Push And Tug On The U.S. Dollar

When the U.S. dollar index (DXY) crosses its 200-day moving average (DMA), it tends to launch into sustained moves. After the U.S. dollar broke down below its 200DMA in June, the subsequent selling in the dollar continued for seven months. So when DXY broke out above its 200DMA in the last week of March, I started to reconsider my long-standing bearishness on the U.S. dollar.

The U.S. dollar (DXY) is trading above its 200DMA for the first time since last May.

The Push

Part of the dollar’s resurgence is weakness in the euro. The euro (EUR/USD) is 57.6% of the U.S. dollar index. The European union is freshly struggling with the coronavirus pandemic with poor vaccine rollouts, spreading variants, and looming prospects of new lockdowns. The accumulation of issues is surely motivating sellers in the euro. The euro versus the British pound (EUR/GBP) is one of the best ways to confirm sentiment on the euro. EUR/GBP trades at a 13-month low.

EUR/GBP has trended down for all of 2021 on its way to the current 13-month low.

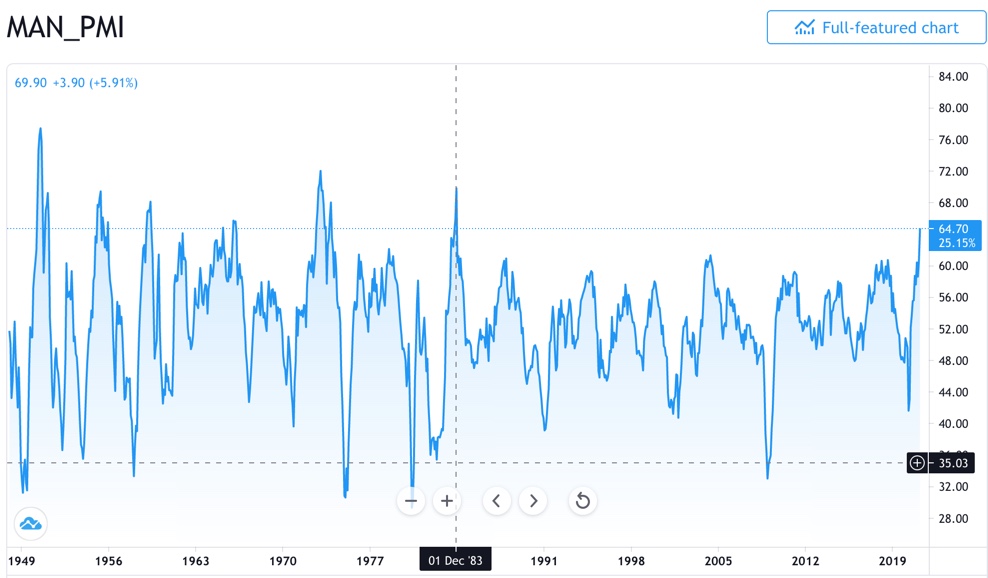

A rapidly recovering U.S. economy is an even more important factor for the U.S. dollar. The April ISM Manufacturing index for the U.S. hit its highest level since 1983. Of course, manufacturing is recovering off a severe slowdown, but the signal is clear. The U.S. recovery is full steam ahead. Buying into the U.S. economy requires buying U.S. dollars.

The ISM Manufacturing Index surged to a near 38-year high as the U.S. economic recovery continues to heat up. Source: TradingView.com

The Tug

Trading in commodity-related currencies still reflects the fundamental drivers of U.S. dollar weakness: massive and historic easy money monetary and fiscal policies. For example, the South African rand (USD/ZAR) may be stuck in a trading range, but it remains just a few percent above 14-month lows. The case I made for the Canadian dollar remains intact with USD/CAD continuing a downtrend and pivot around its 20DMA.

When I see the scale of the federal debt held by Federal Reserve banks and the size of the Federal Reserve balance sheet, I cannot help clinging to bearishness on the U.S. dollar.

Source: U.S. Department of the Treasury. Fiscal Service, Federal Debt Held by Federal Reserve Banks [FDHBFRBN], retrieved from FRED, Federal Reserve Bank of St. Louis, April 3, 2021.

Source: Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis, April 3, 2021.

However, for now, I stick with the technicals. In the push and tug on the U.S. dollar, the push is slowly but surely turning the battleship around. Fading rallies in EUR/USD looks like the most consistent and reliable way to ride the coattails of the change in U.S. dollar momentum. I am still sticking by short USD/CAD until its downtrend ends.

Be careful out there!