This Week: GBPUSD, EURUSD & CHINAH Index In Focus

- UK GDP to steer GBPUSD sentiment this week

- Germany ZEW to shape EUR outlook, key for EURUSD

- China data to guide CHINAH index, risk tone in play

- Strong UK or China data could lift markets broadly

- Misses risk pressure on GBP, EUR, and China equities

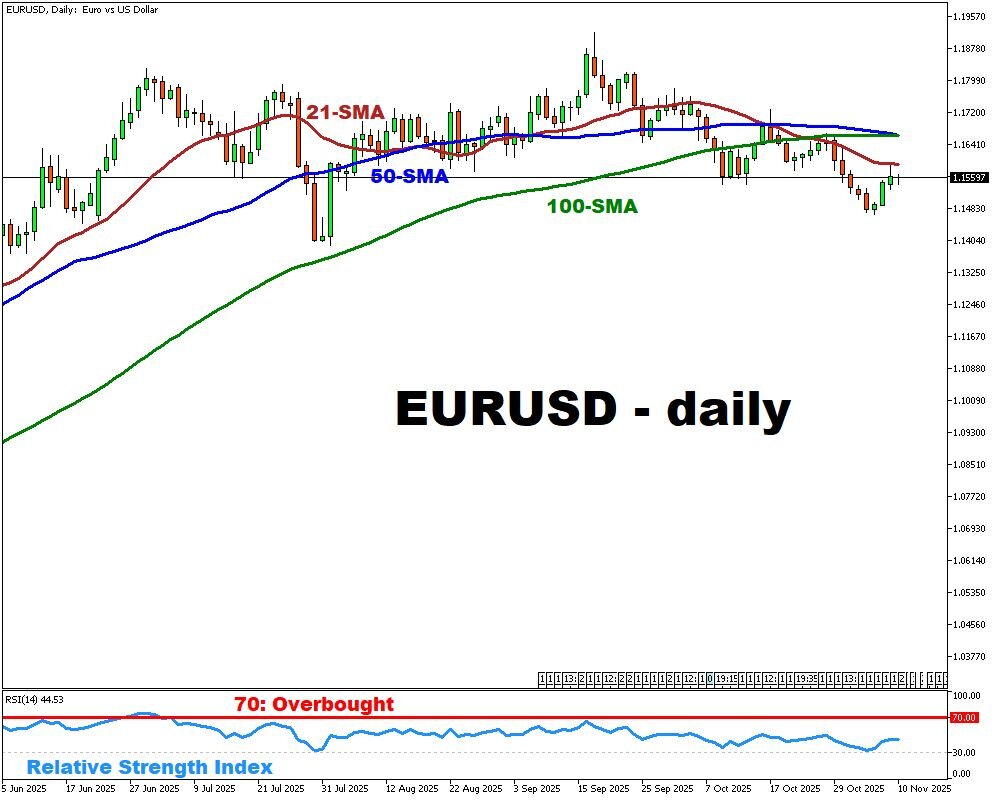

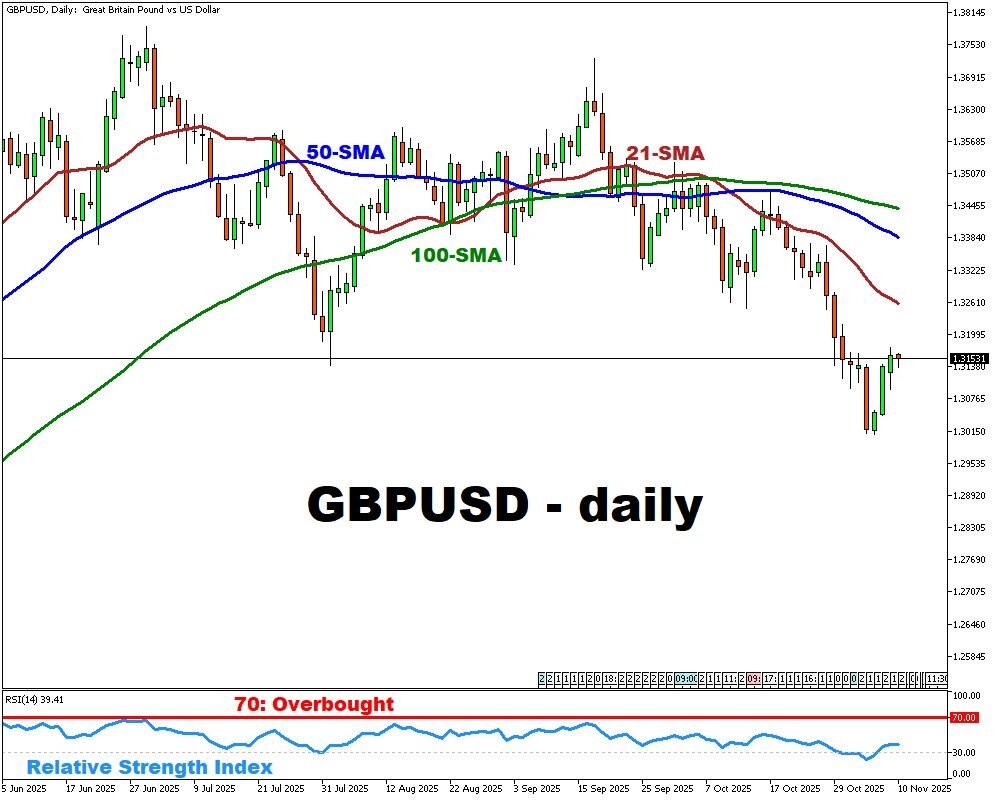

For GBP/USD, the spotlight will be on the UK growth outlook via the upcoming GDP release. Meanwhile for EUR/USD, the focus turns to the ZEW Economic Sentiment Index for Germany.

