Two Trades To Watch: DAX, GBP/USD Forecast - Tuesday, Jan. 20

Image Source: Pixabay

DAX slumps for a third day as Trump’s tariff threats weigh

The DAX, along with its European peers, is falling ON Tuesday, dropping to its lowest level since early January amid escalating transatlantic tensions and renewed tariff uncertainty.

President Trump is doubling down on his plan to acquire Greenland, raising tensions with European leaders and making for a fraught start to the World Economic Forum in Davos.

Over the weekend, Trump threatened 10% tariffs on Germany and seven other European countries from February 1st, which could rise further if Trump doesn’t acquire Greenland.

The EU is considering its options, from a diplomatic approach to halting the EUS-EU trade deal to applying anti-coercion measures. These include tariffs and halting US investment in the region, among other measures.

The threat of tariffs and the potential for EU retaliation are fuelling fears of a renewed trade war. This would be particularly harmful for German carmakers, which have fallen sharply.

Trump has also threatened 200% tariffs on French wine and champagne, hitting drink makers and the CAC.

There is still scepticism among investors about whether Trump would go through with his threats. Trump and European leaders will hopefully speak face-to-face at the WEF. However, so far, the US president has shown few signs of softening his rhetoric.

Looking ahead, U.S. markets open after a long weekend for Martin Luther King Day. US futures are trading around 1% lower.

On the data front, German ZEW economic sentiment figures are due to be released shortly and are expected to show that sentiment improved from 45.8 in January to 250. Not big numbers could help to limit some losses.

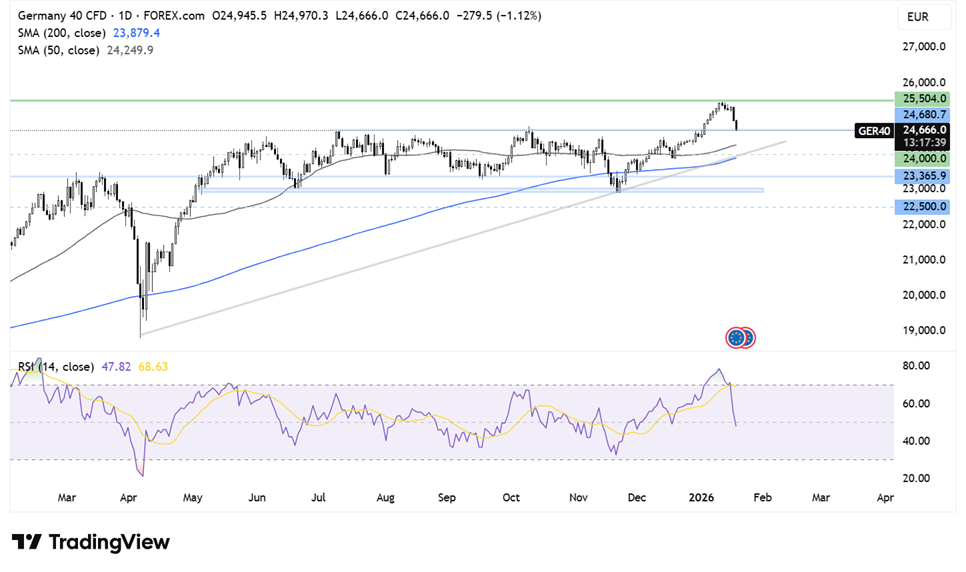

DAX forecast – technical analysis

The DAX’s recovery from the 22,900 November low ran into resistance at a record high of 25,500 last week before rebounding lower. The price is testing the 24,700 support level, the July and October highs, and the RSI is pointing lower. The long-term uptrend remains intact.

Sellers will look to take out this 24,700 support to negate the near-term uptrend. A break below here exposes the 50 SMA at 24,250, ahead of the 24,000 round number and 23,375. A break below 23k could spark a much deeper sell-off.

Should support hols, buyers will need to recover above 25,500 to create a higher high.

(Click on image to enlarge)

GBP/USD rises on USD weakness & despite soft UK jobs data

GBP/USD is rising amid USD weakness and after UK jobs data.

The US dollar is falling for a second day on Tuesday after threats from the White House toward the European Union over the future of Greenland have triggered a sell-off across US stocks and bonds.

The US dollar has fallen to its lowest level since January 12 as renewed tariff threats from Trump against EU allies have triggered the so-called sell-America trade, which emerged in April's Liberation Day announcements.

The prospect of prolonged policy uncertainty and loss of confidence in US leadership is accelerating the devaluation trend for now. There is hope that the US administration could de-escalate at the World Economic Forum this week.

The pound is rising, boosted by the weaker dollar and despite softer UK jobs data. UK firms cut jobs at the fastest pace in 2020, and wage growth eased to its lowest level in 3.5 years amid more signs of a weakening jobs market as the BoE considers how much further it can cut rates.

UK payrolls fell by 43,000 in December, a month after the chancellor's tax-raising budget, which was double the forecast. Unemployment remained unchanged at 5.1%, hovering near pandemic-era highs and slightly ahead of the 5% expected. Meanwhile, wage growth excluding bonuses slowed to 4.5%, marking its weakest pace since April 2022.

The data is bearish for the pound; however, the figures play second fiddle to geopolitical tensions in the de-dollarisation trade.

GBP/USD forecast – technical analysis

After running into resistance at 1.3550., GBP/USD fell back, finding support around the 1.3350 level, and the 50 SMA, recovering higher above the 200 SMA. This, combined with the RSI above 50, keeps the uptrend intact.

Buyers will look to rise above 1.35 resistance to bring 1.3550 back into focus. A rise above here creates a higher high.

Sellers will needto break below 1.3350 to create a lower low and spur a deeper decline towards 1.32.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: FTSE 100, EUR/USD Forecast - Monday, Jan. 19

Two Trades To Watch: GBP/USD, Oil Forecast - Thursday, Jan. 15

Two Trades To Watch: Oil, EUR/USD Forecast

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more