This Week: USD Index, BoE & Germany Trade In Focus

- Key week: ISM, BoE, Germany trade data ahead

- USD eyes ISM PMI; print below 50 seen weak

- BoE likely holds rates; tone drives GBP move

- German surplus eyed; strong data aids euro

A data-heavy week lies ahead with three key impulses: the U.S. ISM Manufacturing PMI, the Bank of England (BoE) rate decision, and Germany’s trade-balance release.

With the dollar under pressure, the pound caught between inflation and growth, and the euro sensitive to external demand, the tone of each release and forward guidance will be pivotal for USD Index, GBPUSD, and EURUSD.

Events Watchlist:

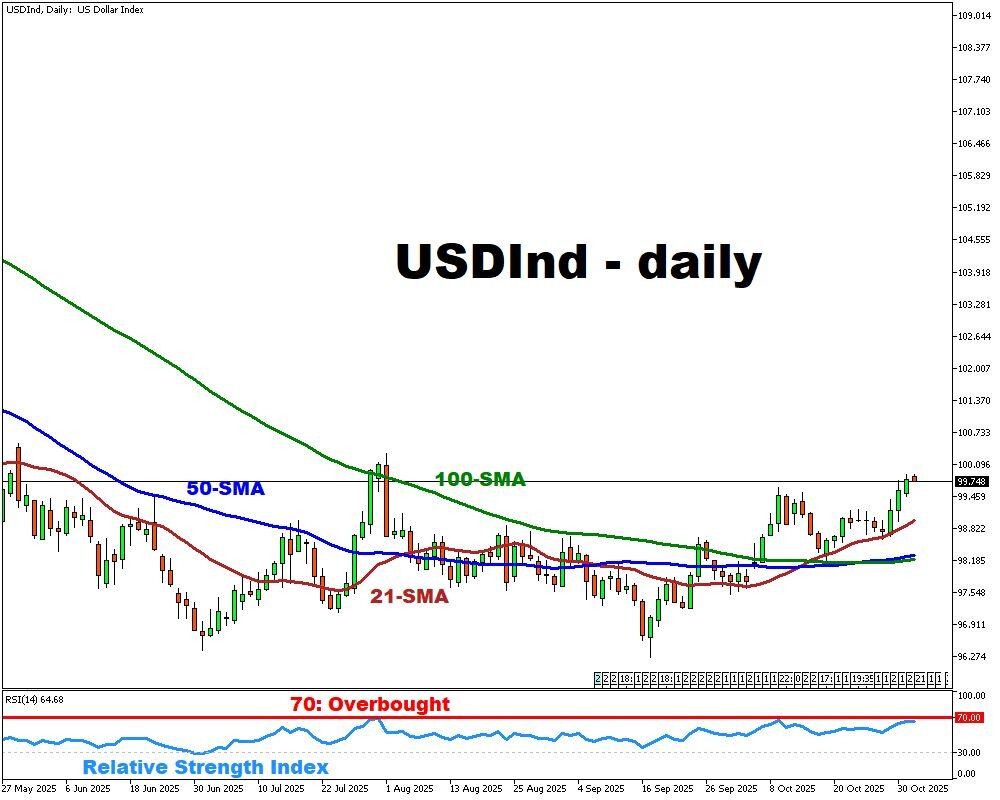

Monday, Nov 3: U.S. ISM Manufacturing PMI – USD Index

The ISM Manufacturing PMI is expected around 49.0, still below the 50-growth threshold, with prior readings signaling contraction. A print above expectations could bolster the dollar and lift the USD Index; a miss or further weakness would likely keep downward pressure on the greenback.

Thursday, Nov 6: BoE Interest Rate Decision – GBPUSD

Markets expect the BoE to hold rates at 4.00%, with about 87% of respondents in a Reuters poll forecasting no change. A dovish tilt or hints of early cuts could weigh on the pound, while a hawkish hold would likely support GBPUSD.

