The Old Maid Of Q3 Earnings

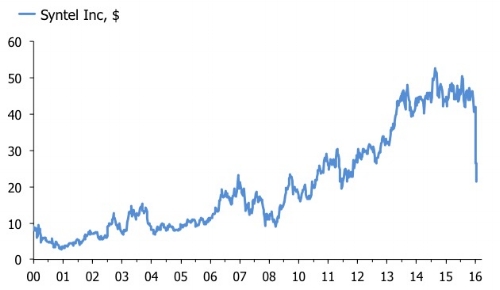

In equities, the headline indices were largely directionless last but there was a lot of action underneath the surface thanks to firms in the U.S. reporting Q3 earnings. On that note, the season has so far been unkind to your humble scribe; indeed it seems that I have managed to get myself stuck with nothing other than the old maid this quarter. There can be no better way to re-introduce the Mark to Market section than to report how yours truly was in front of the queue at the proctologist last week. The portfolio was thoroughly rear-ended by the calamity of Syntel Inc earnings (SYNT) . A 5% year-over-year decline in revenue, which was higher than the market expected, and a massive hit due to a $270M tax bill on repatriated cash, which led to a $2.58 loss per share, were parts of the ugly highlights. Bedpans overflowed quickly as the market pushed down the stock a cool 15% on Thursday, before continuing the drubbing with a “modest” 5.6% follow-through on Friday. Blow out the chart, and the extent of the pain endured in this stock is staggering. The share price has given back just over half of its post-crisis rally within the space of less than a month. I thought it was safe to buy this thing after the initial gap in the beginning of October, but the market has so far cut through my kevlar glove like a warm knife through butter.

Just a flesh wound, right?

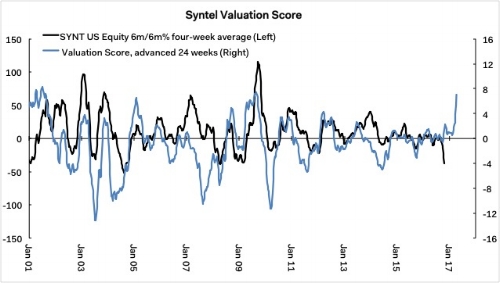

A couple of points about the “stock selection” method at this place are probably in order here. Firstly, I run a very aggressive quality on U.S. and European stocks. At the moment, the U.S. screen returns only 22 names out of the entire universe of stocks tracked by Bloomberg on U.S. exchanges. Syntel has been drifting in and out this screen recently, which is why the gap down earlier this year caught my eye. There is nothing better than to buy a solid firm after a washout. This brings us to the second point. Syntel has a very good fit with my dynamic valuation score. Based on its “historical” multiples and its recent spectacular fall from grace, this model is currently very bullish on the stock. For example, the swoon has pushed the trailing P/E to 7.6 that, by a mile, is a record low. Another interesting factoid is that the stock is trading 51% below its 40-week average, a level last tagged after the deluge in 1999.

Buying opportunity or a contrarian ruse?

I am not going to get into a detailed analysis at this point, but 2016 will be a horror show. Take cash on balance sheet for example, which is estimated to go from a healthy $980M in 2015 to a lowly $88M this year. I think the dramatic price action partly is because the market is discounting the possibility that Syntel will have to raise more equity here. But low debt, a fat margin, and solid free cash flow yield should carry the day for them ... I hope. In the short run, though, a lot of volatility, and "commentary", are certain in this name. Patience is needed I think. On the flip side, the argument is that a mid-cap tech company who relies on a number of big accounts has a dire future in a world where the big boys are fighting hard to reach "singularity" first. I still think firms like this can deliver value, though. F5 Networks (FFIV) and Tessera (TSRA) are two other horses that have done well for me this year, and which I plan to buy back.

