Crypto’s Meltdown Is Good News For Gold

The crypto meltdown is picking up momentum…

Today, the price for a single bitcoin dropped below $16,000 and maybe even lower by the time you read this alert.

This after topping out above $65,000 in late 2021.

So far this year, the price of Bitcoin is down roughly 76%. (Chart pulled from Coinbase)

Bitcoin’s most recent decline came after cryptocurrency exchange FTX experienced a “liquidity crisis.” This was essentially a modern-day version of a run on the bank.

And with many customers unable to access funds for an extended period, cryptocurrencies are facing another crisis of confidence.

This crisis for cryptocurrency investors is leading to an opportunity for another important area of the market.

Welcome Back Gold Investors!

Yesterday morning I noticed a strange surge in a few of my investments.

The price of gold — along with stock prices for precious metal miners — traded sharply higher.

At first, I didn’t understand what was going on.

There were no major economic reports that would have affected gold prices. And I couldn’t find any headlines tied directly to gold prices.

But as the FTX drama started to unfold, I saw exactly what was going on.

Investors were moving capital out of “digital gold” (what some call Bitcoin and other cryptocurrencies). And that capital was moving into real gold.

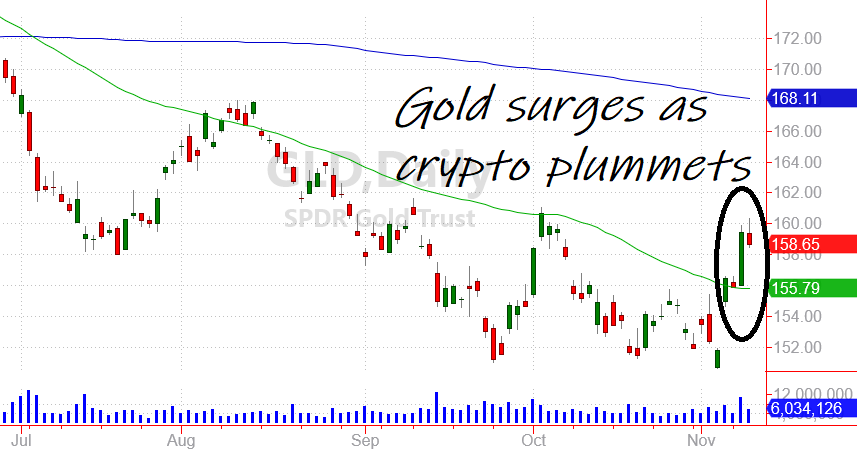

Take a look at Tuesday’s gold surge:

Over the past few years, Bitcoin and gold have attracted the same type of investors… People (and institutions) that want to protect their wealth against a potential decline in the value of fiat currencies.

For centuries, gold has been a great long-term hedge against inflation. And it’s also been a way for people to store value when entire financial systems have collapsed.

Since there are only a limited number of Bitcoin that will ever be mined, many people thought that this cryptocurrency could take the place of gold.

But with the most recent liquidity crisis, many of these investors are moving capital out of cryptocurrencies and into the tried and true safe haven of gold.

Two Catalysts Driving Gold Higher

I’m becoming more bullish on gold as we head into the end of the year. And there are now two major catalyst that could send gold prices higher.

Over the weekend, I added shares of the SPDR Gold Trust (GLD) to my bullish watch list. (You can see the most recent changes to the watch list here.)

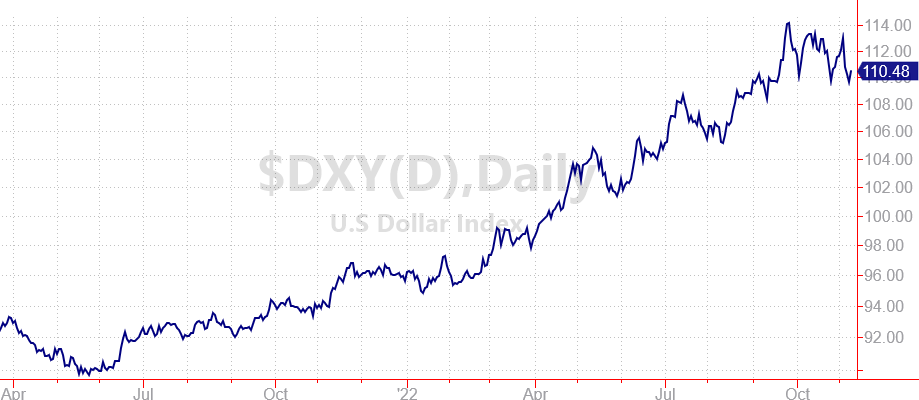

We’ve talked about how the strong U.S. dollar has been a headwind for gold this year. But as the dollar starts to roll lower, that headwind could reverse — helping to push gold prices higher.

Here’s what the U.S. dollar index looks like midway through the week:

While the dollar hasn’t completely broken down, the uptrend now looks challenged.

Keep in mind, being “long the U.S. dollar” is a crowded trade among institutional investors. So if the dollar breaks support, it could trigger a major exodus, sending the greenback sharply lower in a short period of time.

Between a weakening U.S. dollar and more destabilization in the cryptocurrency market, gold could move sharply higher into the end of the year.

After failing to protect investors from inflation for the past 12 months, gold has some catch-up work to do. And investments leveraged to the price of gold could lead to big gains over the next few months.

More By This Author:

Big Stocks Aren’t Always Better

Adding November Plays To The 20/20 Watch List

Inflation is Here to Stay — Just Look at the Stats