GBP/USD Drops Below 1.2700 Post FOMC Minutes Release

GBP/USD hovers around the 1.2700 mark as the latest Federal Reserve Open Market Committee (FOMC) minutes showed that some Fed officials wanted to raise rates. Still, they agreed to pause to assess the impact of the Fed’s cumulative tightening amidst maintaining a restrictive stance. The GBP/USD is trading at 1.2692, down 0.12%.

The US Dollar Index (DXY) barely reacted to the data and stayed firm at around 103.290, while US Treasury bond yields continued to climb after the June minutes release. Expectations for two rate hikes remained unchanged, with odds for November at 31%, while for July, chances for a rate hike are at 88.7%, as shown by the CME FedWatch Tool.

Summary of the FOMC’s June meeting minutes

FOMC’s minutes showed that all participants judged it appropriate or acceptable to leave rates unchanged to assess the impact of cumulative tightening. However, Fed officials that wanted to lift rates by 25 bps mentioned the tightness of the labor market as the main reason for a hike. At the same time, all participants agreed to keep a restrictive stance as appropriate.

In the meantime, Fed staff sees a mild recession late in the year, as mentioned in the May minutes, while upside risks to the inflation outlook or the possibility of inflation expectations might become unanchored, remained key to the policy outlook.

GBP/USD Price Analysis: Technical outlook

(Click on image to enlarge)

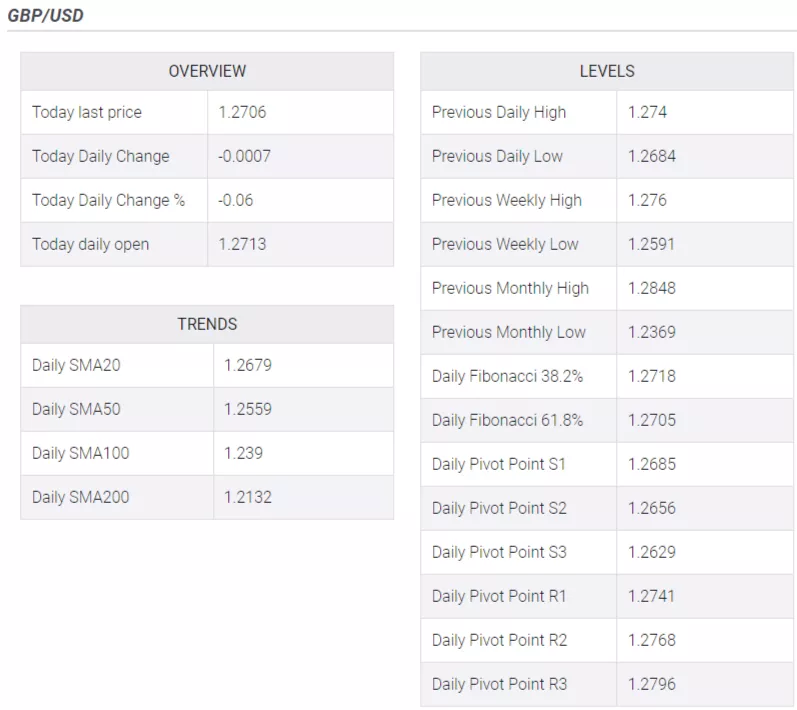

The GBP/USD failed to react to the data, though it turned negatively but clung above the 1.2700 figure. However, the GBP/USD remains capped by the weekly high of 1.2739 seen last Tuesday but failed to dive beneath the 1.2700 figure. From an oscillator perspective, the Relative Strength Index (RSI) drops toward the 50-midline, while the three-day Rate of Change (RoC) depicts buyers losing momentum. But unless GBP/USD tumbles below 1.2700, upside risks remain. On the downside, key support levels lie at the 20-day EMA at 1.2662, followed by the 1.2600 figure and the 50-day EMA at 1.2567. On the upside, resistance lies at 1.2700, followed by 1.2736 and 1.2750.

More By This Author:

Dow Still Angling Toward 35,500 Ahead Of FOMC Minutes, Jobs Report

Pound Sterling Recovers As UK PM Sunak Shows Confidence About Price Stability

WTI Crude Oil Slides As Global Economic Slowdown Concerns Weigh On Demand

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more