TGIF – Bank Earnings Boost Markets

BLK, C, JPM, STT and WFC all beat estimates this morning with JPM (got ’em) pulling in $14.5Bn in profits for the quarter – boosted by a net $1.5Bn windfall from their takeover of First Republic Bank during the crisis. That’s up from $8.65Bn last year so very nice progress (67%) for JPM – it’s good to be the king!

The largest bank in the country, JPMorgan benefited from its size during the banking panic in March. Customers pulled deposits from smaller banks after the failure of Silicon Valley Bank and flocked to JPMorgan’s perceived safety. JPMorgan attracted some $50 billion in deposits in March alone, executives said in April.

As interest rates have risen rapidly, the bank has been able to charge more on loans while increasing the payouts for deposits more modestly, creating record revenues. That profit machine continued in the second quarter. JPMorgan made $21.78 billion in net interest income (what it earns on loans minus what it pays on deposits) – a third-straight record.

(Click on image to enlarge)

JPM is a Dow component and they are up $4, which is 25 Dow points but the big boost for the Dow this morning is UNH, who beat and raised guidance and they are up $14 this morning and that’s adding 119 points to the price-weighted Dow.

The Dow is, in fact, up 143 points pre-market and that is almost EXACTLY the total gain of UNH and JPM so the net rest of the index is flat and there’s nothing really to get excited about – especially with the Dollar still way down at 99.85.

(Click on image to enlarge)

(Click on image to enlarge)

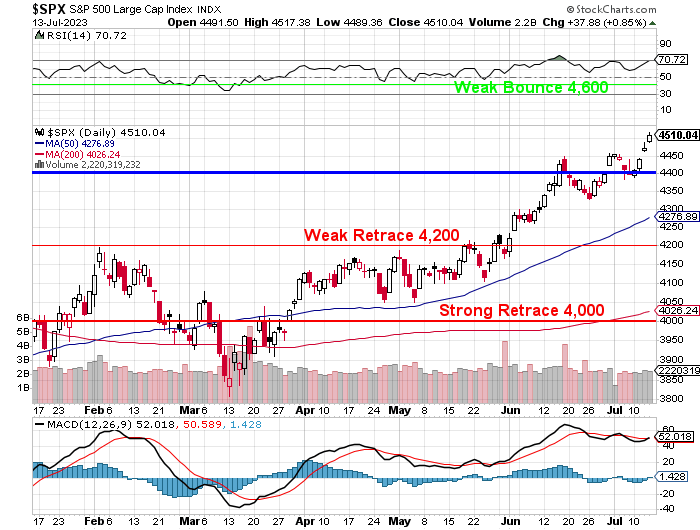

As you can see, there’s no mystery as to what’s driving the S&P 500 this week. 4,549 is up 125 points (2.8%) since Monday’s open and the Dollar is down 2.6% for the week. None of this really matters as we’re still between 4,400 and 4,600 – which is the Weak Bounce Line on the more aggressive S&P chart that we are still test-driving:

(Click on image to enlarge)

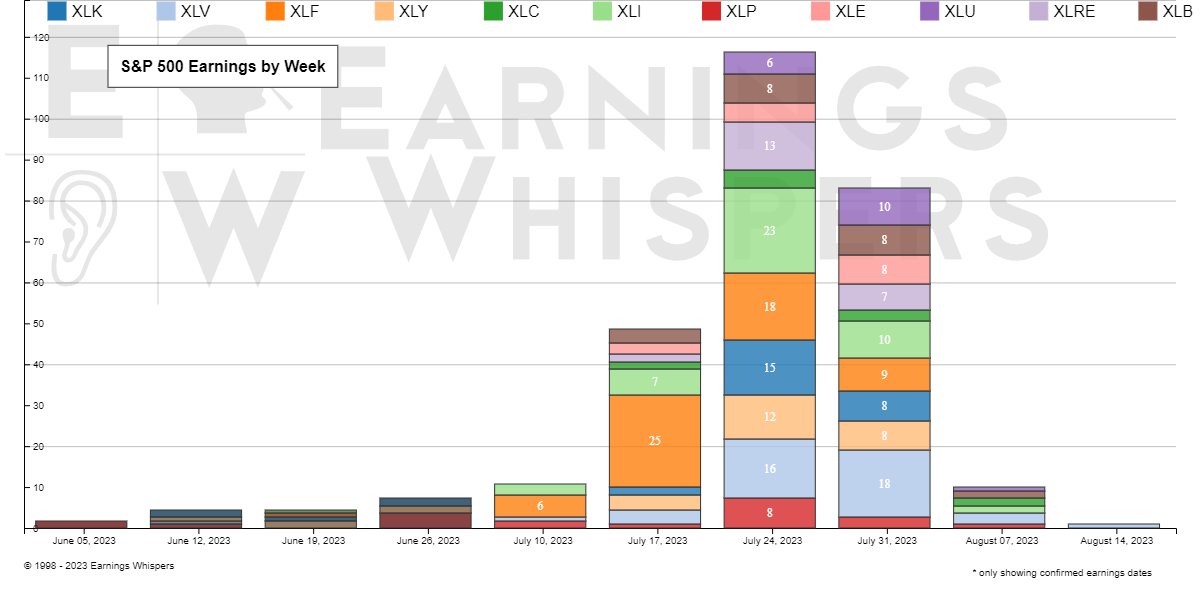

It seems like the banks are doing well and next week we get a lot more (XLF) reporting along with about 10% of the S&P 500 but the last week of the month is the biggie, with 117 S&P companies reporting beginning on July 24th – a busy month for analysts!

(Click on image to enlarge)

We also have portfolio reviews next week so busy, busy, and no holidays in sight…

Have a great weekend.

More By This Author:

Tuesday Already?Monday Market Mayhem – Trade Wars

Faltering Friday – Wrapping Up A Weak Week At Nasdaq 13,000

Click here to try Phil's Stock World free. Try PSW's ...

more