G10 FX Talking: Dollar Decline Should Be Selective

Softer US data will, in our view, lead the Fed to cut rates in September – a prospect that markets are almost entirely pricing in now. Political developments in the eurozone and US, as well as easing cycles from other central banks, should get in the way of a broad-based dollar decline. The Antipodeans and the Norwegian krone are looking better than their peers.

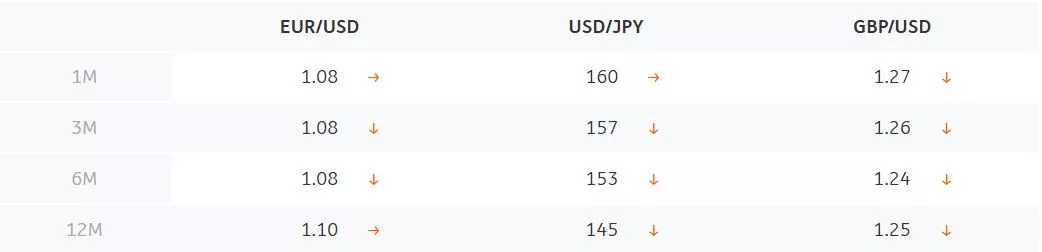

Main ING G10 FX Forecasts (versus forwards)

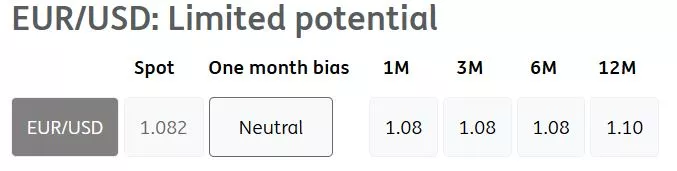

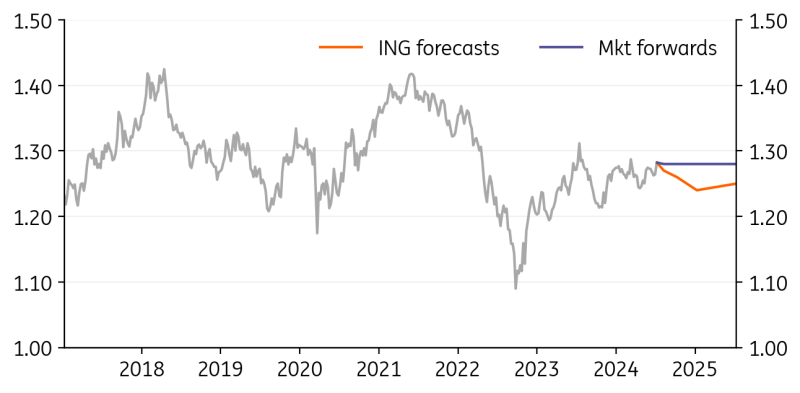

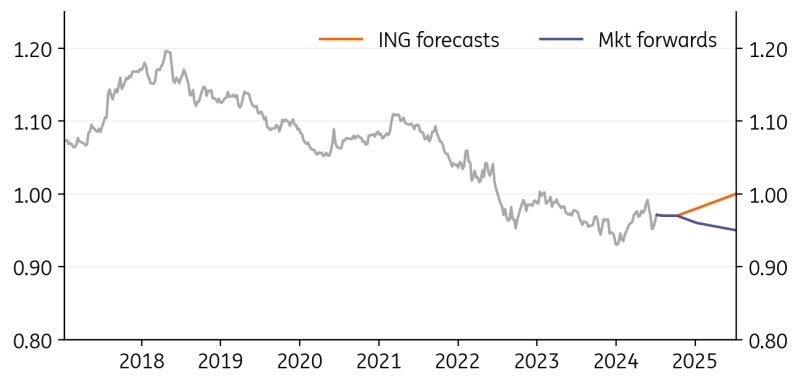

- The French election resulted in a hung parliament, a somewhat unintuitively pro-market result. But given fiscal concerns, markets had a preference for Marine Le Pen’s alliance over the left-wing group to win more seats. The euro still faces downside risks during tricky coalition talks and given longer-term fiscal concerns.

