The Canadian Dollar’s Rapid Devaluation: A Precarious Predicament For The Bank Of Canada

A year ago, the Bank of Canada (BOC) delivered the first of two rate cut surprises for the year. So with oil still cratering ever lower, I can understand why the market seemed braced for yet another rate cut last week. Instead, the BOC not only stood still on rates, but also it expressed an implied reluctance to reduce rates any further unless absolutely necessary. The result was an immediate jump in the Canadian dollar (FXC) featuring a drop in USD/CAD. USD/CAD continued to sell off right into the week’s close.

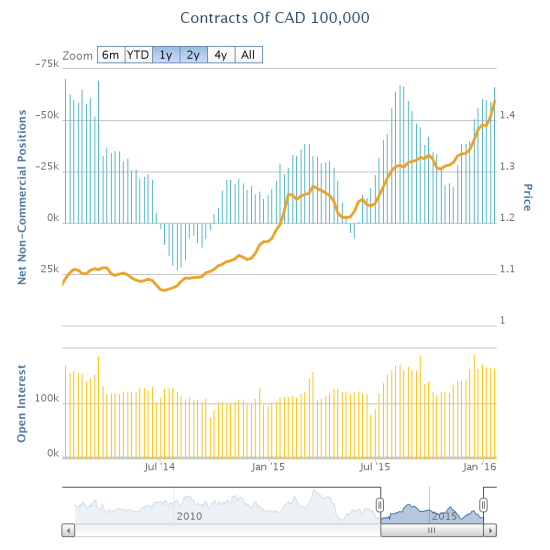

Going into the Bank of Canada January, 2016 decision on monetary policy, speculators were ramping up net short positions against the Canadian dollar.

Source: Oanda’s CFTC’s Commitments of Traders

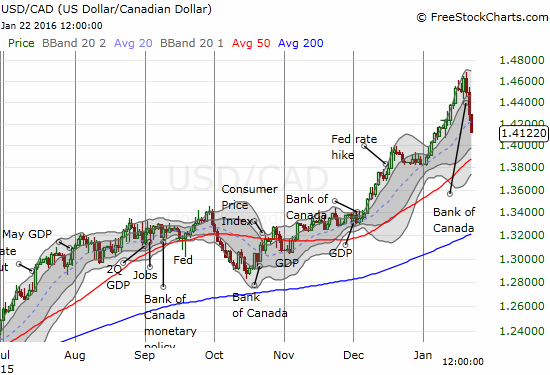

USD/CAD printed topping action just ahead of the Bank of Canada decision. The currency pair has shot nearly straight down ever since.

Source: FreeStockCharts.com

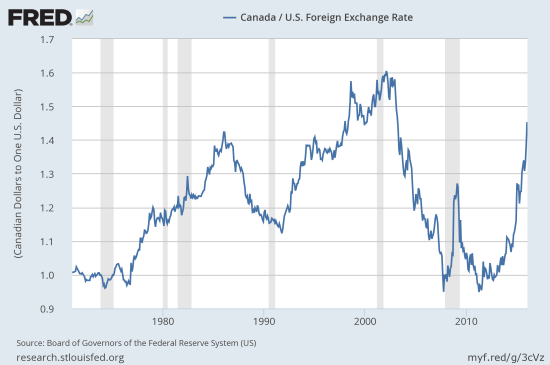

The Canadian dollar has been weaker but the PACE and extent of the weakening is nearly without recent precedent.

Source: Board of Governors of the Federal Reserve System (US), Canada / U.S. Foreign Exchange Rate [DEXCAUS], retrieved from FRED, Federal Reserve Bank of St. Louis, January 23, 2016.

Here is the key quote from Governor Stephen S. Poloz’s opening statement:

“It is fair to say, therefore, that our deliberations began with a bias toward further monetary easing.”

The on-going collapse in oil and all its destructive consequences for the Canadian economy still justify further easing. BUT…

“First, the Canadian dollar has declined significantly since October, which means that the non-resource sectors of our economy are receiving considerably more stimulus than we projected then. Let’s remember that it typically takes up to two years for the full effect of a lower dollar to be felt.

Second, past exchange rate depreciation is already adding around 1 percentage point to our inflation rate. This is a temporary effect, and is currently being offset by lower fuel prices—another temporary effect. However, we must be mindful of the risk that a further rapid depreciation could push overall inflation higher relatively quickly. Even if this is temporary, it might influence inflation expectations.”

In other words, financial markets have pounded the Canadian dollar so thoroughly that most of the BOC’s goals for easing have been accomplished already. The potential 2-year lag in impact means that the BOC must proceed with extreme caution when deciding to add more kindling to the raging fire of currency devaluation.

Moreover, this devaluation is now exerting inflationary pressures on the Canadian economy – to the tune of an incremental 1 percentage point. While current inflation may still be within tolerance, the pace of the increase could be strong enough to send future inflation expectations soaring past the BOC’s comfort zone. Given the lagging impact of the devaluation, the BOC could find itself fighting stubbornly high inflation expectations for an uncomfortably long time. During the press conference, Poloz clarified that the BOC does not think this process is underway. The Bank is simply keeping an eye on this potential – which is clearly enough to give them caution about doing anything that further drives down the value of the Canadian dollar.

Given these cautionary caveats, the BOC decided to leave rates just where they are. From the press release:

“The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent…

…All things considered, therefore, the risks to the profile for inflation are roughly balanced. Meanwhile, financial vulnerabilities continue to edge higher, as expected. The Bank’s Governing Council judges that the current stance of monetary policy is appropriate, and the target for the overnight rate remains at 1/2 per cent.”

