TalkMarkets Tuesday Talk: June Ablaze

June is a month when flower gardens are ablaze with color. Unfortunately, this week cities in the U.S. are ablaze as well, as rioting has taken hold as people protest the killing of George Floyd in Minneapolis at the hands of the police. In Hong Kong there is also social unrest as police for the first time in 30 years, have denied permission for organizers to hold the annual vigil for victims of the Tiananmen Square massacre; citing concerns over the spread of COVID-19. It remains to be seen if domestic security concerns in both the US and China will deflate or inflate the tensions between the two trading partners. As both Xi Jinping's and President Trump's leadership skills continue to be tested this week, so will investor appetites for risk be tested in the markets. US markets closed higher on Monday and Tuesday market futures have opened flat. Here is what some TalkMarkets contributors have to say about the market at the open of the June trading month.

Because of the uncertainty in markets worldwide due to the COVID-19 pandemic many investors, individual and institutional alike have pulled away from investing in foreign companies. Todd Campbell of E.B. Capital Markets in an exclusive for TalkMarkets takes a look at the current climate for ADRs in his article, Best & Worst ADRs.

He notes that the best sectors right now are Healthcare,Technology, Utilities and Consumer Goods. In the healthcare sector one of the companies he likes is Germany based Fresenius Medical Care, which offers kidney dialysis services and manufactures and distributes equipment and products used in the treatment of dialysis patients (FMS).

In the technology sector he likes the Chinese company Tencent (TCEHY) as well as the Israeli software company Neptune Intelligence Computer Engineering (NICE). As far as consumer goods Japanese electronics giant Sony (SNE) and Chinese concern TAL Education Group (TAL) are June standouts.

Campbell believes the countries with the best investing climate right now are Bermuda, Canada and Denmark. He includes a chart of the top 12 ADRs (American Depository Receipts) in his article.

John Galt of TheoTrade in, Economy Skirted A Depression, But Risk Is Still Here, notes that the April PCE report is the worst ever and how things will worsen if federal unemployment benefits are taken away by the end of July.

"This economy would be far worse than the Great Depression if it wasn’t for government help. Even if there were no shutdowns, many people would have stayed inside which means the problem wouldn’t have been avoided. It's not being dramatic to say the economy was saved."

Galt is also concerned about the economic effect of the current rioting in US cities and it's probable contribution to a second COVID-19 wave, "There’s also the possibility the virus spreads because of the riots and there’s a chance of a 2nd wave. America went from socially distancing to the exact opposite with all these protests. It’s an unfortunate test to see the effectiveness of the distancing."

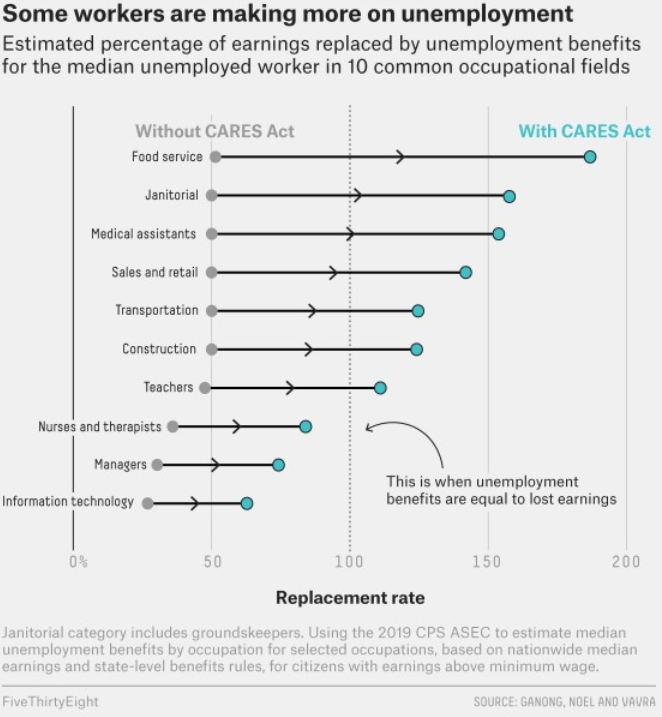

Galt includes some excellent charts detailing the state of the US economy including the one below which shows the positive effect of the CARES act:

Despite the disastrous April PCE, Galt concludes that government actions have saved the US from entering into a Depression.