- So, if you are searching for a star performer, look elsewhere than the euro. Aside from political uncertainty, eurozone activity surveys are starting to lose steam; and an ECB that relies on its own (optimistic) inflation projections can still cut twice in 2024.

- We believe any US-macro-driven rally close to 1.10 will offer opportunities for strategic EUR/USD selling this summer.

Source: Refinitiv, ING forecasts

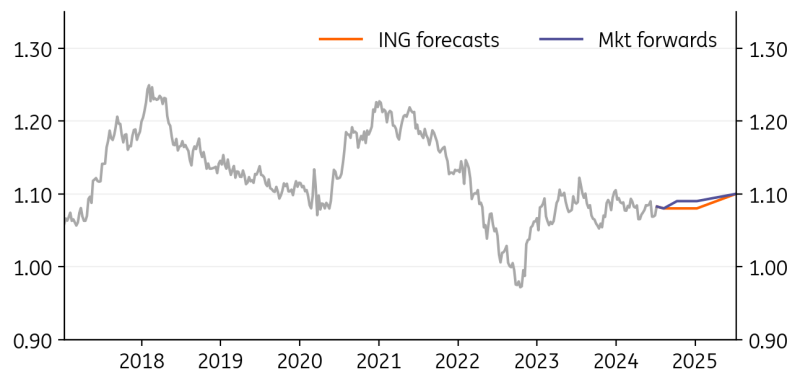

USD/JPY: Time for the BoJ to step in?

- Observing the yen’s most recent demise, it is clear that Japan’s verbal interventions are ineffective. Despite some softer US data, speculative selling pressure on the yen remains elevated.

- Periods of quiet volatility may continue to push USD/JPY higher, with a new line in the sand for intervention now close to 165, in our view. Crucially, large FX sales in 2Q proved to be only a temporary solution, meaning more pressure on the BoJ to hike.

- Markets are pricing in 6bp for the 31 July Bank of Japan meeting. We are more hawkish, narrowly favouring a 15bp July hike and another move by year-end. The BoJ can help the yen, although our bearish USD/JPY profile primarily relies on Fed cuts.

