Two Trades To Watch: DAX, Oil - Wednesday, June 7

Image Source: Pixabay

DAX edges higher despite weakness in manufacturing. Oil falls on economic slowdown worries, EIA data due.

DAX edges higher despite weakness in manufacturing

The DAX is heading for a mildly positive start, after losses in the previous session, as investors weigh up the latest data from Germany.

German industrial production rose 0.3% MoM in April, after falling -3.4% in March. Expectations had been for a 0.6% rise.

The data comes after German manufacturing PMI data highlighted concerns over the sector last week, which showed that the sector shrank at its fastest pace in three years. German factory orders also unexpectedly fell in April, dropping 0.4%.

The data paints a gloomy outlook for the German economy and raises concerns that Germany’s recession could be extended into Q2.

While the latest data supports a pause from the ECB, central bank officials continue to support further tightening.

In addition to weak data from Germany, investors are also weighing up softer than expected China trade data. Exports plunged 17%, and imports dropped 7%, highlighting worries over the economic recovery in China.

Still, the downside is being limited by expectations that the Fed could soon pause rate hikes. The market is pricing in an 81% probability that the Fed will keep rates on hold next week.

Looking ahead, the economic calendar in Europe and the US is quiet, so trading could remain subdued.

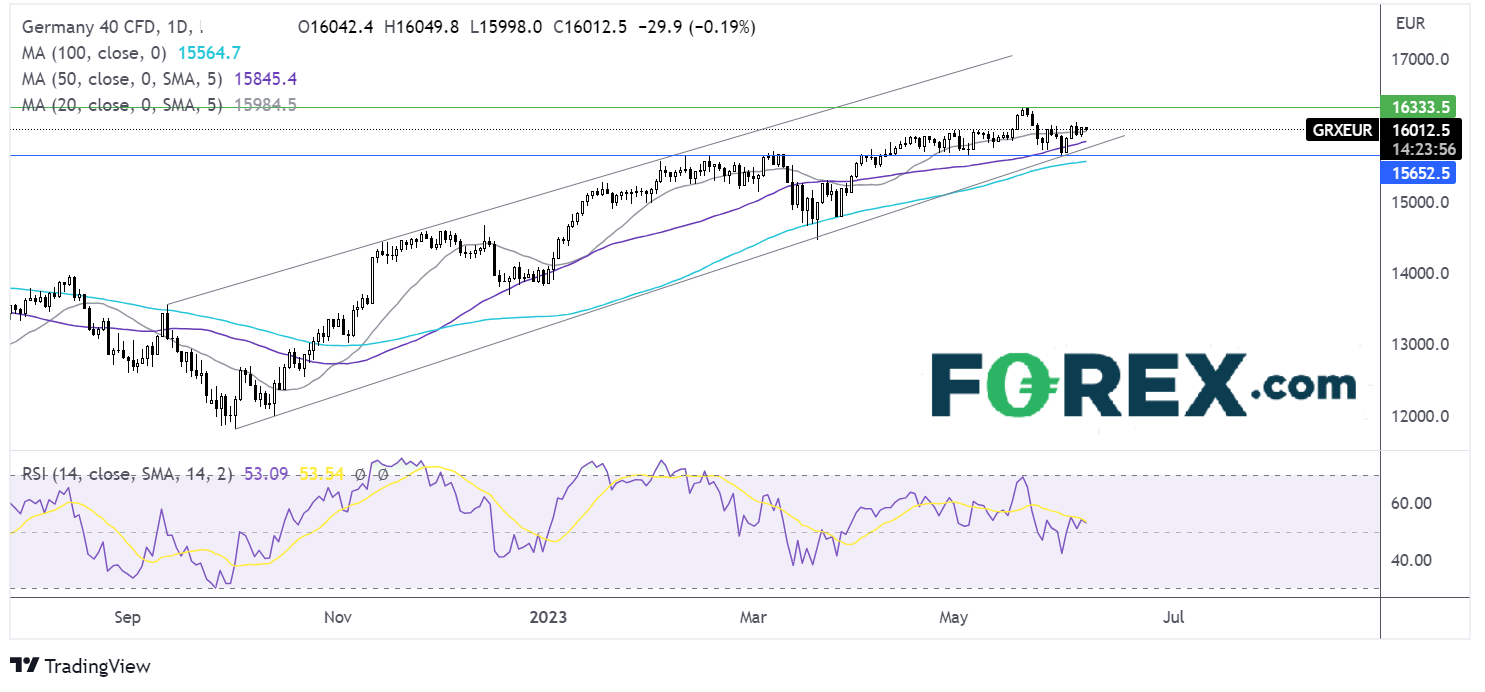

DAX outlook – technical analysis

The DAX continues to trade within an ascending channel. However, the run higher has lost steam and has traded in a tight range across the past two weeks, capped on the upside by 16100 and 15625 on the downside. The RSI is almost neutral.

Buyers will look for a rise above 16100 to bring 16335 into focus and fresh all-time highs.

Meanwhile, sellers will look for a break below the rising trendline support at 15730, opening the door to 15625 and a lower low.

(Click on image to enlarge)

Oil falls on economic slowdown worries, EIA data due

Oil prices are falling, giving back all the gains from Saudi Arabia’s decision to cut output.

Weaker-than-expected Chinese trade data, coupled with US recession concerns, are dragging on oil prices, which had rallied by as much as 3% at the start of the week after the OPEC+ meeting.

China, the world’s largest oil importer, saw its trade surplus drop to a 13-month low in May, driven by a sharp drop in exports, as foreign demand for Chinese goods evaporated, and imports fell signaling weak domestic demand. The data adds to recent soft China data which has raised concerns over the strength of the post-pandemic recovery. The data undermines expectations that a strong China recovery will drive oil demand to record highs later this year.

The data also comes after a string of weaker data from the US including weak service sector growth, as Australian GDP slows considerably and amid rising concerns over the outlook in Germany and Europe. Fears of a global recession could keep oil prices under pressure.

Limiting the downside, API data showed that oil stockpiles shrank by more than expected in the previous week as the US summer driving season ramps up, but rising gasoline and distillate inventories casts some doubts over how much demand is improving. EIA inventory data is due later today.

Oil outlook – technical analysis

The oil price has slipped to 71.50, after failing to rise above the 50 sma, keeping sellers hopeful. The RSI neutral, giving away few clues.

Sellers will look for a move below 70.00 to test 67.00, the late May low.

Buyers could look for a rise above 75.00 the 50 sma and the weekly high, to create a higher high.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, Oil - Tuesday, June 6

Dow Jones Outlook: Stocks Fall After Strong Jobs Data

Two Trades To Watch: EUR/USD, Oil - Thursday, June 1

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more