Two Trades To Watch: FTSE 100, EUR/USD Forecast - Monday, Jan. 19

FTSE falls as on tariff threats, Gold miners jump

The FTSE, along with its European peers, has kicked off Monday lower, although the UK index is holding up better than the likes of the DAX, the CAC, and the broader EU stocks index.

Stocks are being pulled lower by a broad risk-off mood amid rising geopolitical tensions between the US and Europe over Greenland.

Trump doubled down on his plan to acquire Greenland, announcing a 10% tariff on several EU countries, including the UK, from next month, which will raise all US import tariffs to 25%.

Concerns over the impact on the economy have pulled banking stocks sharply lower. Meanwhile, precious metal miners are providing support after Gold and silver rise to fresh record highs amid safe-haven flows.

Separately, Burberry is falling by more than 2.5% following Chinese data showing the Chinese economy grew by 5% in 2025. However, this was owing to strong exports while domestic demand remained weak. Retail sales highlighted this weakness, rising 0.9% YoY in December, slowing from 1.3% in November and missing expectations of a 1.2% gain. This was the weakest growth since December 2022.

Today, the US markets are closed for a public holiday, and the UK economic calendar is quiet. Looking ahead to the week, UK unemployment and CPI data will be in focus, as will developments surrounding Greenland.

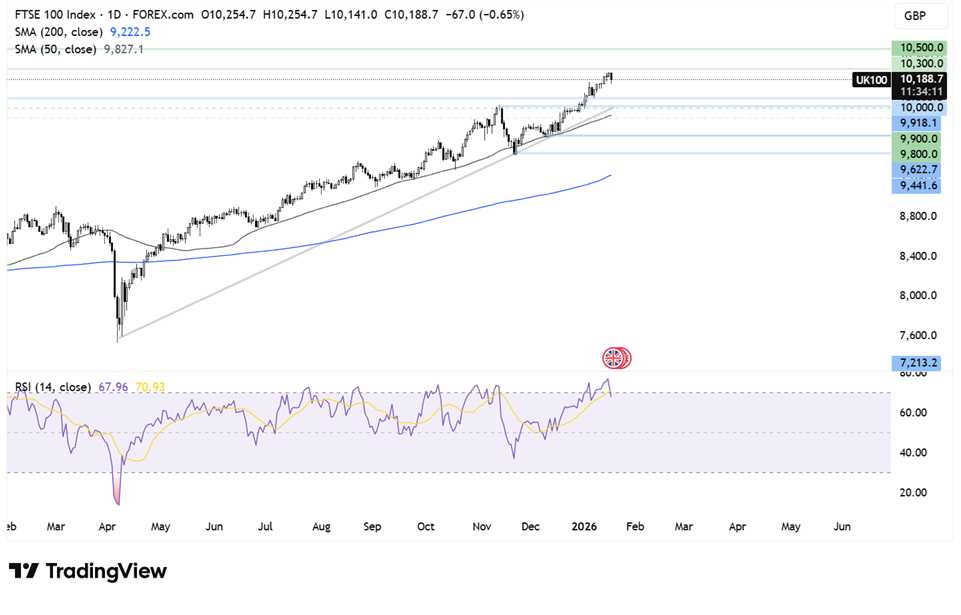

FTSE forecast – technical analysis

The FTSE 100 has trended higher since April, trading above its rising trendline, reaching a record high of 10,250 on Friday before easing lower today to 10,180 at the time of writing. The move lower is pulling the RSI out of overbought territory. The uptrend remains intact.

Buyers will look to rise above 10,250 to fresh record highs towards 10,300 and 10,500.

Support is seen at 10,000. A move below 9930 would negate the near-term uptrend. While a move below 9625 creates a lower low.

(Click on image to enlarge)

EUR/USD rises despite Trump’s trade tariff threats

EUR/USD is rising from a 6-week low amid USD weakness as investors become unnerved by U.S. President Trump's latest tariff threats against Europe over Greenland.

Over the weekend, Trump said he would impose additional 10% tariffs on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and Britain from February 1st, until the US is allowed to buy Greenland.

The EU has also threatened retaliatory tariffs of €93 billion in response to Trump's Greenland threat, raising fears of an all-out trade war between the US and the EU.

After dropping briefly in overnight trade, European currencies, including the euro, the pound, and Scandinavian crowns, are rising now

Instead, investors are dumping the dollar in a similar fashion to after liberation day tariffs, triggering a crisis of confidence and US assets.

On the data front, Eurozone inflation fell to 1.9% YoY in December, down from 2.1% in November and below the preliminary 2% reading. This was the first time since May that inflation was below the ECB’s 2% target, reinforcing expectations that the central bank will leave rates unchanged.

The US is closed for a public holiday, so trading volumes could be thin.

EUR/USD forecast - technical analysis

EUR/USD ran into resistance at 1.18 before rebounding lower, breaking below the 50 SMA and testing the 200 SMA and horizontal support at 1.1585.

Sellers will look to break below this support to extend losses towards the 1.15, the November low. A break below here opens the door to 1.14.

Should the 1.1585 support hold, buyers will look to rise above 1.1665, the 50 SMA and the upper band of the falling channel. A break above here opens the door to 1.17 and a rise above 1.18 creates a higher high.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: GBP/USD, Oil Forecast - Thursday, Jan. 15Two Trades To Watch: Oil, EUR/USD Forecast

Two Trades To Watch: FTSE 100, DAX Forecast

Disclaimer: StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information ...

more