Is The Market Entering Another Commodity Supercycle?

At this time last year, the market swarmed with meme stock stories as Redditor WallStreetBets drove the hype leading to a rapid surge in prices. However, things seem to have taken a different turn this year, with investors choosing the more fundamentally found options rather than highly hyped stocks.

A report by the Capital.com research team likens the current commodity migration to previous periods of the commodity supercycle, where investors rallied commodity prices to historical highs before triggering a global financial crisis.

“The investor migration into commodities appeared to be in direct correlation with the recent upbeat price action in these markets, which suggests the world may be entering a so-called commodity supercycle.”

For reference, in 2007, oil prices spiked 184% to reach the current all-time highs before plummeting in 2008, which also coincided with the global financial crisis. And now, the light crude oil price seems to have rocketed nearly 630% to trade at new 14-year highs before the recent pullback.

However, as seen in the chart, the current rally still seems set to continue potentially setting new all-time highs. What follows after that, no one knows but the market is already abuzz with the expectation that we could witness one of the greatest financial crises in years.

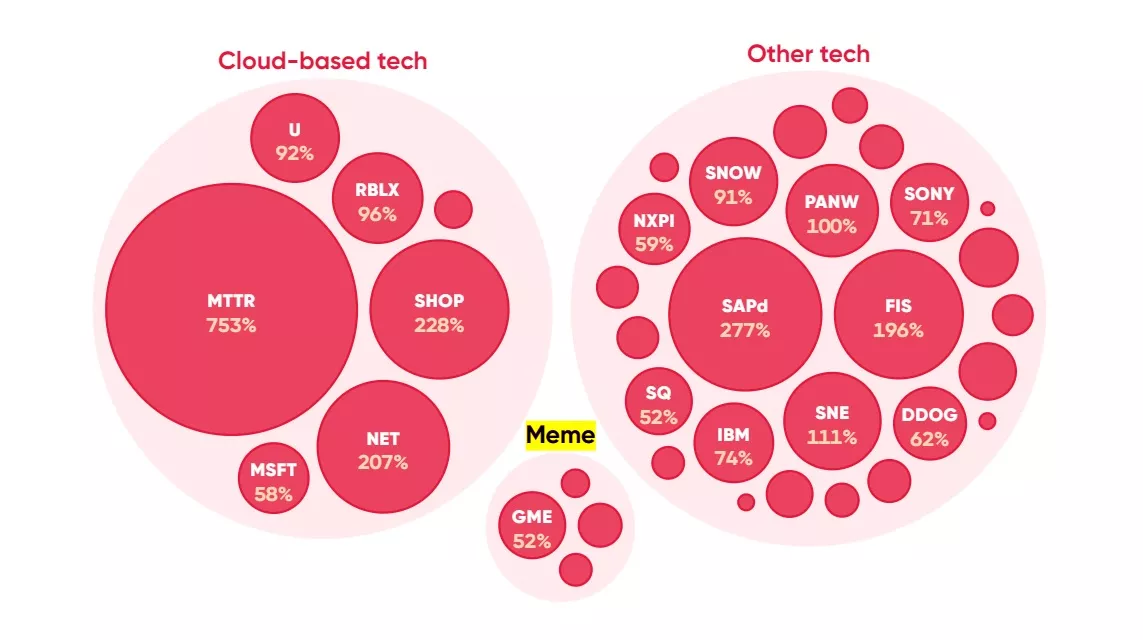

While the attention seems to be shifting towards commodities and more fundamentally sound stocks, meme stocks continue to witness a significant drain in trading activity according to Capital.com’s report.

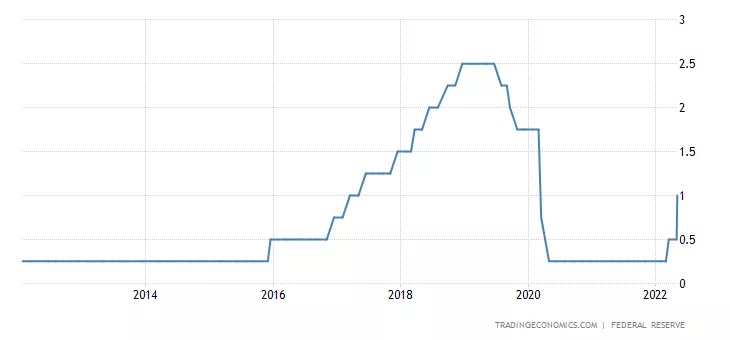

The report attributes the recent meme and tech stocks exodus to rising inflation rates which forced various economies around the world to hike interest rates. The US Federal Reserve raised rates two times from the covid levels of 0.25% to the current level of 1%, while the Bank of Canada and the Bank of England have also raised their benchmark rates.

“Meme stocks seemed to lose some of their shine, with a slowdown in trading volumes,” the analysts wrote.

Investors may also be moving towards commodities to capitalise on the recent rise in demand for raw materials, which could be a logical option for those looking to diversify their investments amid increased volatility in equity markets and the crypto.

While stocks like GameStop and AMC continue to witness a significant decline in transaction volume, Autodesk, Meta Platforms, Microsoft, Matterport, Cloudflare, Roblox, Shopify and Unity Technologies saw activity rise by 26% during the first quarter of 2022.

stock trading activity via Capital.com

Matterport and Shopify saw trading activity increase by 753% and 228%, respectively, whereas Meta Platforms, the parent company of Facebook, WhatsApp and Instagram attracted a 768% increase in transaction activity.

Nonetheless, stock prices still plummeted between February and the first two weeks of March amid Putin’s invasion of Ukraine. And although there has been a significant recovery since the final week of March, there are concerns that this could yet turn out to be a dead cat bounce, the report notes.

This explains why investors continue to storm towards commodities as they fear the bear trend may not be over for the equities and crypto markets.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more

No, I don't think it is.

.3 in April. Inflation topped out.

https://www.bls.gov/cpi/