Two Trades To Watch: DAX, USD/JPY Forecast - Friday, Nov. 24

Image Source: Unsplash

DAX slips as a German recession looks more likely

- German GDP fall -0.3% QoQ in Q3

- German IFO business climate is expected at 87.5 vs 86.9 previously

- DAX tests resistance at 16000

The DAX is set to open modestly lower as recession fears build following weaker-than-expected GDP data.

GDP figures from the eurozone's largest economy showed a -0.3% contraction, steeper than the initial -0.1% contraction in the preliminary readings and down from 0.1% growth seen in the second quarter

The German economy has been among the weakest of economies in the eurozone this year. Recent data has pointed to the possibility of a mild recession by the end of this year, fueling bets that the ECB has finished hiking interest rates.

There could be a glimmer of hope on the horizon as German Ifo business sentiment figures, which are due later today, are expected to tick higher to 87.5 upgrade 6.9. This would mark the second straight monthly rise, suggesting the downturn in the eurozone's largest economy may have bottomed out.

The data comes after German PMI figures yesterday, which showed that business activity contracted at a slower pace, again supporting the view that the downturn may have reached its low point.

Meanwhile, news that Israel and Hamas are set to start a four-day cease-fire and exchange hostages for prisoners.

Volumes are expected to remain low owing to the half-day trading in the US markets amid the ongoing Thanksgiving holiday.

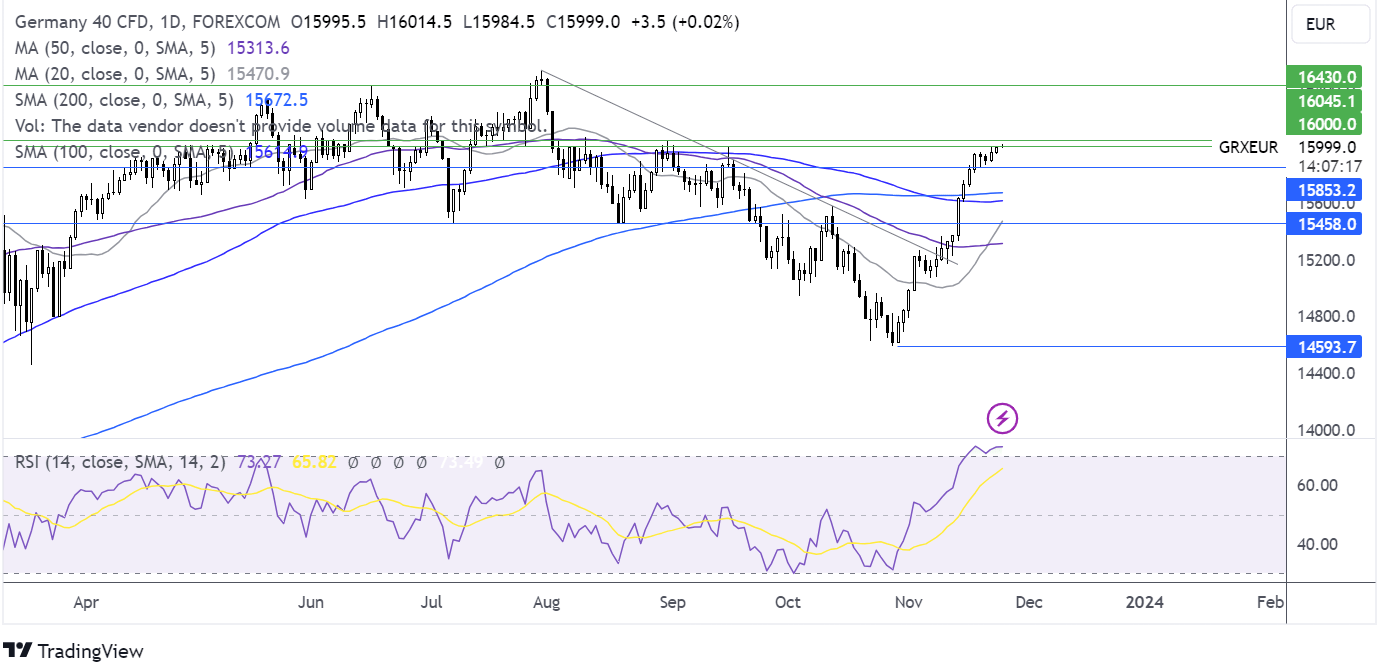

DAX forecast – technical analysis

The DAX has been steadily climbing, rising towards 16000, the key psychological level. The RSI is deeply overbought so buyers should be cautious, a period of consolidation or a fall lower could be on the cards.

Buyers will look to rise above 16000 to extend gains towards 16430, the June high.

Minor support can be seen at 15850 the weekly low. A break below here exposes the 200 sma at 15610.

