This Week: Fed, BoJ & ECB Rate Decisions

- Triple central-bank week to drive global FX moves

- Fed seen cutting 25bp; dovish tone may hit dollar

- BoJ likely holds; hawkish risk could lift the yen

- ECB steady; tone on inflation to guide euro

- Key data, big tech earnings may add volatility

A central-bank triple-header lands next week: the Federal Reserve, the Bank of Japan, and the European Central Bank. Consensus leans dovish at the Fed (rate cut expected), steady at the ECB, and steady-with-hawkish-risks at the BoJ.

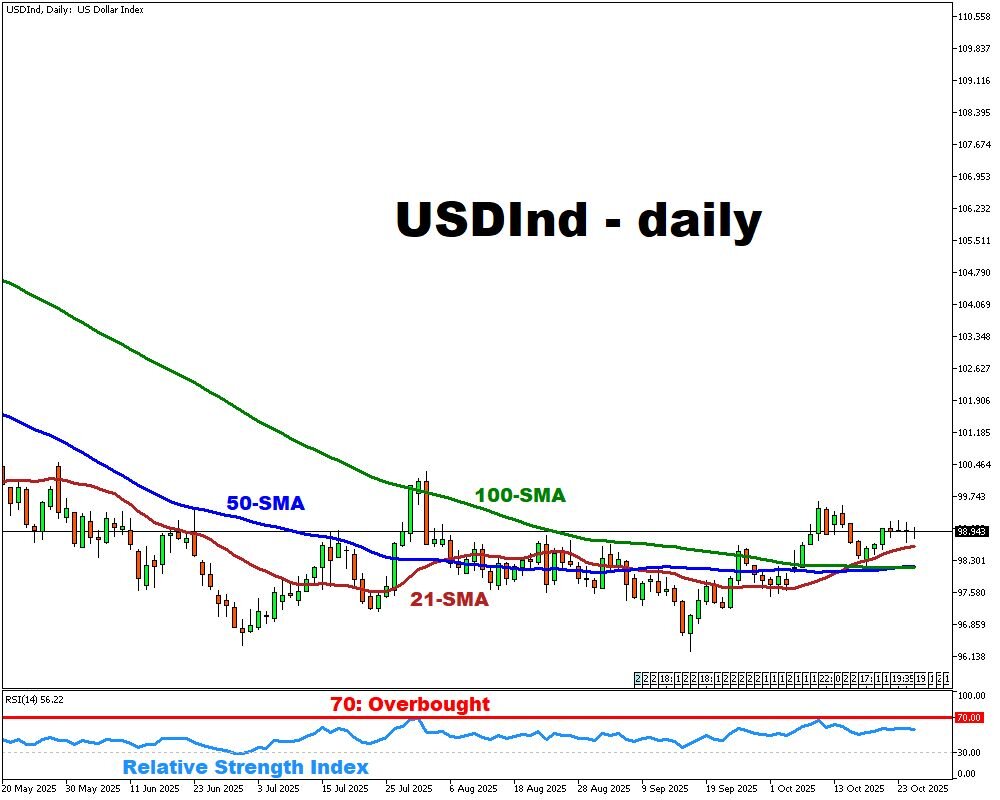

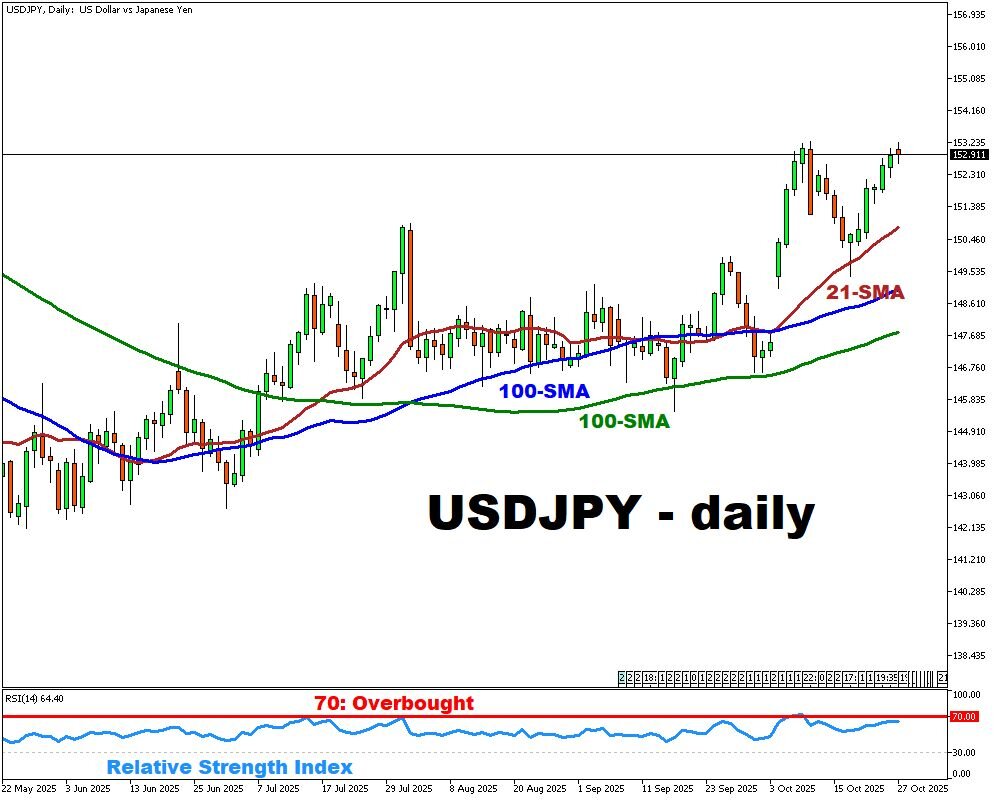

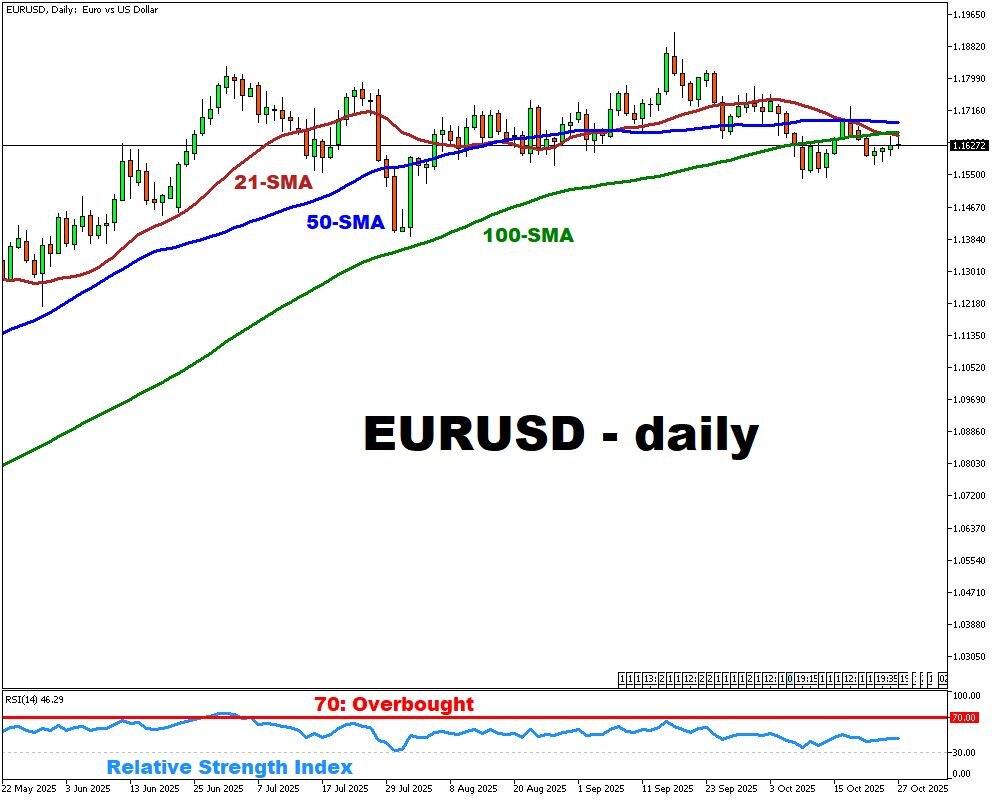

With the U.S. dollar still soft on the year and markets already tilting into month-end, the tone and forward guidance from these three banks will matter as much as the headline policy decision, especially for the USDInd, USDJPY and EURUSD.