Source: Refinitiv, ING forecasts

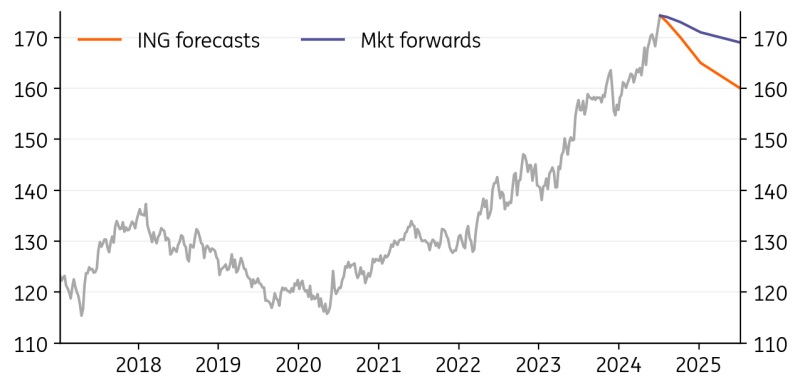

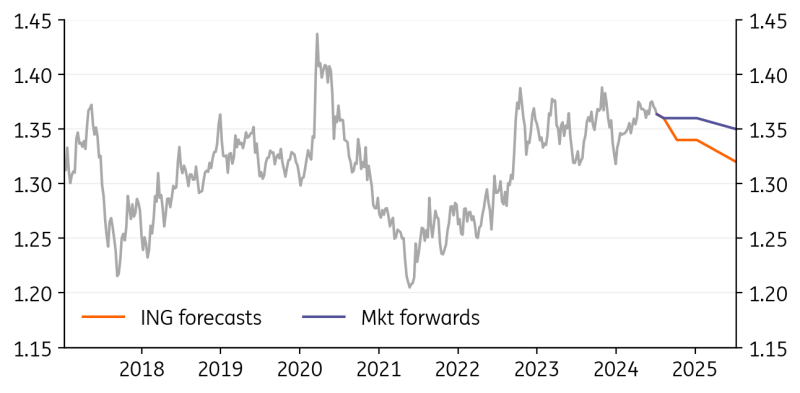

GBP/USD: BoE on track to cut in August

- The two-year GBP:USD swap rate is some 25bp below its March levels and almost 80bp below its August 2023 levels, which were the last two instances where GBP/USD traded in the current region. In other words, Cable is looking a bit expensive.

- Most importantly, we doubt there is much support on the way from Bank of England pricing. We see the MPC deliver a 25bp rate cut in August after the recent dovish tweak in communication, and to follow up with two more cuts by year-end.

- The pound has also been rather sensitive to French political risks, which may not dissipate soon. All in all, we do not see GBP/USD as an attractive way to play any US-macro-driven dollar decline.

Source: Refinitiv, ING forecasts

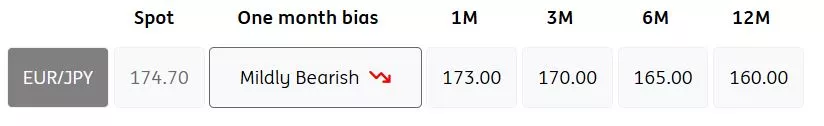

EUR/JPY: Not lacking arguments for a decline

- Speculative, carry-driven pressure on the yen has out-shadowed French elections and sent EUR/JPY above the 170.0 highs in 2008.

- Things can change now if we are right with our views for a 15bp rate hike by the BoJ this month, a further softening in US data (generally, a EUR/JPY net-negative), and lingering EZ political risk.

- Still, we admit a BoJ hike in July is a very close call and cannot ignore the clear tendency to test Japanese officials’ new tolerance levels on the yen. While our macro calls lead us to forecast a recovery in the highly undervalued yen, the path to a structurally lower EUR/JPY should not be a smooth one, and there are upside risks to our downward-sloping base case scenario.