(Click on image to enlarge)

USD/JPY slips after Japanese inflation data ahead of US PMIs

- Japan's CPI rose to 3.3% from 3%

- US services PMI is expected at 50.4 vs 50.6 previously

- USD/JPY struggle to rise above 50 sma

USD/JPY is falling after Japanese inflation ticked higher and following mixed PMI data.

Japanese inflation rose to 3.3% from 3% annually in October, and core CPI rose to 2.9% up from 2.8% but was short of the 3% forecast.

The rising inflation supports a more hawkish policy stance from the BoJ. However, PMI data painted a mixed picture with the service sector going is a slightly faster pace whilst manufacturing contracted.

Attention now turns to US PMI data which is forecast to show the services PMI slipped to 50.4 from 50.6 and the manufacturing PMI is expected to tip into contraction, falling to 49.8 from 50.

Signs that the US economy is cooling slightly would support bets that the Federal Reserve's next move will be a rate cut. The USD has been pricing in a dovish pivot from the Fed after inflation cooled by more than expected earlier this month. However, the FOMC minutes released this week gave no indication of when the Fed may start cutting rates. The market is pricing in a rate cut in Q2.

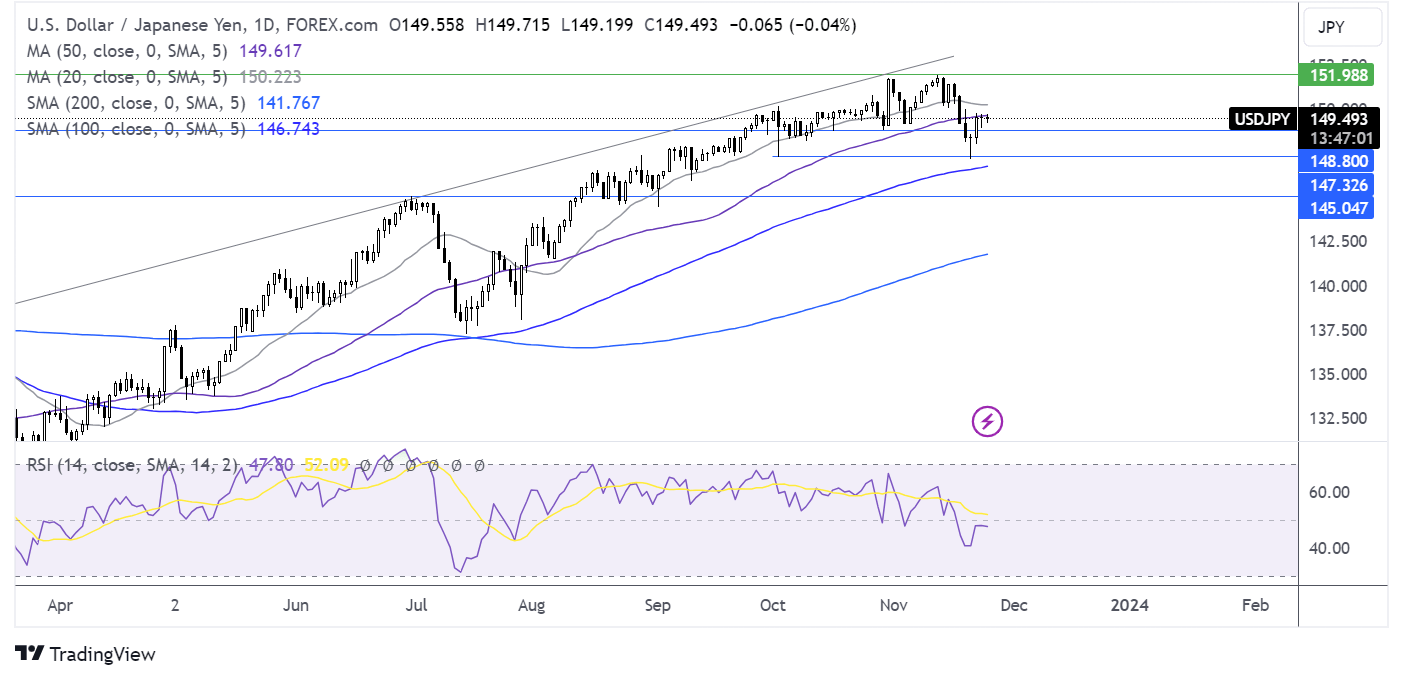

USD/JPY forecast – technical analysis

USD/JPY rebounded off the November low of 147.15 but is struggling to rise above the 50 sma at 149.60. The RSI has slipped below 50.

Sellers will look to test support at 148.80, with a breakdown of this level leading to 147.15, the November low.

Should buyers lift the price above the 50 sma, buyers will strive to test the 20 sma at 150.25 before brining the 151.90 2023 high into focus.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, Oil - Thursday, Nov. 23

Two Trades To Watch: GBP/USD, FTSE 100

Two Trades To Watch: GBP/USD, USD/JPY Forecast - Tuesday, Nov. 21

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more