Two Trades To Watch: DAX, USD/CAD

Image Source: Unsplash

DAX rises with eyes on the energy crisis meeting. USD/CAD falls to 1.30 with jobs data in focus.

DAX rises with eyes on the energy crisis meeting

European energy ministers will meet today to discuss tackling the deepening energy crisis in Europe. The meeting comes after Russia cut flows along the Nord Stream 1 pipeline earlier this week.

The move threatens energy security in the region with rising concerns of gas rationing and blackout, which would affect industries and accelerate the decline into a recession.

However, the meeting could drag on sentiment if the ministers fail to agree on gas sharing and price caps. Furthermore, Russia could respond should they decide on price caps for Russian oil and gas.

Where next for the DAX?

The DAX is attempting to push higher after hitting 12595 earlier in the week. The DAX retaking the 13000 psychological level combined with the bullish crossover on the MACD keeps buyers hopeful of further upside.

Buyers will look to break above 13080 the weekly high, opening the door to 13200 the 50 sma, and a rise over 13350 exposes the 100 sma at 13500. It would take a move over 14000 to create a higher high.

Sellers will look for a move below 12695 to extend the bearish trend and bring 12400, the 2022 low, into target.

(Click on image to enlarge)

USD/CAD falls to 1.30 with jobs data in focus

USD/CAD is falling for a third straight session on Friday, boosted by the weaker USD and as investors look ahead to the Canadian jobs report.

The USD fell sharply overnight, despite hawkish comments from Federal Reserve Chair Jerome Powell, who said that the Fed would keep tackling inflation until the job is done.

Instead, the USD is falling as investors are optimistic that inflation could fall further in August as gasoline prices continue to decline, and as the Fed’s rate hikes take effect.

The loonie is finding support from a modest bounce in oil prices from multi-month lows.

The Canadian labor market report is expected to show 15k jobs created in August, after two straight months of declines. The weakness wasn’t a demand issue but a supply issue owing to a shortage of workers.

The rate of unemployment and average wages are both expected to rise.

The data comes after the BoC hiked interest rates by 75 basis points earlier in the week.

Where next for USD/CAD?

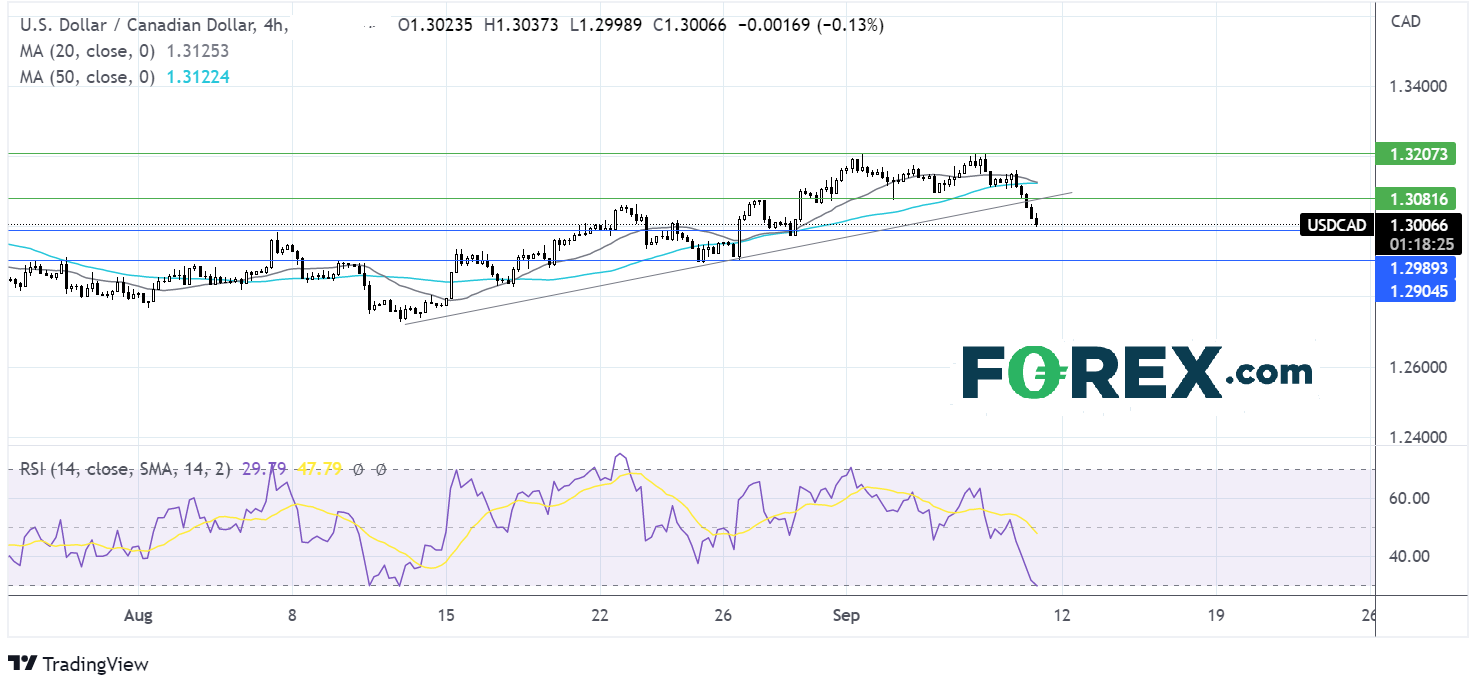

Despite repeated attempts, USD/CAD failed to find acceptance over 1.32, creating a double top. The fall lower has broken below the 20 & 50 sma on the 4-hour chart and has broken below the multi-0week rising trendline. Watch for the RSI falling into oversold territory.

Sellers will look for a break below the 1.30 key psychological level, opening the door to 1.2980, the August 5 high, and 1.29, the August 25 low.

Buyers will look for a move over 1.3080 the August 29 high to head back towards 1.32.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: FTSE, Oil - Wednesday, Sept. 7

ECB Interest Rate Rise: Supersize Or Jumbo?

Two Trades To Watch: EUR/GBP, USD/JPY - Tuesday, Sept. 6

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more