Markets: Bad News Bears

This isn’t a feel-good movie day, but reality as the bad news bears return from a quick 2-week hibernation and the China trade data overnight remind investors that all isn’t well in the global economy. Convergence of the US and China growth rates is one factor, tariffs and talks another, internal weak demand from policy and demographics a third as the world remains mired in uncertainty. Politics continue to hinder confidence as well – with UK May and Brexit coming to a head tomorrow with the fragility of her government in play, with Greece PM Tsipras facing a vote of no-confidence Wednesday after the Greek Independent Party leaves his coalition government over the dispute what to call Macedonia. What you call someone matters. The usual top 10 names for new babies in the US track the 1% in the previous 20 years. Name someone for a rich movie star or sports hero and you have a story built in. Others use family names in honor of their history.

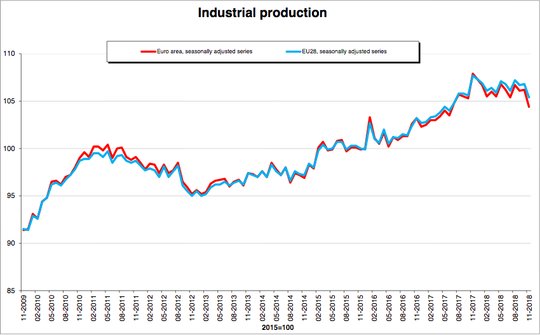

The battle over what to call the present economic and market state seems to be more like two new expecting parents nervously waiting for the birth and fit for the name rather than some romantic comedy with fairy-tale like endings. We are at the beginning of the show and 2019 has been filled with hope with a significant rebalancing from the December gloom. Overnight news beyond the China trade surplus rising thanks to imports collapsing wasn’t supportive for global growth either as Eurozone industrial production hits 3-year lows. What was interesting was the Swedish key inflation rate rising while pipeline rates in Germany fell as they did in India. The split between CPI and PPI data into 1Q will be important to watch to see if the oil price drops in 4Q help profit margins elsewhere. In the interim, the correlation of the global growth to rates to equities and to the USD is very much in play. How the USD trades today beyond the safe-havens of gold, JPY, CHF and bonds is important to measuring the risk-off, bad news is bad news return with central bankers not seen as movie stars able to win over public confidence and fix losing teams anymore.

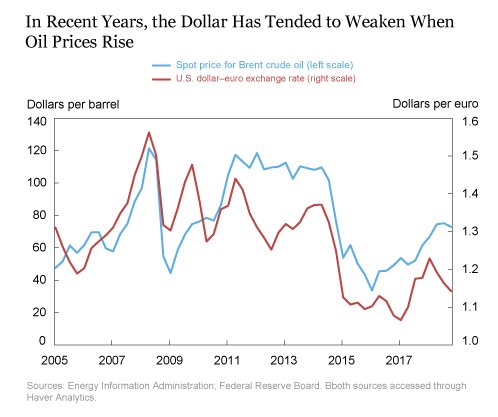

Question for the Day: Does oil matter more than rates for the USD? The correlation of energy prices to the USD was the focus of the Liberty Blog from the NY Fed last week. This is worth reading this week after the bounce back in oil prices last week, and given today’s pullback after the China trade weakness. Global correlations to oil and to China trade make the feel-good hopes for a US/China trade deal insufficient to reverse the present negative momentum in growth in the world. There will need to be more than a “pause” to US rate hikes and to the rest of the worlds push for normalization in rates. Fiscal stimulus from China will need to be more targeted as well with the financial inflows into China for bonds and stocks thanks to MSCI and Barclays adding them means a CNY that is too strong and not able to counter the imbalances elsewhere in the economy. The role of the USD in countering global pains is clear and it’s not going to go away in 2019.