Events Watchlist:

Wednesday, Oct 29: Fed interest rate decision – USDInd

The Fed funds target rate stands at 4.00%–4.25%, and markets currently expect a 25 bp cut at this meeting. A cut, especially with dovish guidance, would likely weigh on the dollar and pull the USD Index down. If the Fed holds or signals less clarity on cuts, dollar strength could re-assert.

Thursday, Oct 30: BoJ Interest rate decision - USDJPY

The BOJ’s policy rate is 0.50%. Markets mostly expect a hold next week, with polls shifting the next 25bp hike to December/January. That said, recent dissent and hawkish commentary from board members keep the risk of a hawkish surprise alive. A hawkish move or guidance would likely strengthen the yen (USDJPY lower).

Thursday, Oct 30: ECB interest-rate decision – EURUSD

The ECB is expected to hold its 2.00% rate steady, with attention on inflation guidance and its data-dependent stance. A hawkish tone highlighting persistent price risks could lift EUR/USD, while a neutral or dovish message stressing weak growth would likely pressure the euro toward lower levels.

Other major events this week:

Monday, Oct 27

- EUR: Germany Ifo Business Climate (Oct)

- MXN: Mexico Balance of Trade (Sep)

- CAD: Canada New Housing Price Index (Sep)

- USD: US Durable Goods Orders (Sep); Dallas Fed Manufacturing Index (Oct)

Tuesday, Oct 28

- GER40: Germany GfK Consumer Confidence (Nov)

- FRA30: France Unemployment Rate (Sep)

- MXN: Mexico Unemployment Rate (Sep)

- WTI: US API Crude Oil Stock Change (w/e Oct 24)

Wednesday, Oct 29

- AUD: Australia Inflation Rate (Q3)

- JP225: Japan Consumer Confidence (Oct)

- SPN35: Spain GDP (Q3)

- GBP: BoE Consumer Credit (Sep); Mortgage Approvals/Lending (Sep)

- USD: Fed Interest Rate Decision; US Goods Trade Balance (Sep); Wholesale Inventories (Sep); Retail Inventories Ex Autos (Sep)

- CAD: BoC Interest Rate Decision

- WTI: US EIA Crude Oil Stocks Change (w/e Oct 24)

- Major Earnings: Microsoft, Alphabet, Meta Platforms

Thursday, Oct 30

- NZD: New Zealand Business Confidence (Oct)

- JPY: BoJ Interest Rate Decision; Unemployment Rate (Sep); Industrial Production (Sep); Retail Sales (Sep)

- FRA40: France GDP (Q3)

- SPN35: Spain Inflation Rate (Oct); Business Confidence (Oct)

- EUR: ECB Interest Rate Decision; Germany GDP (Q3); Germany Inflation Rate (Oct); Eurozone GDP (Q3)

- MXN: Mexico GDP (Q3)

- USD: US GDP (Q3); Initial Jobless Claims (w/e Oct 25)

- Major Eearnings: Apple, Amazon

Friday, Oct 31

- CNY: China NBS Manufacturing (Oct); Non-Manufacturing PMI (Oct)

- GER40: Germany Retail Sales (Sep)

- CHF: Swiss Retail Sales (Sep)

- FRA40: France Inflation Rate (Oct)

- EUR: Eurozone Inflation Rate (Oct)

- CAD: Canada GDP (Aug)

- USD: US Core PCE (Sep); Personal Income & Spending (Sep)

More By This Author:

Gold Tumbles After Rally On ETF Sell-Off WaveTesla Q3: Profit Pressure, AI Hopes Ahead

Brent’s Slide – Geopolitics & Oversupply In Play

Disclaimer: This material should not be viewed as financial advice. The content provided, including views and opinions, is for information purposes only.