WTI Crude Oil Slides As Global Economic Slowdown Concerns Weigh On Demand

Western Texas Intermediate (WTI), the US crude oil benchmark, slides towards the end of the New York session, down 0.55% at $70 per barrel, as worries for a global economic slowdown might dent oil’s demand, despite Saudi Arabia and Russia’s supply cut announcement. At the time of writing, WTI exchanged hands at $70.01 after hitting a daily high of $71.72.

Worldwide economic slowdown fears overshadow Saudi Arabia, and Russia cut announcements as WTI dives

WTI remained under pressure despite Saudi Arabia’s intentions to cut oil output by one million barrels in July, extending it to August. Although it triggered an upward reaction, WTI edged lower as manufacturing activity worldwide slowed down, as revealed by S&P Global PMIs.

China’s Caixin PMI expanded modestly by 50.5, exceeding estimates of 50.2, but continues to decelerate as June’s data trailed May’s 50.9. That, alongside Eurozone’s (EU) deceleration, Germany’s technical recession, and recently revealed ISM Manufacturing PMI data in the US staying at recessionary readings, capped WTI rally.

The ISM Manufacturing PMI for June came at a recessionary area at 46.0, below estimates and the prior’s month reading, suggesting the US economy is decelerating. That could refrain the US Federal Reserve from increasing rates twice towards the end of 2023 as investors brace for July’s 25 basis points rate hike.

Aside from this, Russia’s intent to boost oil prices reported that it would reduce its exports by 500,000 bpd in August, revealed Deputy Prime Minister Alexander Novak.

Meanwhile, the total crude oil output brings the Organization of Petroleum Exporting Countries (OPEC) and its allies production to 5.16 million barrels per day (bpd). It should be said that Riyadh and Moscow have been trying to bolster prices, though China’s reopening after Covid-19 is failing to gather pace.

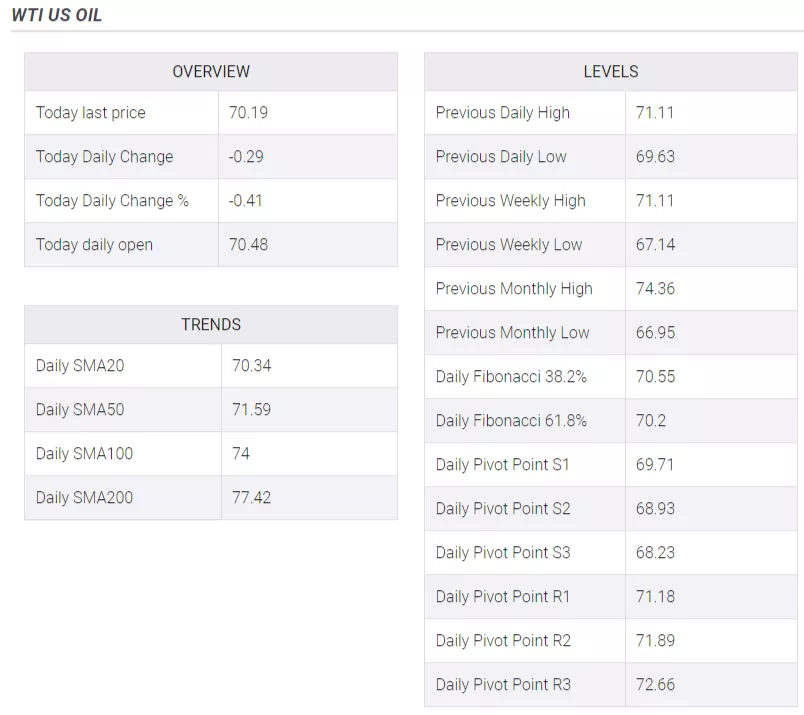

WTI Price Analysis: Technical outlook

(Click on image to enlarge)

WTI remains neutral to downward biased after failing to crack the 50-day Exponential Moving Average (EMA) at $71.63, though capped on the downside by the 20-day EMA at $70.22. However, late in the US session, WTI slipped below the latter, opening the door for a re-test of the $70.00 figure. A breach of the latter will expose immediate support at $67.10, followed by the March 20 daily low of $64.41. Once cleared, WTI would dive to the year-to-date (YTD) low of $63.61.

More By This Author:

EUR/JPY Strives To Test 158.00 As ECB Prepares For A Fresh Rate Hike Cycle

EUR/GBP Price Analysis: Slid On High UK Yields, Dark Cloud Cover Formed

Gold Price Forecast: XAU/USD Closes Third Consecutive Week Of Losses

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more