Silver Price Analysis: XAG/USD Sunk Below $30.00 As Bearish-Engulfing Pattern Loomed

Image Source: Pixabay

- Silver declined 3.86%. This fall was sparked by firm US Treasury yields and a strong US dollar.

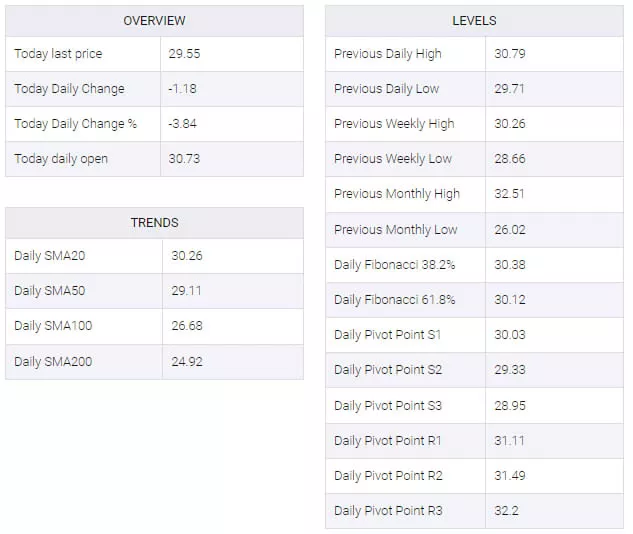

- The technical outlook showed a bearish engulfing pattern with the RSI turning bearish, indicating potential further losses.

- Key support levels: 50-DMA at $29.09, $29.00, and MTD low of $28.66, with deeper support at 100-DMA of $26.60.

- Key resistance levels: June 7 high at $31.54, $32.00, and year-to-date high of $32.51.

On Friday, the price of silver dropped sharply and snapped two days of gains amid firm US Treasury bond yields and a strong US dollar. The grey metal was seen trading at around $29.53, down approximately 3.86%.

XAG/USD Price Analysis: Technical Outlook

Silver still appeared to be bullish-biased as Friday's price action followed through Thursday's trading, completing a ‘bearish engulfing’ chart pattern. Momentum shifted in sellers’ favor as the Relative Strength Index (RSI) turned bearish and opened the door for further losses.

That said, XAG/USD's first support would be the 50-day moving average (DMA) at $29.09; it will expose the $29.00 figure. Breaching this level could lead to the MTD low of $28.66, ahead of a potential drop towards the 100-DMA at $26.60.

On the flip side, if XAG/USD resumes its uptrend in the coming days, the next resistance level would be the June 7 high of $31.54. Clearing this level would target the $32.00 mark before challenging the year-to-date high of $32.51.

XAG/USD Price Action – Daily Chart

(Click on image to enlarge)

XAG/USD Technical Levels

More By This Author:

USD/JPY Price Analysis: Surges Past 159.00, Approaches Yentervention Levels

GBP/USD Price Analysis: Extends Losses And Approaches 1.2600

Silver Price Analysis: XAG/USD Stays Firm And Consolidates Around $29.50

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more