"Panic-Driven Hoarding Of Bank Notes:" People Aren't Abandoning Cash During The Pandemic, They're Socking It Away

Habits change in the midst of a global recession, not to mention a global pandemic. We have already looked at how the pandemic has caused seismic shifts in many industries, but it is also causing a shift in how people think about, handle, and (in this case) hoard cash.

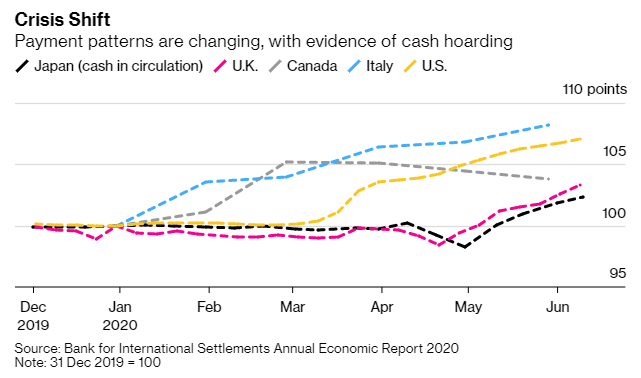

While we have been told non-stop that the pandemic is going to prompt the demise of paper currency and the words "digital dollar" continue to make appearances in government white papers and studies, the Bank of England found that there was actually a marked increase in bills in circulation in places like the U.S., Canada, Italy, Spain, Germany, France, Australia, and Russia.

And while we continue to hear arguments about a cashless society being more efficient and less virus-friendly, it would still pose a major challenge to implement and would - in the case of this study - directly contradict how people are handing their cash during the global pandemic, according to Bloomberg.

Charles Goodhart and co-author Jonathan Ashworth wrote in their study: “While the economic shutdowns and increased use of online retailing are currently diminishing cash’s traditional function as a medium of exchange, it seems that this is being more than offset by panic driven hoarding of banknotes.”

“Cash in circulation has actually been growing strongly,” they continued. And while it may just be a small portion of a percentage of the cash that Central Banks have printed, the velocity of money can't be ignore for inflationary purposes.

The research stands at odds with President Donald Trump’s former economic adviser Gary Cohn, who recently advocated for the disappearance of cash. Up until now, cash use has been on the decline due to credit cards and electronic transferring of money.

Michele Bullock, an assistant governor at Australia’s central bank, also argued against cash, calling COVID-19 the "ultimate disruptor of the payment system."

But a study from the Bank of International Settlements also supports the B of E study. It says that the rise in digital transactions during the pandemic wasn't at the expense of cash use. “Precautionary holdings of cash have risen in some economies – even as its use in daily transactions has fallen,” the study found.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more

This is very insightful and correct. During downturns people tend to stock paper money for the sense of security it brings and to deal with unexpected emergencies. Also noted is the fact that people are less likely to spend larger sums of money if they must use paper money.

I don't understand all this talk of "abandoning paper money." Digital currency may be the future, but paper money isn't going away any time soon.

Agreed. Also digital currency like bitcoin has a terrible way of using inordinate amounts of memory and if you lose your password you have in essence lost your ability to use it which is not a very good solution for users.