More Dollar Weakness — Here’s What To Buy

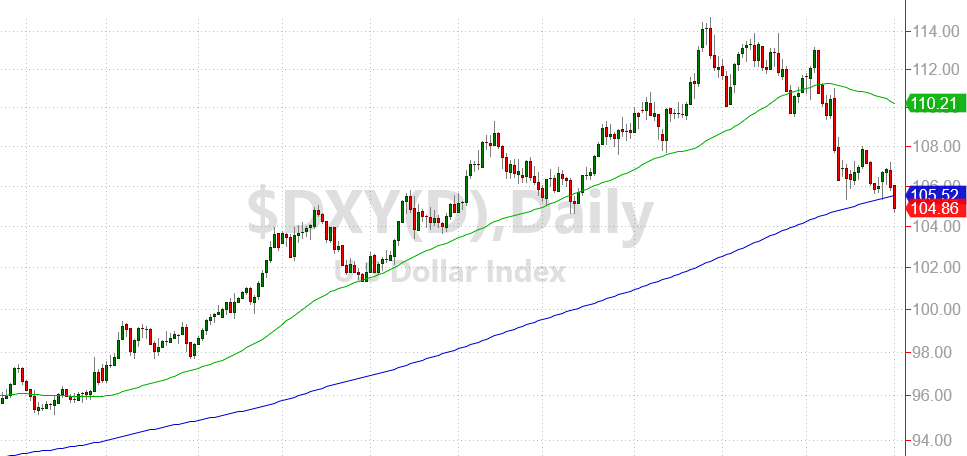

The U.S. dollar continues to fall. And today, the dollar index is taking out an important support level:

The blue line you see in the chart above is the dollar index’s 200-day moving average. And while there’s nothing “magical” about this line, it’s an important statistic that traders watch closely.

When a stock, or commodity — or even a currency — breaks this line, it indicates the long-term trend has shifted.

So today’s move is yet another indication of long-term weakness ahead for the U.S. dollar.

This has some big implications for your investments. So today I want to take a look at investments that will work well when the U.S. dollar is trending lower.

Why the Weak Dollar Is Trending Lower

On Wednesday, Fed Chairman Jerome Powell gave a speech at the Brookings Institution.

Here’s the quote getting the most attention from investors: “It makes sense to moderate the pace of our rate increases…“

In other words, the Fed is ready to slow its interest rate hikes as inflation begins to ease.

This is good news for most stocks because it means the Fed is less likely to push the economy into a full-fledged recession. (We may still get a recession. But a less hawkish Fed gives us a better possibility of avoiding one.)

But fewer interest rate hikes puts pressure on the U.S. dollar.

This is because international investors can’t expect to get quite as much yield moving capital into U.S. accounts. So capital will begin to flow away from the dollar and back toward other international opportunities.

Since currency trends can take many months (and even several years) to complete, the dollar’s breakdown could have much farther to go. Especially if U.S. interest rates weaken compared to the direction of international interest rates.

What to Buy When the Dollar Falls

A falling dollar acts as a tailwind for commodities like gold, oil, natural gas, and copper.

That’s because it takes more “weak dollars” to buy an ounce of gold or barrel of oil. The weaker the dollar becomes, the more dollars it takes to buy “stuff”.

We’re already seeing a surge for the price of gold.

And global demand continues to be strong for oil and gas, industrial metals, and other important commodities.

Another great way to play the falling U.S. dollar is to own stocks of U.S. companies that have customers around the world.

When the U.S. dollar is weak, it means other currencies are strong in comparison.

So customers with euros, yen or other currencies can actually buy more with the money they have to spend. That makes U.S. products more competitive on international markets.

Also, when U.S. companies book a profit in a foreign currency, that profit represents more dollars when the U.S. dollar is weak.

Even a steady profit in euros will naturally mean earnings will grow when measured in dollars.

So big international stocks like Coca-Cola (KO) and Procter & Gamble (PG) are natural beneficiaries of the weakening dollar.

Now that the dollar is moving steadily lower, I’ll be zeroing in on the best trades to profit from the weakening U.S. dollar.

More By This Author:

Why Bad Stocks Could Get (Much) Worse

How To Play China’s Zero-Covid Policy Change

Crypto’s Meltdown Is Good News For Gold

Excellent article. I bought a ton of P&G @ 151 average and am hoping this stock does well in 23.