Speculators Raise New Zealand Dollar Bets After Drop To All-Time Low

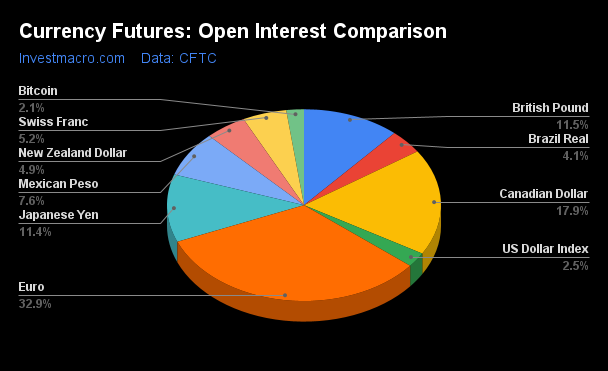

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday January 21st and shows a quick view of how large market participants (for-profit speculators and commercial traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the euro will decline versus the dollar.

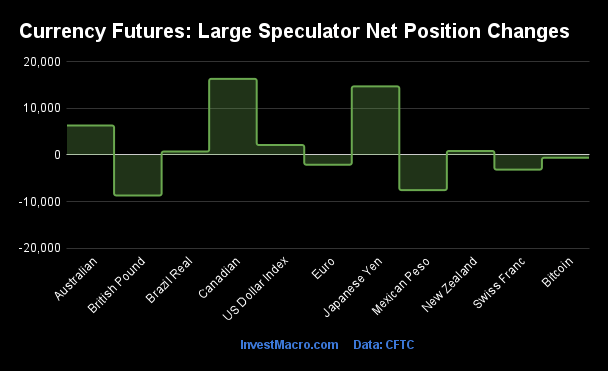

Weekly Speculator Changes led by New Zealand Dollar & Brazilian Real

The COT currency market speculator bets were slightly higher this week as six out of the eleven currency markets we cover had higher positioning while the other five markets had lower speculator contracts.

More By This Author:

Speculator Extremes: Lean Hogs & Nasdaq Lead Weekly Bullish Positions

Currency Speculators Push New Zealand Dollar Bets To Lowest Level Since 2019

Speculator Extremes: Ultra T-Bonds, AUD, 5-Year & USD Index Lead Bullish & Bearish Positions

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more