GBP/USD At A Crossroads: Momentum Needed For New Buying Opportunities

Photo by Colin Watts on Unsplash

The GBP/USD pair has again lost direction, hovering around 1.3283 on Thursday after hitting a seven-day high mid-week.

Key drivers influencing GBP/USD movement

The US dollar weakened on Wednesday, allowing the pound to regain ground. This shift followed ongoing currency negotiations between the US and South Korea, where both parties agreed to continue discussions on exchange rate policies. The reduced demand for the greenback lent support to most major currencies, including sterling.

Domestically, the market focus shifted to the Bank of England (BoE) commentary. Deputy Governor Sarah Breeden emphasised the necessity of long-term reforms in the bond market. At the same time, Monetary Policy Committee (MPC) member Catherine Mann noted that further rate cuts would require more evident signs of easing price pressures – essentially, a sustained drop in inflation.

Meanwhile, the latest UK labour market data revealed an increase in the unemployment rate to 4.5%, the highest since 2021, accompanied by a slowdown in wage growth.

These factors have collectively reinforced expectations of further monetary policy easing by the BoE. Despite internal MPC dissent, last week’s 25bps rate cut caught markets off guard, as many expected a pause in the easing cycle.

Technical analysis: GBP/USD

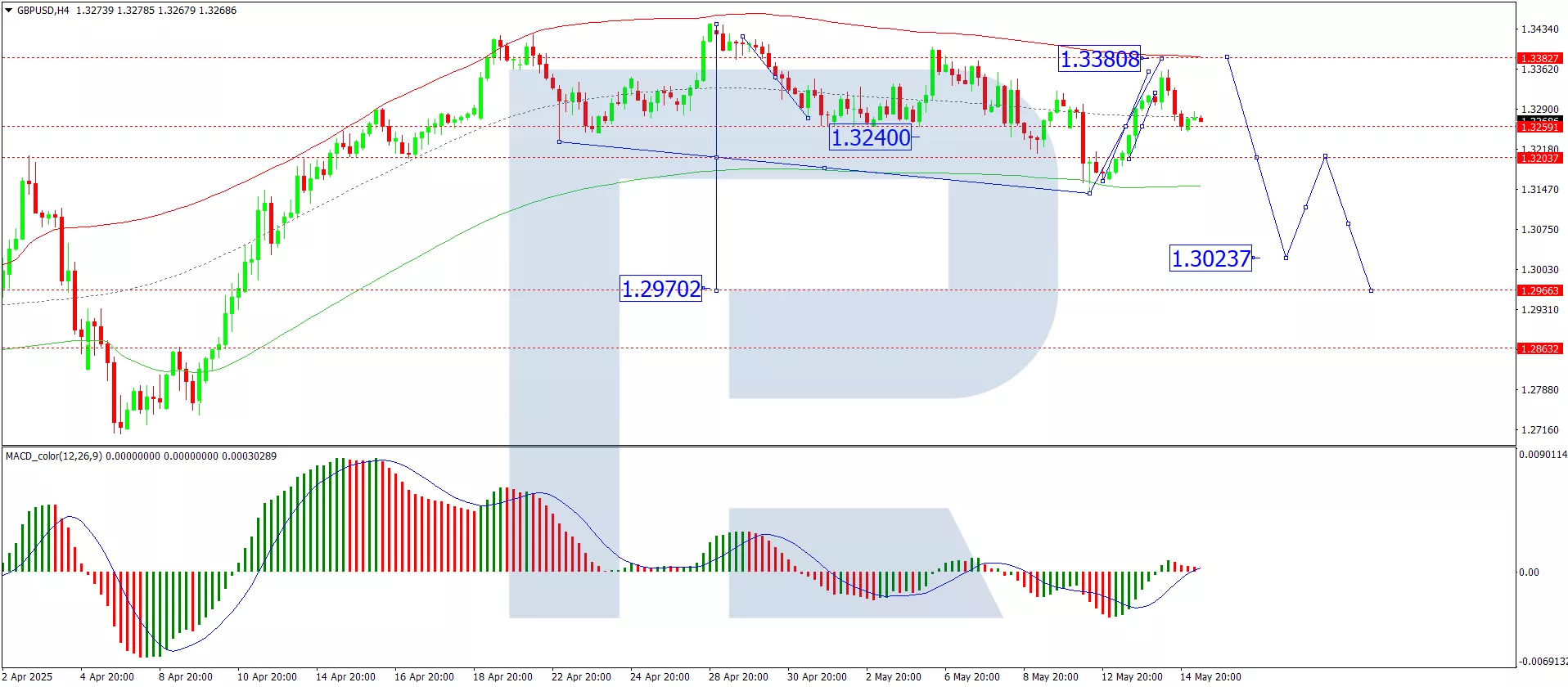

H4 Chart:

(Click on image to enlarge)