FX ALGEBRA SAYS EURO SHOULD GO LOWER

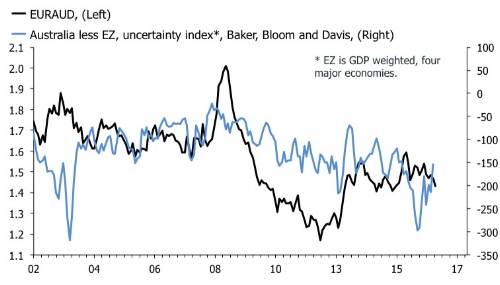

The continuing march higher of the dollar is starting to get interesting. What if EURGBP had to retrace to 0.8ish, and what if GBPUSD is destined to, at least, tag the flash crash lows? Put that in your EURUSD pipe and smoke it! I know that the ECB is being dragged kicking and screaming into an extension of QE, and I know that the Fed probably is raising rates in December. But I am starting to get the feeling that the dollar bull has legs here no matter what the Fed, or anyone else, decides to do. In this respect, the resilience of AUD is interesting, and it is particularly interesting, I think, to look at the EURAUD, which has declined decisively. The puritans amongst you will retort that the story on EURAUD is simply a weighted average of the narratives that drive AUDUSD and EURUSD. Maybe so, but indulge me for a minute. Positive carry and a safe distance to the political quagmire of Eurozone vulnerabilities, Brexit, and NATO sabre rattling with Putin. Suddenly, Sidney waterfront property is not such a bad investment, even if residential real estate in Australia is well ... expensive.

Sub 1.40 for EURAUD in Q4?

BACK TO THE FUTURE IN CHINA?

Another story that caught my eye was debate about a return of the debt-to-equity swaps to deal with mounting debt in the Chinese corporate sector. FT Alphaville's David Keohane have the key points, but this piece by South China Morning Post about Yunnan Tin is also interesting. This story harkens back to the 1999 where China used debt-to-equity swaps to deal with a rising amount of non-performing loans in the banking sector. This paper by the BIS from 2002 on the nuts and bolts of the asset management companies is worth a look, and here is how Edward Steinfeld from MIT described it in 2001.

Beginning in the autumn of 1999, the Chinese government introduced a series of policies to address a phenomenon that for at least a decade had been virtually ignored: the vast accumulation of non-performing assets in the national banking system. Arguably the most sweeping and complex of these measures has been the program of debt-equity swaps engineered between financial institutions and their failing state enterprise borrowers.

(...)

Certainly the good news is that from its inception, the debt-equity swap program was premised on the realistic view that the problems of China’s financial sector are inseparable from the problems of its state-owned industrial sector. Bank restructuring cannot proceed without SOE restructuring, and vice versa.

FT Alphaville's account of the most recent incarnation of this idea suggests that China has learned from previous mistakes, and seeks to take a tougher stance this time around. The key bit, which caught my eye from the information released so far, is that the "selection" of firms, which qualify for debt-to-equity swaps is supposed to be stricter. This is what China's State Council, as quoted by FT Alphaville, said (my emphasis):

"The SC’s guidelines also state that banks will not be forced into transactions and that firms with no prospects will not be eligible for debt-to-equity swaps."

Needless to say, I am sceptical that the definition of "no prospects" will be applied in a strict sense, but I am open to be proven wrong. Another issue is that the stated aim by China to separate the state from its large corporations. Or more specifically, the idea to dismantle the size and power and state owned enterprises, SOEs, probably conflicts with a big revival of a debt-for-equity swap. The first company through the ringer is Yunnan Tin, see story above, with the China Construction Bank leading a group of banks to buy ¥10B of debt from five subsidiaries of Yunnan. Converting said debt into equity is expected to reduce the firm's debt-to-asset ratio to 60% from 85%. But the whole thing, as adeptly explained by Keohane, is very circumspect. Firstly, China Construction Bank is itself a creditor to Yunnan Tin, to the tune of ¥5B, but this won't be the debt that will be converted into equity. Apparently, the idea is that other banks will purchase that debt, although it isn't really simple to figure out how it is supposed to work. Finally, the contract also apparently include repurchase agreement which stipulates that Yunnan Tin will purchase the stock back if performance is not as expected. This is just baffling. If the firm does not perform as expected, can we be sure that it has the ability to repurchase the shares without, you know, raising debt to do so? If this sounds like passing on the old maid until someone eventually gets stuck with it, then maybe that is exactly what it is.