Two Trades To Watch: GBP/USD, DAX - Thursday, June 8

Photo by Colin Watts on Unsplash

GBP/USD rises as the OECD warns over high inflation. DAX slips ahead of Eurozone GDP data.

GBP/USD rises after OECD warns over high inflation

- OECD forecast 6.9% inflation in 2023

- The market sees peak rates at 5.5%

- GBP/USD trades in a symmetrical triangle

GBP/USD is rising for a second day as the pound capitalizes on a weaker U.S. dollar and after the OECD warned over sticky inflation in the UK.

The OECD said that it expects UK inflation to be at 6.9% by the end of the year, which would be the highest in the G20 except for Turkey and Argentina.

Stick inflation raises the prospect of more interest rate hikes from the BoE, in contrast to the Federal Reserve, which is widely expected to pause interest rate hikes in June with another possible rate hike in July. The market sees peak BoE rates at 5.5%, up from 4.5% currently.

However, growth in the UK is expected to be lackluster at 0.3% in 2023, up from a previously expected -0.2%.

Lower-tier data points have been mixed. The UK Recruitment and Employment Confederation survey showed that the labor market could be cooling. Starting salaries for permanent staff rose at the slowest pace in 2 years.

Meanwhile, the Royal Institute of Chartered Surveyors warned that recent good news surrounding the property sector could be overshadowed by further rate hikes, which would hamper the sector.

Looking ahead, the UK economic calendar is quiet, so investors are likely to look towards the US calendar for direction. US jobless claims data could provide further clues about the health of the US labor market following Friday's strong nonfarm payroll report. Initial jobless claims are expected to rise 235K from 232k.

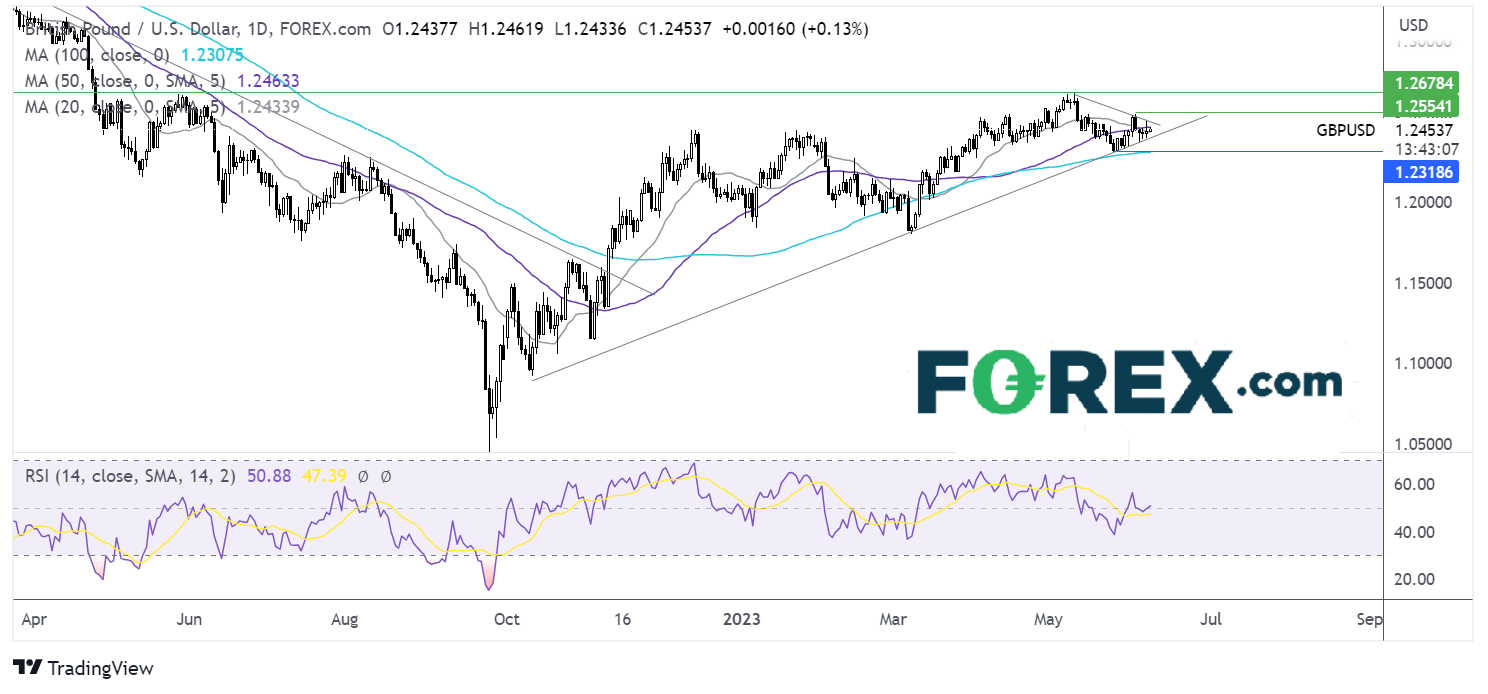

GBP/USD outlook – technical analysis

GBP/USD trades within a symmetrical triangle with the RSI neutral.

Buyers will be looking for a rise above 1.25, the falling trendline resistance, to open the door to 1.2550, the June high, and 1.2660, the May high.