Source: Refinitiv, ING forecasts

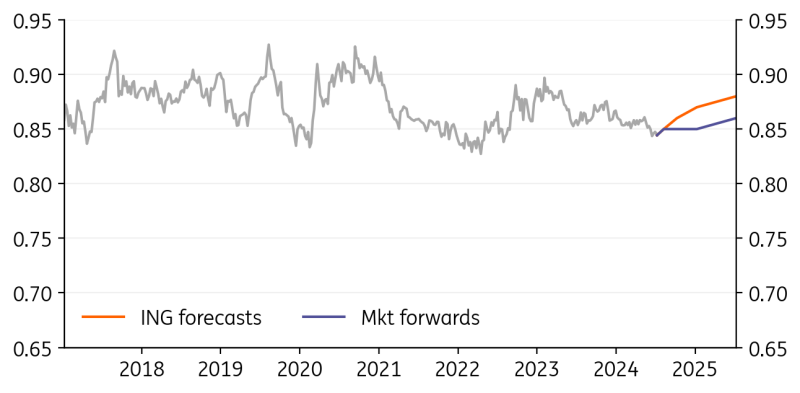

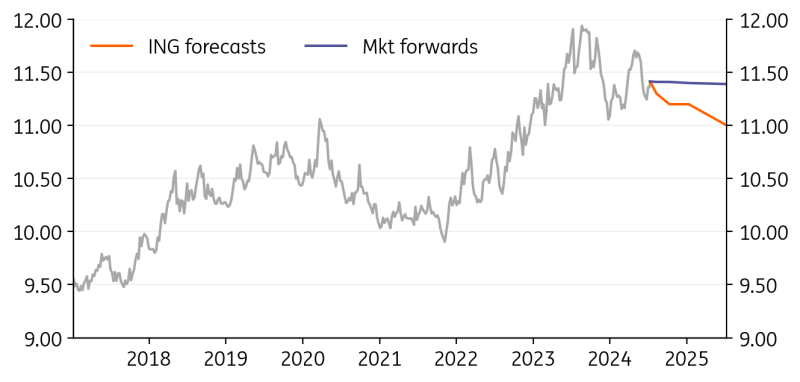

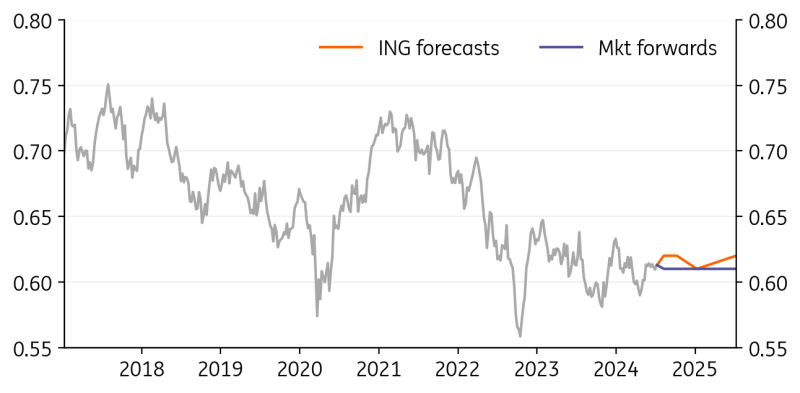

EUR/GBP: Cheap, but patience still needed

- Our bullish profile for EUR/GBP remains primarily a function of our more dovish call for BoE easing (75bp), against only 50bp by the ECB. The pair is already trading significantly on the cheap side compared to its short-term rate differential.

- As we discuss here, the new British government is facing a significant public finance challenge, which might lead to higher taxation already in the first year – a GBP negative.

- Still, we are aware more patience may be needed to see EUR/GBP trade higher, mostly due to the prolonged political uncertainty affecting the euro. Monetary policy divergence should still drive the pair back to the 0.86+ 2024 highs before year-end.

Source: Refinitiv, ING forecasts

EUR/CHF: Low inflation softens franc

- EUR/CHF has rebounded from the mid-June 0.9500 lows thanks to a surprise 25bp rate cut by the Swiss National Bank, sub-consensus inflation and the unwinding of safe-haven positions on French politics.

- With core CPI falling to 1.1% in June, markets are pricing in 60% chances of a September cut. Total expected easing by year-end remains around 25bp, though, meaning markets agree with us that the SNB will slow easing as it approaches the neutral rate.

- EUR/CHF may be left without much sense of direction after an eventful June. The SNB’s threat to intervene against fresh CHF appreciation should put a floor to the pair, but lingering EU political risk argues against big rallies for now.

