“Is A Dollar Crash Coming?”

That’s the title of a symposium in The International Economy, with Anders Åslund, Scott K.H. Bessent, Lorenzo Bini Smaghi, Jill Carlson, Stephen G. Cecchetti, Menzie D. Chinn, Lorenzo Codogno, Tim Congdon, Marek Dabrowski, Mohamed A. El-Erian, Heiner Flassbeck, Takeshi Fujimaki, Joseph E. Gagnon, James K. Galbraith, James E. Glassman, Michael Hüther, Richard Jerram, Gary N. Kleiman, Anne O. Krueger, Mickey D. Levy, Thomas Mayer, Jim O’Neill, Adam S. Posen, Holger Schmieding, Derek Scissors, Mark Sobel, Makoto Utsumi, and Chen Zhao.

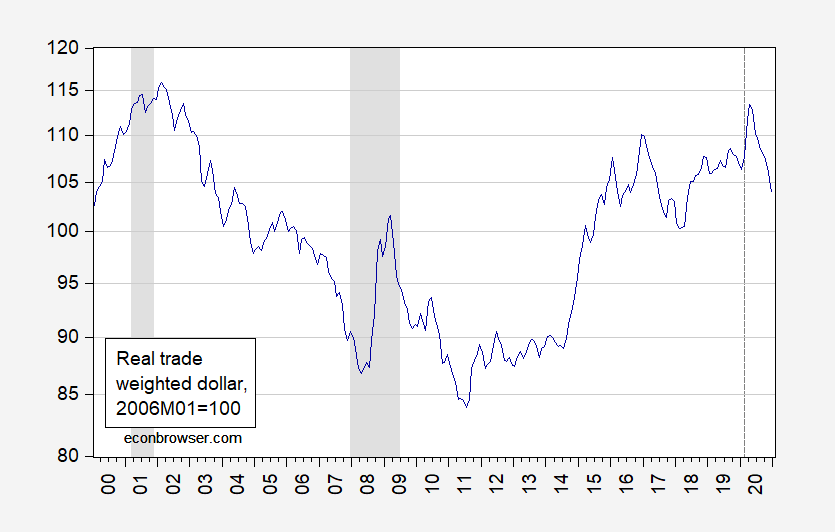

Figure 1: Real trade weighted US dollar against a broad basket of currencies, 2006M01=100 (blue). Goods & services weighted spliced to goods weighted at 2006M01. Source: Federal Reserve Board via FRED, and author’s calculations.

My conclusion here:

The foregoing does not mean the dollar’s role might not be eroded by the rise of regional currencies. In fact, that outcome seems inevitable, eventually. Nor does it mean that the value of the U.S. dollar might not decline as macro factors wax and wane—risk appetite increases, or U.S. interest rates fall relative to foreign interest rates—but in the absence of one that is sharp and persistent, that’s not a crash. In fact, a moderation in the dollar’s value is to be expected, and would encourage net exports, thereby boosting U.S. economic growth and employment.

Joe Gagnon (PIIE):

The correct metric for excessive debt is not to compare the stock of debt to the flow of income but instead to compare the interest expense to the flow of income. Debts need never be paid down, but they do have to be serviced.

On that metric, the advanced economies are in good shape. Government interest burdens, in particular, have fallen despite rising debt stocks. Indeed, a true inflation-adjusted accounting would show a negative burden, meaning that higher debt reduces a government’s budget deficit. That is the market’s way of saying “please borrow more.”

Of course, this beneficent situation may not last forever. At some point, real interest rates may return to positive territory. That is why it is important to use the debt wisely and invest in human and physical capital (education and infrastructure) that will yield high returns to society for years to come. Any increase in real interest rates likely would be gradual and would result from good news for economic growth, making it easier to undertake the needed fiscal consolidation.

And from Mark Sobel (OMFIF):

The RMB is a good candidate for appreciation. But China has an extremely weak financial system and is increasingly authoritarian. Despite increased inflows into Chinese bonds and stocks, major capital account opening runs the risk of massive outflows, depreciation, and financial instability. Chinese property protections leave much to be desired.

A major U.S. policy mistake undermining macro stability or the dollar’s reserve currency properties could sow the seeds of dollar demise. Excessive unilateral use of financial

sanctions could weaken the dollar over the longer haul.But there are now no alternatives. One day the soothsayers of doom may prove right. In the meantime, the repeated prophesies are tired.

But Adam Posen (President, PIIE) warns:

What would make the U.S. dollar crash beyond this downward adjustment in its international financial role is domestic political breakdown. Public debt levels and even current account deficits do not matter much for a large high-income democracy in and of themselves, so

long as people believe that taxes can be raised if needed. That probability is what has kept the Japanese economy afloat even as public debt levels went above 200 percent of GDP. If due to a contested election or a divided partisan Congress the United States repeatedly cannot pass budgets in 2021, that portends badly for the dollar, just as it

would for any other economy.

Disclosure: None.

These are terribly worded sentences:

"The foregoing does not mean the dollar’s role might not be eroded by the rise of regional currencies. In fact, that outcome seems inevitable, eventually. Nor does it mean that the value of the U.S. dollar might not decline as macro factors wax and wane..."

Way too many uses of the word "not". It's not clear what you mean. I think you meant to say:

"The foregoing does not mean the dollar’s role might be eroded by the rise of regional currencies. In fact, that outcome seems inevitable, eventually. Nor does it mean that the value of the U.S. dollar might decline as macro factors wax and wane..."

I removed the second "not" in both sentences. Is that the meaning you are trying to convey? Of course, I might not not be correct.

Makes more sense that way. Thanks.

I certainly hope not!