Has The Yen Found A Position Of Strength To Push Back Against The Dollar?

The USD/JPY currency pair has pulled back over the last few days to cut short its 2-month rally. The pair had spiked to trade at a new multi-year high of 139.405 before last week’s pullback. The pullback coincided with the Bank of Japan’s decision to keep the base interest rate unchanged at -0.1%.

On the contrary, most of Japan’s colleagues at the G20 have raised interest rates, led by the US, which boosted its Funds rate by another 75 basis points following last month’s surprise 100 basis-point hike.

Canada, the UK, the EU and even Australia, have all raised interest rates over the last two months.

And while the US dollar has continued to strengthen against other currencies, its position against the Japanese yen seems to be weakening.

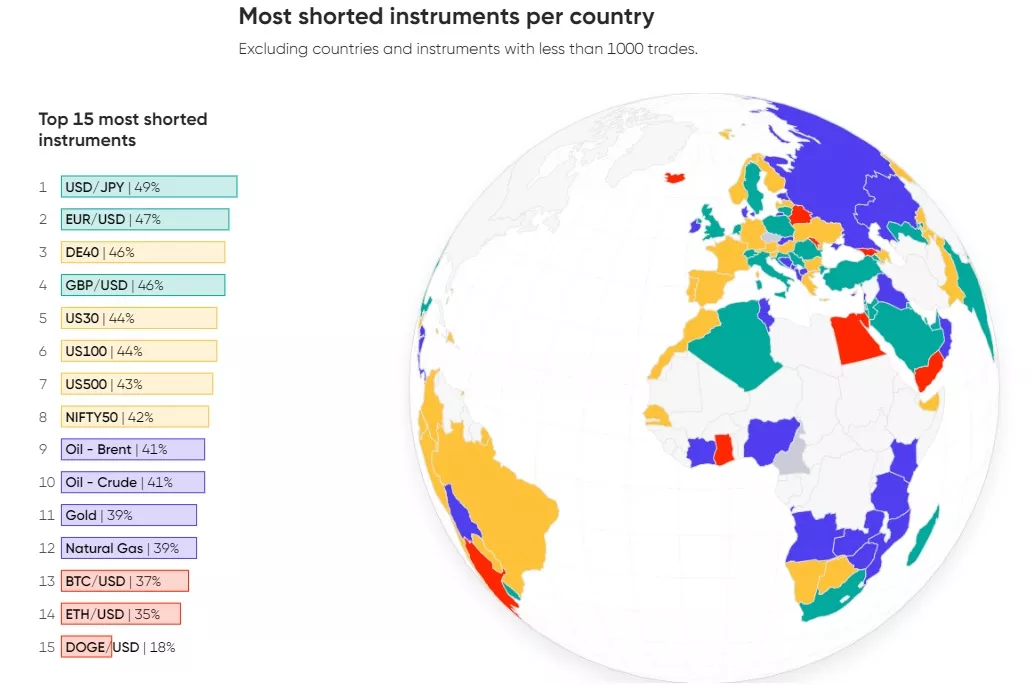

In fact, the market may already be beginning to realize this based on Capital.com’s trading trends report for Q2, which showed that 49% of traders on Capital.com shorted the USD/JPY currency pair, making it the most shorted instrument on the platform globally.

Image source: Capital.com

The report also suggested that should the Federal Reserve issue another hawkish report, the market could continue to short the USD/JPY currency pair. And although there was an unsuccessful attempt to bounce back on Monday and Tuesday, the pair pulled back again on Wednesday after the Fed confirmed a 75 basis-point rate hike.

Technical overview

Technically, the currency pair seems to have recently pulled back to avoid slipping back into overbought conditions in the 14-day RSI. As a result, this has created an interesting price action opportunity for both sides of the market.

From a bullish perspective, given the persistent recession fears, the US dollar is still seen as a safe haven in the market, which means the pullback could present an opportunity to buy.

On the other hand, coming at the back of another hawkish report and President Biden responding strongly to those claiming the country is in a recession, The Bank of Japan’s negative interest rate may end up boosting the Japanese yen, which is contrary to how currencies react to negative interest rates.

As a result, the JPY could gain strength against the USD, resulting in a continuous downward trend in the currency pair.

Moreover, with inflation data still indicating a rising cost of living, the USD/JPY currency pair could find it hard to mount a significant bull run until US inflation begins to fall.

Conclusion

In summary, with the USD/JPY currency pair experiencing a short ratio of nearly 50% in Q2 on one of the leading brokerage platforms, Capital.com, coupled with lingering recession fears now could be a great time to buy the rebound.

However, if President Biden’s views on “supposed inflation” are anything to go by, then BoJ’s negative interest rates could boost the yen against the greenback, resulting in more declines in the USD/JPY currency pair.

More By This Author:

NFTs And Collectibles Tokens Bounce Back Amid The Crypto Collapse

Is The Market Entering Another Commodity Supercycle?

Web3 Tokens To Watch In 2022

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more

Good read, thanks.