The oil to USD correlation matters for capital flows and investments as well. The breakdown of the US petro-dollar connection and funding mechanisms from OPEC has been ongoing but its effect now is exaggerated by the US rate and deficit divergence. Here is the key part of the NY Fed piece on explaining the correlation - The fact that oil-exporters were not major cross-border investors until the 2000s fits the timeline of when the dollar-oil price correlation appeared. IMF data show the North Africa/Middle East region running current account deficits in the 1980s and 1990s, indicating that this region was borrowing rather than investing in the rest of the world. The balance turned into a $77 billion surplus in 2000 in response to a 50 percent increase in oil prices over the previous two years. The upward trend in oil prices eventually pushed the balance to $340 billion in 2008. The rate of foreign investment by oil exporters has since then moved in step with oil prices, falling to $44 billion in 2009, jumping to $414 billion in 2012, and collapsing into net selling territory in 2015. This narrative may also clarify why the correlation is most noticeable during the large oil price swings, since these were also periods when the volume of cross-border purchases of financial assets changed most.

What Happened?

- China December Trade surplus rises to $57.06bn after $41.86bn – more than $51.5bn expected with exports at 2-year lows. Exports fell 4.4% y/y after a 5.4% y/y – weaker than the 3% gain expected. Imports fell 7.6% y/y, biggest decline since July 2016, after a 3% y/y gain in November – and weaker than the 5% y/y gain expected. For all of 2018, China exports were up 9.9% y/y – best in 7-years – while imports rose 15.8% y/y. China’s surplus with the US rose 17.2% to $323.32 in 2018 – most on record and up 17.2% y/y but December exports -3.5% m/m and imports from the US fell 35.8 m/m.

- India December WPI 3.8% y/y after 4.64% y/y - less than the 4.42% y/y expected. Manufacturing WPI fell to 3.59% from 4.21% y/y, Food rose to -0.07% after -3.31% y/y, Fuel fell to +8.38% after 16.28% y/y.

- Germany December WPI -1.2% m/m, +2.5% y/y after 3.5% y/y – less than the 3.4% expected. For all of 2018, WPI rose 2.7% y/y.

- Sweden December CPIF up 0.4% m/m, 2.2% y/y after 2.1% - more than 2.1% expected. The overall CPI rose 0.4% m/m after -0.1% m/m – holding 2% y/y gains – as expected.

- Eurozone November industrial production fell 1.7% m/m, -3.3% y/y after +0.1% m/m, +1.2% y/y – weaker than -1.3% m/m, -2.3% y/y expected – worst in 3 years. Production of capital goods fell 2.3% m/m, durable consumer goods -1.7% m/m, intermediate goods -1.2%, consumer goods -1% and energy -0.6%. The 3 worst drops by nation were in Ireland -7.5%, Portugal -2.5% and Germany -1.9%.

Market Recap:

Equities: The US S&P500 futures are off 0.8% after losing 0.01% Friday. The Stoxx Europe 600 if off 0.8% with China trade concerns key, then Brexit. The MSCI Asia Pacific (ex Japan) fell 1% with China trade concerns driving.

- Japan Nikkei closed for holiday.

- Korea Kospi off 0.53% to 2,064.52

- Hong Kong Hang Seng of 1.38% to 26,298.33

- China Shanghai Composite off 0.71% to 2,535.77

- Australia ASX off 0.03% to 5,833.20

- India NSE50 off 0.53% to 10,737.60

- UK FTSE so far off 1% to 6,846

- German DAX so far off 0.7% to 10,814

- French CAC40 so far off 0.9% to 4,740

- Italian FTSE so far off 1.2% to 19,049

Fixed Income: Weaker equities, more political doubts, and weaker data – all drive bid to US bonds today. But for EU, the key is periphery with the German Bunds up 3bps to 0.21%, French OATS down 3bps to 0.63%, Italy up 3bps to 2.89%, Portugal off 2bps to 1.69%, Greece up 2bps to 4.30% while UK Gilts are off 3bps to 1.26%.