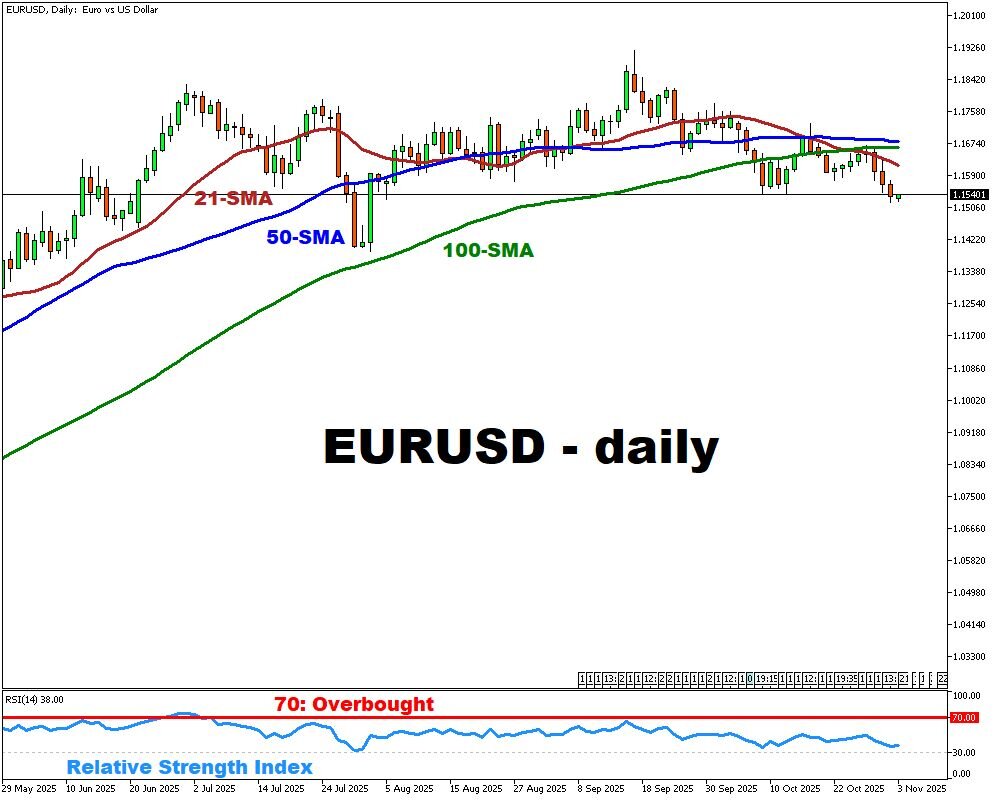

Friday, Nov 7: Germany Balance of Trade – EURUSD

Germany’s surplus for September is forecast at €17.2 billion, above consensus of €15.2 billion. A stronger surplus would lift the euro and push EURUSD higher, while weaker exports or slowing external demand could pressure the pair lower.

Other major events this week:

Monday, Nov 3

- CNY: China RatingDog Manufacturing PMI (Oct); Manufacturing PMI (Oct);

- USD: US ISM Manufacturing PMI (Oct); ISM Manufacturing Employment (Oct)

- AUD: Australia Building Permits MoM (Sep)

- CHF: Swiss Inflation Rate YoY (Oct)

- Major Earnings: Palantir

Tuesday, Nov 4

- AUD: RBA Interest Rate Decision

- USD: US JOLTs Job Openings (Sep); Factory Orders (Sep); Balance of Trade (Sep)

- NZD: RBNZ Financial Stability Report; Unemployment Rate (Q3); Employment Change QoQ (Q3)

- SPN35: Spain Unemployment Change (Oct)

- Major Earnings: AMD (Advanced Micro Devices); Uber

Wednesday, Nov 5

- GER40: Germany Factory Orders (Sep)

- US500: US ADP Employment Change (Oct); ISM Services PMI (Oct);

- WTI: EIA Crude Oil Inventories (Oct 31)

- CNY: China Services PMI (Oct); RatingDog Services PMI (Oct)

- FRA40: France Industrial Production MoM (Sep)

- Major Earnings: Qualcomm

Thursday, Nov 6

- UK100: BoE Interest Rate Decision

- NAS100: Initial Jobless Claims (Nov 1)

- AUD: Australia Balance of Trade (Sep)

- EUR: Eurozone Industrial Production MoM (Sep)

Friday, Nov 7

- CNY: China Trade Balance (Oct)

- CAD: Canada Unemployment Rate (Oct); Employment Change (Oct)

- USD: US Non-Farm Payrolls (Oct); US Unemployment Rate (Oct); Michigan Consumer Sentiment (Nov); US Average Hourly Earnings (Oct)

- GBP: UK Halifax House Price Index MoM (Oct); Halifax House Price Index YoY (Oct)

Sunday, Nov 9

- CNY: China CPI (Oct); China PPI (Oct); Inflation Rate MoM (Oct)

- JPY: BoJ Summary of Opinions

More By This Author:

Gold’s Tug Of War At $4,000 An Ounce

This Week: Fed, BoJ & ECB Rate Decisions

Gold Tumbles After Rally On ETF Sell-Off Wave

Disclaimer: This material should not be viewed as financial advice. The content provided, including views and opinions, is for information purposes only.