US Dollar Roars Back In A Blaze Of Glory As Market Shrugs Off Recession Fears

Image Source: Unsplash

EUR/USD dropped to 1.1110 on Tuesday, with the US dollar surging by over 1% in the previous trading session. The rally was driven by market reactions to news of a provisional agreement between China and the US to reduce tariffs, which helped alleviate global recession fears.

Key factors driving EUR/USD movement

Washington and Beijing have agreed to cut tariffs to 30% and 10%, respectively, for 90 days.

Meanwhile, US Treasury Secretary Scott Bessent confirmed plans to meet with Chinese representatives again in the coming weeks to begin negotiations on a broader trade deal.

The tariff reductions boosted market sentiment towards the dollar, which had previously faced pressure over concerns that President Donald Trump’s trade policies were diminishing the appeal of US assets. However, market nervousness is likely to persist until the White House establishes stable trade terms with all key partners.

Attention now turns to the latest US inflation report, which may show how the new tariff policy affects prices.

Technical analysis: EUR/USD

(Click on image to enlarge)

On the H4 chart, EUR/USD broke below 1.1190, completing the third wave of decline towards 1.1065. Today, we anticipate a corrective wave retesting 1.1190 (from below). Once this correction concludes, a new downward wave towards 1.1040 is expected. This scenario is technically confirmed by the MACD indicator, with its signal line below zero and pointing decisively downward.

(Click on image to enlarge)

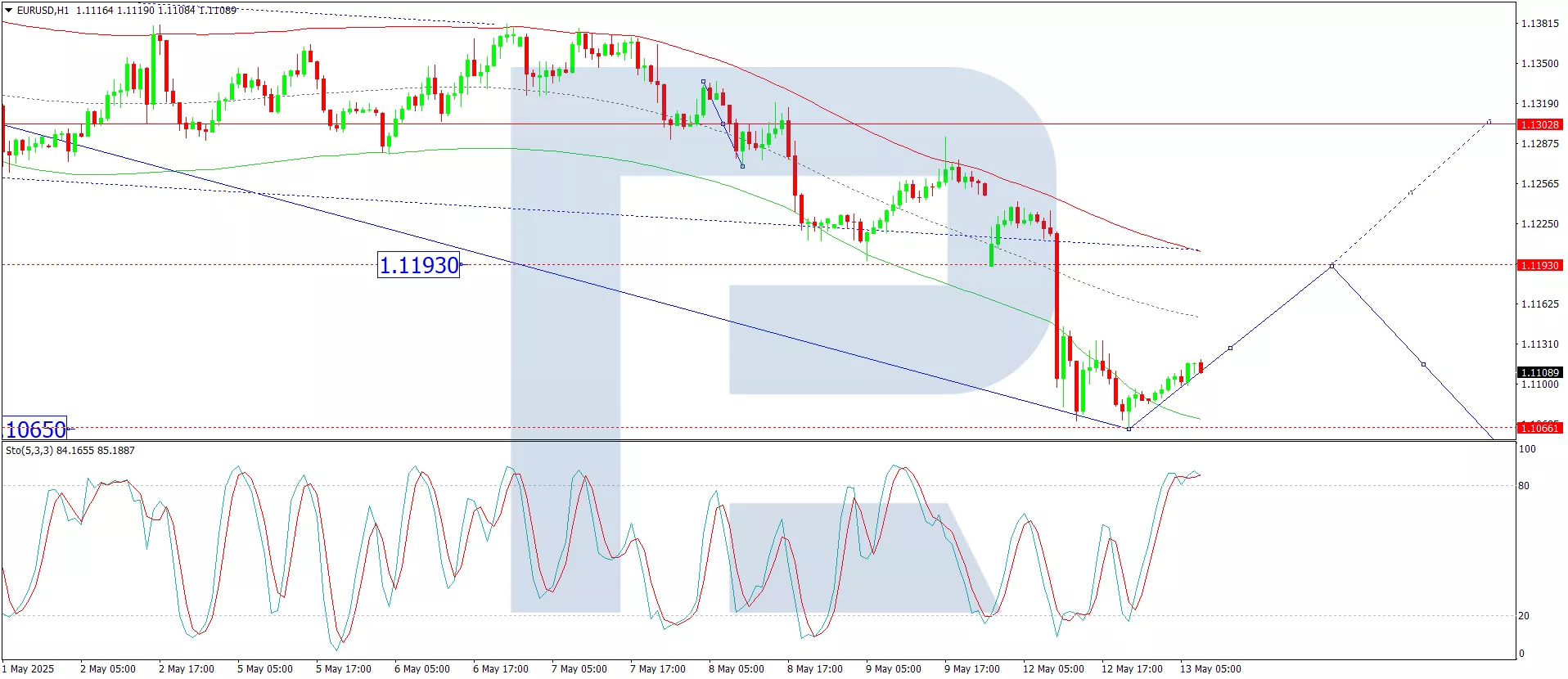

On the H1 chart, the market has achieved the local downside target at 1.1065. Today, a potential rebound to 1.1126 is in focus. If this level is breached upwards, a further correction towards 1.1190 may follow. Subsequently, the downward trend could resume, targeting 1.1040. This outlook is supported by the Stochastic oscillator, whose signal line is above 80 but poised to decline towards 20.

Conclusion

The US dollar’s resurgence reflects improved risk sentiment following the US-China tariff truce, though uncertainty lingers over long-term trade relations. Technically, EUR/USD remains under pressure, with further downside likely after a brief correction.

More By This Author:

Gold Drops To 3,273 USD As Markets Await Trade Deal Developments

Japanese Yen Halts Gains As US Trade Negotiations Return To The Spotlight

Gold Rises As Demand For Safe-Haven Assets Returns

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more