- The pair continues to trade within a broad consolidation range around 1.3260

- The current range extends to 1.3360, with a technical pullback to 1.3260 (testing from above) now underway

- A drop towards 1.3200 is anticipated. A break below this level could extend the downtrend to 1.3100, potentially stretching further to 1.3030

- This bearish outlook is supported by the MACD indicator, whose signal line remains above zero but is trending sharply upward

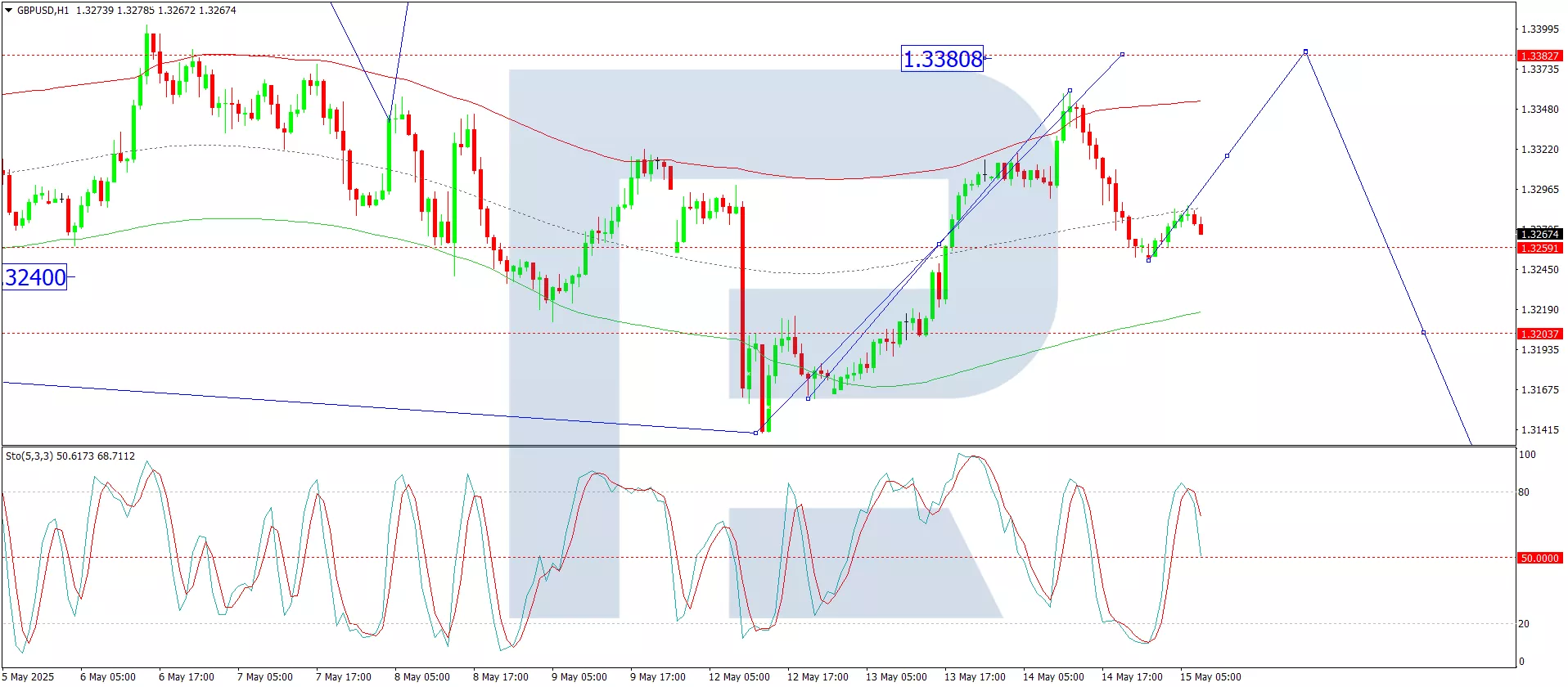

H1 Chart:

(Click on image to enlarge)

- The pair broke above 1.3260, reaching the local upside target of 1.3360

- Today’s corrective decline is testing 1.3260 again

- A renewed upward move towards 1.3380 is possible if support holds

- The Stochastic oscillator aligns with this scenario, with its signal line above 50 and rising towards 80

Conclusion

The GBP/USD remains in a holding pattern, awaiting fresh catalysts for a decisive move. While technical indicators suggest near-term volatility, the broader trend hinges on BoE policy signals and global risk sentiment. Traders should watch for a breakout beyond 1.3360 or a drop below 1.3200 for clearer directional bias.

More By This Author:

Yen Edges Higher As Market Capitalises On News-Driven Rebound

US Dollar Roars Back In A Blaze Of Glory As Market Shrugs Off Recession Fears

Gold Drops To 3,273 USD As Markets Await Trade Deal Developments

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more