Support can be seen at 1.2414, the rising trendline, the rising trendline support. A break below here exposes the 50 sma and May low at 1.23.

(Click on image to enlarge)

DAX slips ahead of Eurozone GDP data

- Eurozone GDP due to show growth stalled

- ECB rate hike expected next week

- DAX trades in a holding pattern

The DAX opened marginally lower but continues in a holding pattern as investors lack direction ahead of the Eurozone GDP release and next week’s central bank meetings.

ECB is expected to hike rates by 25 basis points on Thursday after ECB president Christine Lagarde said this week that inflation was still too high and borrowing costs need to rise.

Meanwhile, the Fed’s move is less certain traders are pricing in a 70% probability of a Fed rate hike. However, this has come down from 80% yesterday after the BoC surprised with a 25 basis point rate hike.

On the data front, Eurozone GDP is expected to show that growth stalled in Q1 at 0%, avoiding a recession. On an annual basis, growth of 1.2%, down from 1.8% in Q4 of 2022. However, with more rate hikes expected from the ECB, growth could slow further over the coming months as the effect of rate hikes is felt.

This week, the data comes after German data has raised concerns over the health of the German manufacturing sector after factor orders unexpectedly fell and industrial production rose by less than expected.

Looking ahead, the US economic calendar is relatively quiet, with just US jobless claims in focus.

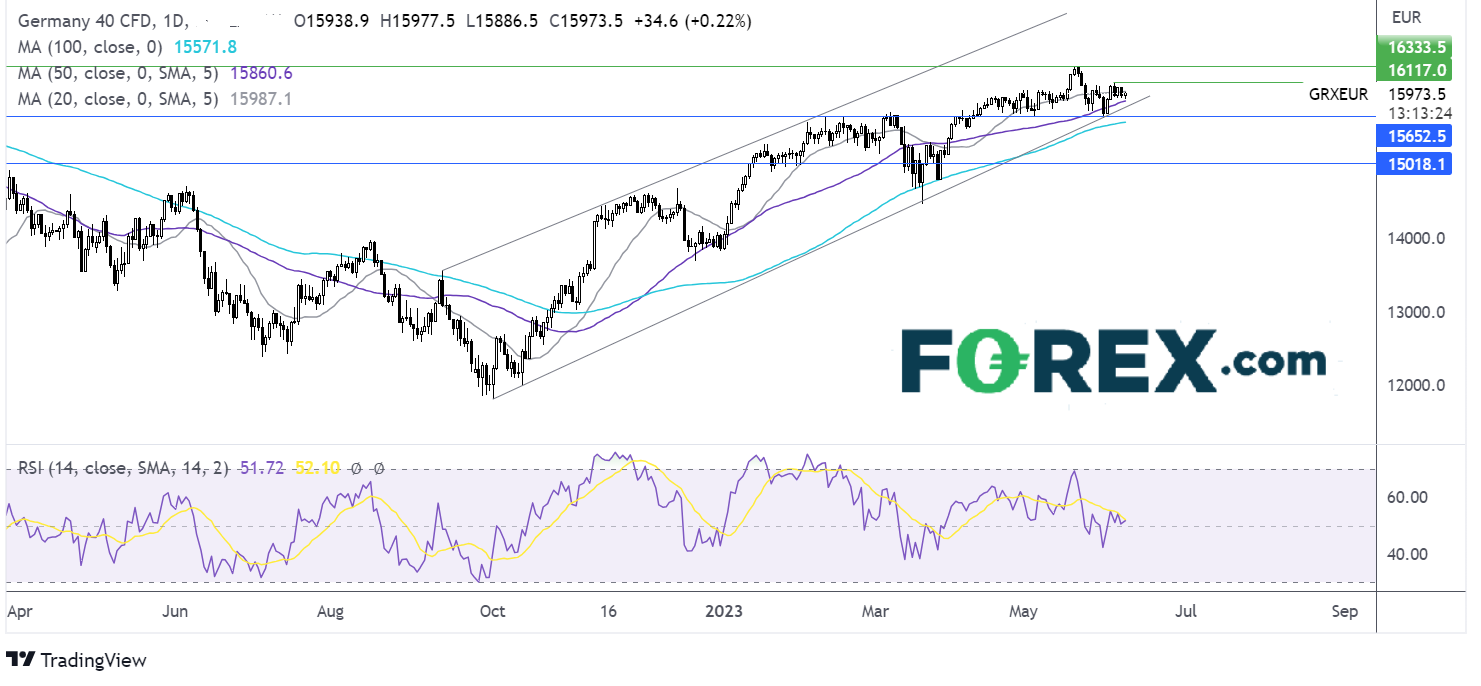

DAX outlook – technical analysis

While the DAX continues to trade within the multi-month rising channel, the bulls are running out of steam. The price has remained range bound across the past week, capped by 16050 on the upside and 15885 on the downside.

Buyers need to push above 16050 to bring 16333 and fresh all-time highs into play.

Sellers will look to break below the 50 sma at 15850 and the rising trendline support at 15775 to bring 16650 into play, the June low. Beyond here, sellers could target 15000.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: DAX, Oil - Wednesday, June 7

Two Trades To Watch: EUR/USD, Oil - Tuesday, June 6

Dow Jones Outlook: Stocks Fall After Strong Jobs Data

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more