Two Trades To Watch: FTSE, Oil - Wednesday, Sept. 7

Image Source: Unsplash

FTSE falls after weak China data. Oil drops to a 7-month low on demand worries.

FTSE falls after weak China data

The FTSE and its European peers are heading lower, paring gains from yesterday. Truss’s draft energy bill’s optimism has evaporated as fed jitters and worries over Chinese growth dominate.

A double hit of weak trade data from China and the prospect of a more hawkish Federal Reserve is pulling stocks lower.

Resource stocks are acting as the biggest drag on the index after the Chinese trade surplus fell to $79.39 billion, well below forecasts of $92.7 billion and down steeply from July’s $101.26 billion. Exports grew 7.1%, more than halving from July and coming up well short of the 12.8% growth forecast.

A weak manufacturing sector amid droughts and earthquakes, in addition to Beijing’s strict zero-COVID policy, means that the outlook remains bleak.

The weaker pound is offering some support to the index.

Attention will be on BoE’s Andrew Bailey as he testifies before Parliament ahead of next week’s BoE monetary policy meeting.

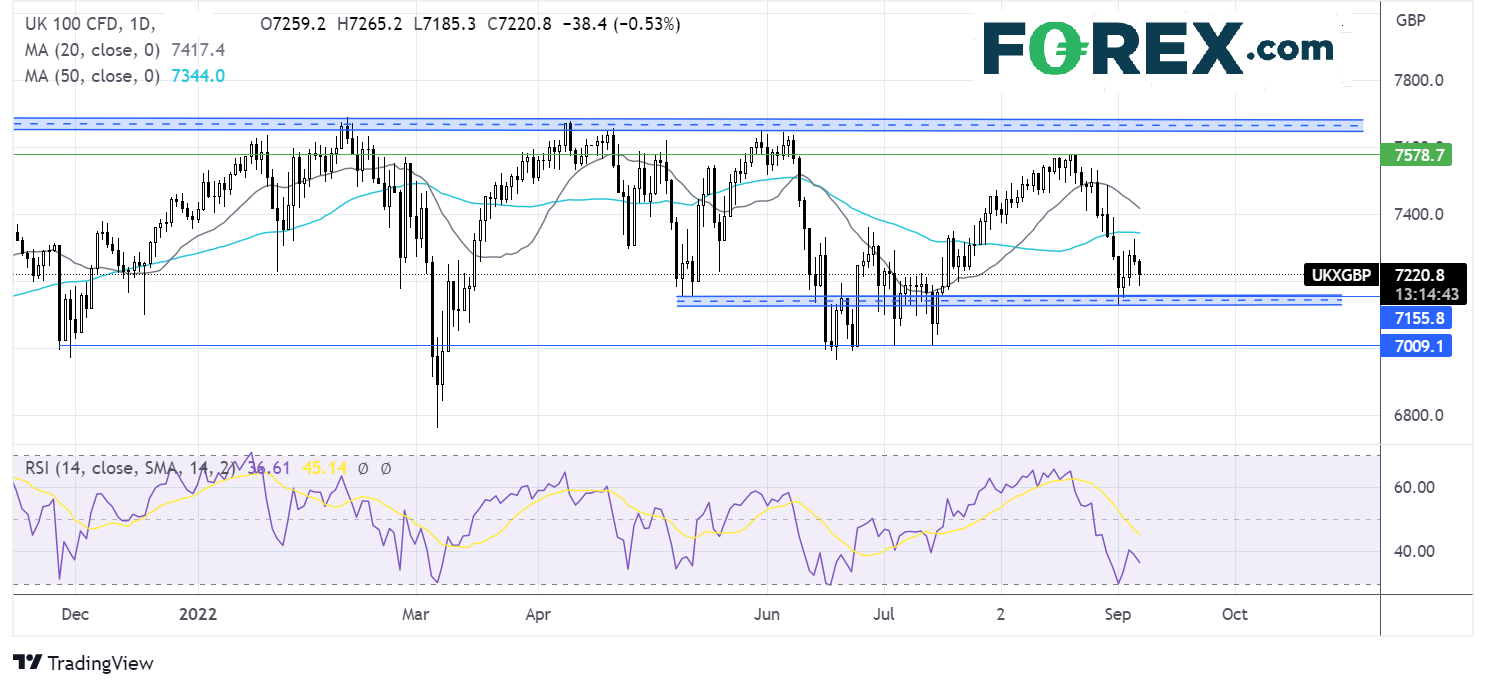

Where next for the FTSE?

The FTSE rebounds off 7130, the September low. Failure to re-take the 50 sma combined with the RSI below 50 supports further downside for the index. Sellers will look for a break below 7130 to extend the bearish selloff opening the door to 7000.

Meanwhile, buyers will be looking for a rise over the 50 sma at 7350 to negate the near-term downtrend and expose the 20 sma at 7420. It would take a move over 7580 to create a higher high.

(Click on image to enlarge)

Oil falls to an 8-month low on demand worries

Monday’s OPEC+ production cut seems like a distant memory as oil prices fall for a second straight session, taking out a key support level.

The demand side of the equation is under the spotlight after data from China highlights the slowdown in the economy amid its ongoing zero-COVID policy. With central banks across the globe tightening monetary policy, global growth is expected to slow considerably.

The oil market has fallen over 30% from June highs as its prices are in a steep global economic slowdown. With the Fed saying that rates will stay high for longer and Beijing showing no signs of swaying from its strict COVID policy, it’s hard to see oil prices rising. It would take more significant action from OPEC to put a floor under oil prices.

Where next for oil?

After running into resistance at the 50 sma at 97.50, the oil price rebounded lower and is testing support at 85, the August low. Sellers need to break below this level to extend the bearish trend towards 83.00, the falling trendline support, and 80.00 round number, and November high.

Buyers will look for a move over 90.55 the 20 sma and weekly high to expose the 50 sma at 94.00. A break above 97.00, the late August high, could create a higher high.

(Click on image to enlarge)

More By This Author:

ECB Interest Rate Rise: Supersize Or Jumbo?

Two Trades To Watch: EUR/GBP, USD/JPY - Tuesday, Sept. 6

Two Trades To Watch: EUR/USD, FTSE - Monday, Sept. 5

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more