As usual, the BOC is cautiously optimistic about economic prospects. Despite a disappointing 2015, the BOC still expects the global economy to resume “gradual strengthening” in 2016. Expectations incorporate an assumed transition to a 6% annual GDP growth rate for China, and continued “solid” performance from the U.S. Even with weak exports to the U.S. in the fourth quarter, the BOC expects export activity to turn right around in 2016. While downgrading its forecast for Canada’s GDP growth in 2016 to 1.4%, the BOC emphasized that year-over-year, growth should be 1.9% for the fourth quarter of this year.

Even though the BOC did not cut rates in this last meeting, make no mistake about its bias. The BOC thinks it could take up to three years for the Canadian economy to fully adjust to the complex structural changes wrought by the collapse of the oil complex. The Canadian economy may not absorb excess capacity in the economy until late 2017. The BOC also acknowledged the growing magnitude of the shock from this collapse. It called this reality a “significant setback compared with our October projection.” During the press conference, Poloz also admitted that the odds of a recession are higher than they have been in a very long time. All these realities imply a notable bias toward weakness for the Canadian dollar for quite some time.

When I wrote about the Canadian dollar’s fresh milestone of weakness, I described a small counter-trend bet that USD/CAD would return to 1.40. As the chart above shows, the USD/CAD just continued to spring higher after the 1.40 breakout. The Bank of Canada’s stasis on rates combined with the forex response was my signal to finally add to that bet. Without a promise to cut rates again, I fully expect USD/CAD to reverse most if not all of recent gains assuming oil does not resume its rapid plunge in the interim.

I will continue to try holding out for that return to 1.40, but I am perfectly fine bailing on the position if renewed strength shows up ahead of this week’s Federal Reserve’s meeting. On a technical basis, the counter-trend momentum in USD/CAD looks like it could easily retest the uptrending 50-day moving average (DMA). At the current pace, this would happen around 1.39. After I close out this short position, I will be quite eager to get back to trading with the trend.

During the press conference, Poloz would not commit to a specific level past which weakness in the Canadian dollar will no longer help the Canadian economy. He would only say that the assessment depends on the nature of the decline. If the currency is declining “on its own,” then there is a problem. An adjustment from economic realities makes sense – the current decline is mostly about the collapse in the oil complex. However, trends beget trends, and I can see several scenarios of overall financial turmoil and volatility that could send USD/CAD hurtling ever higher even independent of a fresh plunge in oil prices.

So, the Canadian dollar presents a precarious predicament for the Bank of Canada. Its devaluation is a necessary part of the Canadian economy’s adjustment to lower oil prices. The potential inflationary impact of this rapid decline could constrain the Bank’s ability to provide more assistance to a wobbly economy. Yet, without this assistance, the weakness of the economy could drive even more weakness in the currency. Currency traders will easily seize upon the trend above all else.

In coming weeks I will be reviewing the Monetary Policy Report (MPR) and a soon-to-be-released BOC paper on the complex impact of the oil shock to find any additional (tradeable) insights.

Disclosure: long FXC, short ...

more

Wow, Canada is worried about inflation?

It is a nuanced concern that is looking out to a chained set of events. Note that Poloz is clear in saying there is no inflation problem at the moment. BUT, the the BOC is worried that if the Canadian dollar depreciates too fast, the resulting contribution to inflation could happen so fast that it convinces people to increase their inflation expectations past the comfort zone. Finally, those increased expectations will start to feed into actual inflation. In other words, there is nothing for the BOC to work against, but this potential is enough to constrain monetary policy given more and more easing will likely contribute to this breakneck pace of devaluation.

Does that work in the real world? Inflation expectations is a concept that skates on thin ice, IMO. As the Canadian dollar plummets, and people feel poorer, they won't be inclined to spend more. In the old days, raises accompanied soaring prices. That has not been the case this millennium.

Setting rates by inflation expectations is a well-formed theory in monetary policy now. I think it was born out of the uncontrolled inflation of the 70s. It has not been tested much because inflation since then has been on a secular downtrend in developed economies. This is the theory that partly allowed the Fed to finally deliver a rate hike even though current inflation is comotose. The Banks like to talk about getting ahead of these expectations. So, theoretically, if they are executing, we will never see inflation expectations get out of hand.

Regardless, when it comes to trading, theory matters much less than the market's actual responses to drivers. So far, the market's response is consistent with a receding belief in imminent rate cuts. And more rate cuts seem highly unlikely given the Bank's commentary. I will be interested to see how the Bank's thread continues to evolve.

Thanks for the interesting comment thread.

Thanks for reading!

I agree with you, Dr. Duru that it is an old doctrine based on the '70's. I remember them well. But, it is a doctrine that has no substance today, so the tightening will likely be too much. But rock bottom rates are no good either, if you listen to the Norwegian bank that wants to do away with cash!

Sounds like I need to add the Norwegian bank to my list to follow! Governor Carney at the Bank of England has also speculated about how getting rid of cash is one method for eliminating the theoretical lower bound to monetary policy. Crazy times!

And to be clear, I do not expect the BOC to hike rates anytime soon. Poloz was not suggesting anything like that. I am guessing the next rate hike cycle is several years away...

By the way, for the record, I covered my USD/CAD short as it got "close enough" to my 1.40 target. Ahead of the Fed, I did not want to hold the position although I suspect the Fed will help grease the skids for USD. I might use such a dip to get back on trend (up) for USD/CAD.

So, this is what I think, Dr. Duru, the central bank of Canada could now be in the business of popping bubbles. It will likely make the situation worse, so someone will be able to take advantage of the situation.

Are you talking about Canada's housing bubble? At least in the big cities. The Bank has consistently pointed out the rising imbalances due to rising debt. The Bank keeps talking like it has this rise under control. Time will tell.