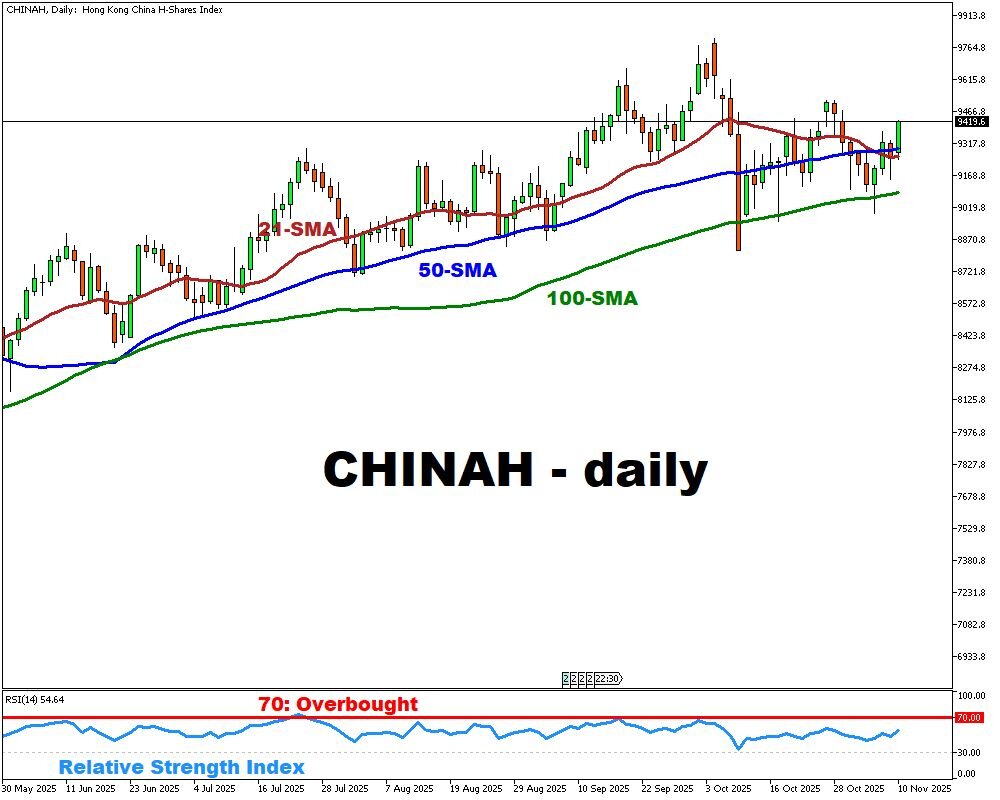

Finally, the CHINAH index will hinge on the forthcoming industrial production and retail sales data from the People’s Republic of China.

Events Watchlist:

Tuesday, Nov 11: Germany ZEW Economic Sentiment – EURUSD

Germany’s ZEW Economic Sentiment index rose to 39.30 in October (from 37.30 in September) and the consensus for November is around 34.0. If the index comes in above ~34, it could signal improved confidence in Germany’s near-term outlook, likely favoring the euro and lifting EURUSD; a downside miss would risk weighing on the euro.

Thursday, Nov 13: UK GDP – GBPUSD

Quarter-on-quarter growth is expected at 0.3% (previously 0.3%), with the year-on-year rate forecast at 1.3% (previous 1.4%). A steady or stronger print could reinforce sterling, particularly if paired with sticky inflation; a miss would highlight stagnation risks and pressure GBPUSD lower.

Friday, Nov 14: China Industrial Production & Retail Sales – CHINAH index

Industrial output is seen slowing to 5.8% y/y (from 6.5 %), while retail sales are forecast at 2.2% y/y (previous 3%). Stronger-than-expected prints would boost market confidence in China’s recovery and likely lift the CHINAH index; weaker numbers could dampen risk appetite.

Other major events this week:

Monday, Nov 10

- AUD: Australia Westpac Consumer Confidence Change (Nov)

- JPY: Japan Current Account (Sep)