- US Bonds bid on equities and safe-haven demand– 2Y off 3bps to 2.52%, 5Y off 3bps to 2.5%, 10Y off 3bps to 2.67%, 30Y off 2bps to 3.02%.

- Japan JGBs closed for holiday.

- Australian bonds bid up on China trade– 3Y off 4bps to 1.79%, 10Y off 4bps to 2.27%.

- China bonds lower with inflows key– 2Y up 2bps to 2.67%, 5Y up 4bps to 2.94%, 10Y up 1bps to 3.14%.

Foreign Exchange: The US dollar index 95.62 off 0.1%. Focus is on safe-havens. In EM, USD mostly bid – EMEA: RUB off 0.5% to 67.204, ZAR off 0.4% to 13.882 – ASIA: INR off 0.8% to 70.93 while KRW off 0.45% to 1122.40.

- EUR: 1.1465 flat. Range 1.1451-82 with focus on 1.1420 and 1.1520 as hot points – ECB Draghi tomorrow – weaker data driving.

- JPY: 108.00 off 0.5%.107.99-108.55 with EUR/JPY 123.90 off 0.5% - all about equities with Japan on holiday.

- GBP: 1.2850 up 0.1%. Range 1.2818-1.2880 with EUR/GBP .8910 off 0.2% - Brexit and no deal fall-out vs. uglier politics in play 1.27-1.2950 keys.

- AUD: .7195 off 0.45%. Range .7175-.7218 with China trade and commodities driving - .7150 pivot against .7250 resistance. NZD off 0.2% to .6815.

- CAD: 1.3275 up 0.1%. Range 1.3254-1.3298 with focus on 1.3250 base building and 1.3320 resistance. Oil,rates and data driving.

- CHF: .9820 off 0.2%. Range .9812-.9846 with safe haven demand returning and risk for .97again. EUR/CHF off 0.3% to 1.1260.

- CNY: 6.7655 up 0.1%. Range 6.734-6.7720. The USD bid up on trade story with 6.73 base now for 6.80 retest.

Commodities: Oil down, Gold up, Copper off 0.7% to $2.6750

- Oil: $51.01 off 1.1%.Range $50.43-$52.11 with focus on equities/china trade and Saudi comments. $50-$52 key. Brent off 1% to $59.88 with $60 break reopening $57.50 risks.

- Gold: $1296 up 0.5%.Range $1287.70-$1296.60 with $1300 and $1305 in play as equities/USD return as drivers of fear. Silver off 0.1% to $15.65 but Palladium up 0.6% to $1287.10 while Platinum off 1% to $809.60.

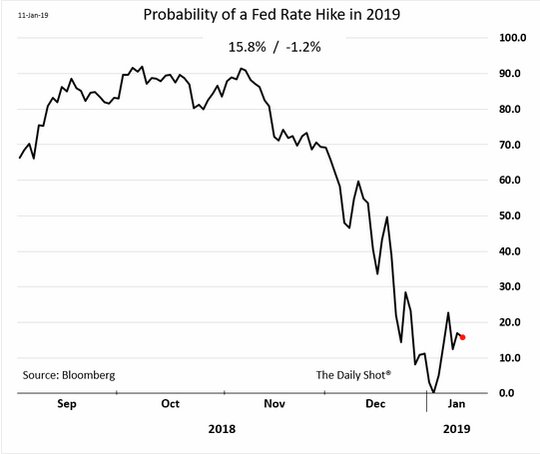

Conclusions: Can the Fed hike rates in 2019? The market wants to believe in good news and not bad. The lack of big stories early in the week make the focus abroad that much more difficult to handle and the correlation of US to the rest of the world growth rates that much more in play. 2019 is about convergence not US divergence. The return of better equities led to better growth hopes in the US and eventually that feeds into the FOMC policy reaction function. The discounting of FOMC rate hikes in 2019 isn’t a sign of confidence for the overall market.

Economic Calendar:

- 1100 am US Dec NY Fed CPI expectations 2.97%p 2.9%e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.