"Debt has shifted to the government which can likely handle it. Even with increased debt we have seen a stronger dollar and lower inflation. That’s the opposite of what you’d see if people were worried about America’s debt."

In Making Sense Of Pandemic Valuations, another TalkMarkets exclusive, economist Karl Sjogren, tries to understand why "expectations that affect valuations are being upended" and in particular how this will affect start-up companies who raise money from the private rather than the public sector.

Sjogren notes, "A public company’s valuation is set daily. For a private one, it is set infrequently—when they raise equity capital. Many startups will need money in the next few quarters and a number of them have laid off employees and taken other measures to preserve cash. For those with weak performance or questionable business models, there is the prospect of a down round—a lower valuation—which will squeeze the ownership position of other shareholders and employees."

If valuations of start-up companies do drop drastically, this means that the timeline for the M&A or IPO prospects of these companies will get pushed out exponentially, making such investments less attractive to investors, (and without this investment) stifling innovation and hence, economic growth. Start-ups in Israel, for example, are terrified of this prospect and have called on the government to come to their aid.

In his column, June 2020 Monthly, TalkMarkets contributor, Marc Chandler reviews May events and what June may hold for some of the world's major currencies. "The investment climate in June will be shaped by forces that emerged in May. Many countries began relaxing lockdowns and various activity-based alternative data, like traffic patterns, Open Table Reservations showed improvement on the margins. Sentiment surveys, while mostly still depressed, were better than April readings. The long slog back has begun."

Though Chandler like others continues to see the US Dollar as the safe haven currency of choice he does note that:

"Since the end of March, the Australian dollar has been the best performing major currency, appreciating about 8.5% against the US dollar. Australian equities were also a significant beneficiary of the reflation-trade with the main benchmark up nearly 5% in May. The Federal Reserve had greater scope to approach the zero-bound than the Reserve Bank of Australia and this has resulted in the return of a normal relationship, where Australia offers an interest rate premium over the US." (FXA) Interesting.

For those with strong risk appetites, Chandler cites the Mexican peso as the strongest foreign currency in May, having gained 9% against the US dollar. That having said it is still the third weakest currency year to date behind the Brazilian Real and the South African Rand and he notes that the "shift in the peso's fortunes is more the result of the broader risk environment than an improvement in Mexico's economic or political outlook."

With regard to Pound Sterling (FXB) there does not seem to be much good news in the offing for the British currency.

"Nothing seemed to go in the UK's favor in May, and sterling was dragged lower. Although sterling recouped some of its earlier losses that carried it to six-week lows in the middle of May (~$1.2075), it was still the weakest of the majors, depreciating nearly 2.75% against the dollar...Trade talks with the EU do not appear to be going particularly well, and this may also weigh on sterling."

Monday's rates for the pound were 1 GBP = USD 1.2479 to1.2563, the 52 week range has been USD 1.1412 to 1.3514.

Andrew Moran of The Mises Institute in There's No End In Sight To The Zombie Economy, believes that the combination of cumulative quantitative easing programs and coronavirus related economic stimulus is creating thousands of "walking dead" companies which will cause the economy to come crashing down in two to three years time when the Fed moves to tighten credit.

Moran defines a "zombie company" as "a business that requires perpetual bailouts to keep its doors open, or it is a deeply indebted firm that can only repay the interest on its debt." He says that according to new data from Arbor Data Science, "American zombie businesses employ about 2 million people".

Due to the plethora of cheap capital being provided by central banks such as the Fed, Moran argues that nothing could be worse for Main Street businesses "because now capital is being misallocated and transferred to unproductive enterprises."

The endgame for what Moran is calling the "zombification" of the economy, "will only be felt in a few years when the Fed chooses to tighten up and remove the training wheels. We have seen what happens when the Fed scales back its quantitative easing efforts: triple-digit losses on the stock market and ballooning debt-servicing payments. If this ever happens, a tidal wave of debt defaults and bankruptcies will swallow the US." In such a scenario Jane and Joe investor and JP Morgan alike will be the walking dead. A gruesome prospect indeed.

Concern being one of this week's watchwords for citizens and investors as one, I leave you with this quote from Martin Luther King:

"And I must say tonight that a riot is the language of the unheard. And what is it America has failed to hear? ... It has failed to hear that the promises of freedom and justice have not been met. And it has failed to hear that large segments of white society are more concerned about tranquility and the status quo than about justice and humanity."