- SPN35: Spain Consumer Confidence (Oct)

Tuesday, Nov 11

- AUD: Australia NAB Business Confidence (Oct)

- GBP: UK Unemployment Rate (Sep)

- EUR: Germany ZEW Economic Sentiment Index (Nov)

- USD: US ADP Employment Change Weekly

Wednesday, Nov 12

- AUD: Australia Home Loans (Q3); Investment Lending for Homes (Q3)

- USD: Philadelphia Fed CEO Paulson Speech

- WTI: US API Crude Oil Stock Change (w/e Nov 7)

- BRENT&WTI: OPEC Monthly Report

Thursday, Nov 13

- UK100: UK GDP (Q3); Goods Trade Balance (Sep); Industrial Production (Sep); Manufacturing Production (Sep)

- AUD: Australia Employment Change (Oct)

- FRA40: France Unemployment Rate (Q3)

- EUR: Eurozone Industrial Production (Sep)

- NZD: New Zealand Business PMI (Oct)

- USD: US CPI (Oct); Initial Jobless Claims (w/e Nov 8)

Friday, Nov 14

- CNY: China Industrial Production (Oct); Retail Sales (Oct); Foreign Direct Investment (Oct)

- EUR: Germany Wholesale Prices (Oct); Eurozone Balance of Trade (Sep); Eurozone Employment Data (Q3)

- USD: US PPI; Business Inventories (Sep&Aug)

Sunday, Nov 16

- JPY: Japan GDP (Q3)

More By This Author:

XAUUSD Climbs On Rate-Cut Odds

Silver Shift: Safe-Haven Flow Meets Dollar Drag

This Week: USD Index, BoE & Germany Trade In Focus

Disclaimer: This material should not be viewed as financial advice. The content provided, including views and opinions, is for information purposes only.