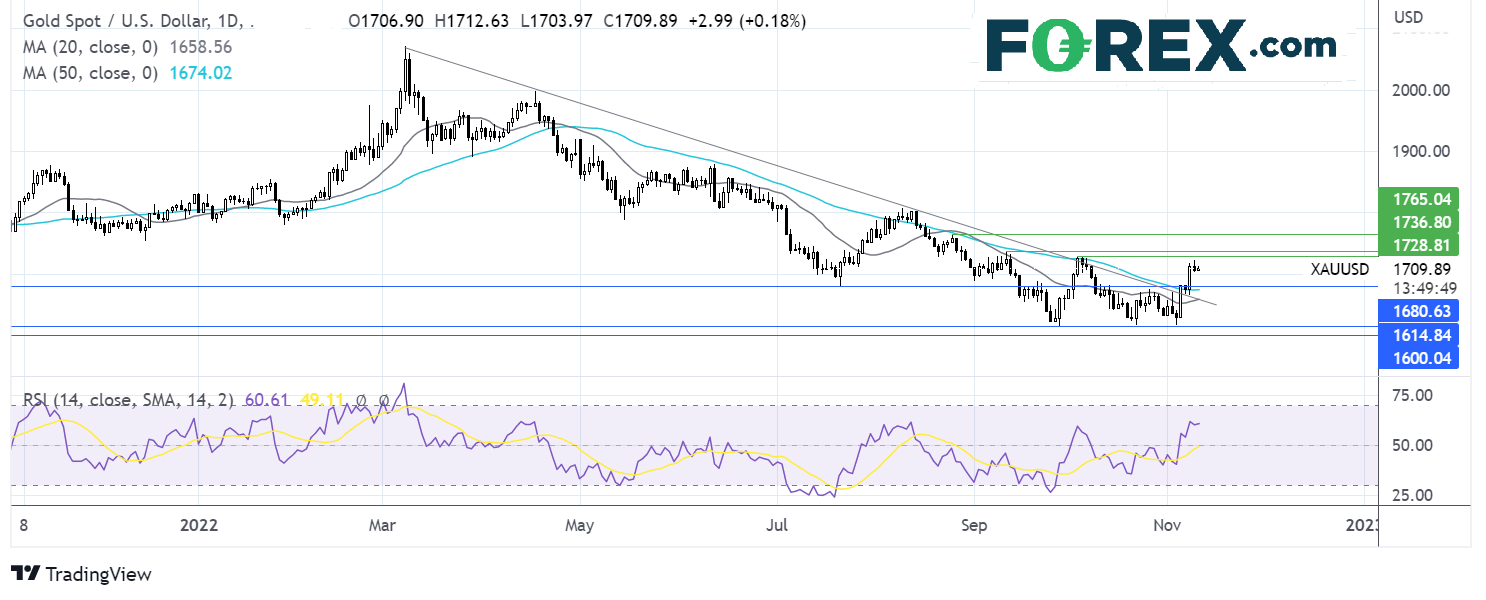

Where next for the Gold price?

Gold once again found support at 1616 the 2022 low for the third time and has rebounded higher. The rise above the 20 & 50 sma and the multi-month falling trendline, plus the bullish RSI keeps buyers hopeful of further gains.

Buyers will look for a rise over 1722 the weekly high, to bring 1730 the October top into focus and 1735 the September 12 high. Above here 1765 the August 25 high comes into focus.

Sellers could look for a breakdown of the 50 sma at 1674 and the 20 sma at 1658, to bring 1616.

(Click on image to enlarge)

Can the DAX stay above the 200 sma support?

The DAX is edging lower extending losses from the previous session as the market mood remains fragile.

The turmoil in the crypto market and the tighter-than-expected midterm elections in the US have hurt market sentiment.

Two days after the midterm elections, the Republicans are edging towards taking the House of Representatives, but the Senate remains in the balance.

Corporate earnings in Germany see Deutsche Telekom lift full-year guidance after strong Q3 profits. Merek also reported better-than-expected earnings.

The eurozone economic calendar is light. US inflation is expected to drive sentiment.

Where next for the DAX?

The DAX has rebounded from the 11810 2022 low, rising above the 50 sma and the falling trend line resistance and is attempting to hold above the 200 sma at 13600. The RSI is in bullish terror.

Buyers will look for a rise over 14000 the August high to extend the recovery.

Failure of the bulls to defend the 200 sma could see the price fall back towards 13130 the falling trendline resistance.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: AUD/USD, FTSE

Two Trades To Watch: EUR/USD, S&P 500 - Tuesday, Nov. 8

Two trades to watch: GBP/USD, Nasdaq - Thursday, Nov. 3

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more