Source: Refinitiv, ING forecasts

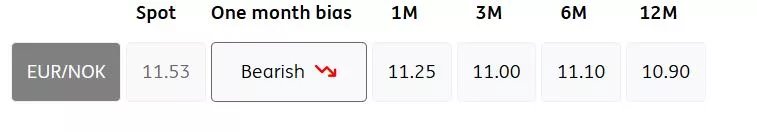

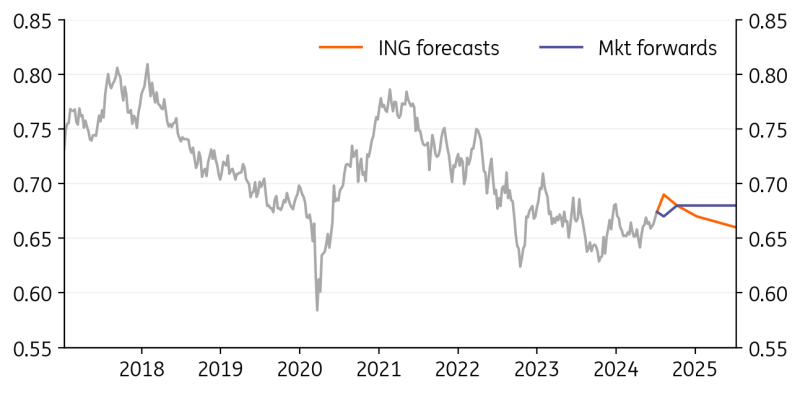

EUR/NOK: Krone can be a star

- We retain a preference for NOK over SEK, and see the Norwegian currency particularly well positioned for a rally in high-beta FX driven by lower USD rates. More details in this note.

- A hawkish Norges Bank (in stark contrast with the Riksbank) is a key factor that can support NOK, which has incidentally lower direct exposure to EU political risk than SEK, EUR or GBP.

- Norges Bank should remain hawkish this summer, and the declining FX purchases are unlocking more upside room for NOK. We cannot exclude that by the time the Fed cuts in September (as per our forecasts) EUR/NOK will trade as low as 11.00.

Source: Refinitiv, ING forecasts

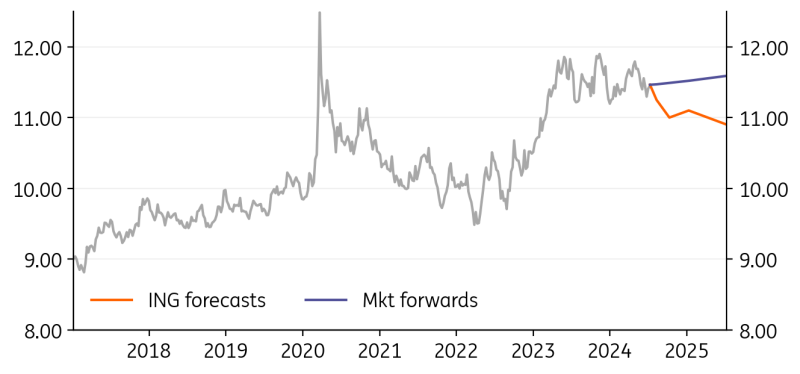

EUR/SEK: Riksbank can cut another 75bp

- Swedish inflation is set to drop substantially in the June print: consensus expect headline CPIF well below 2% and CPIF excluding energy at 2.5%. The rest of the macro picture is grim: growth was soft in May and unemployment is well above 8%.

- A dovish Riksbank has virtually no reasons to scale back on easing plans. They are projecting two or three cuts by year-end: recent data are reinforcing our call for three.

- As mentioned above, we strongly prefer NOK over SEK in a scenario where US data continues to soften. The prospect of RB cuts and weaker fundamentals can limit the upside for SEK.

Source: Refinitiv, ING forecasts

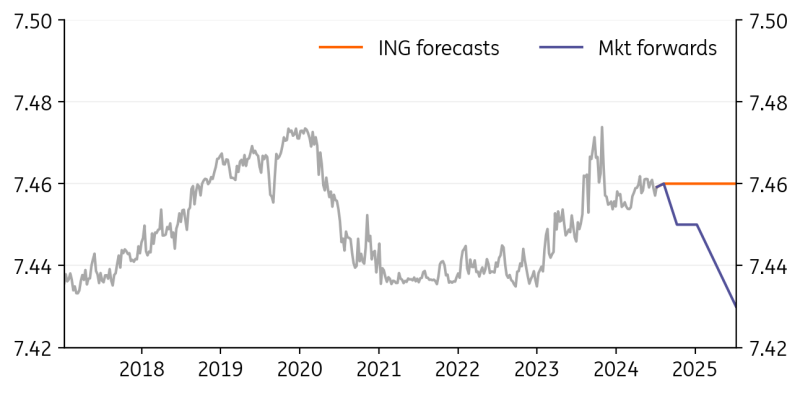

EUR/DKK: Unchanged 7.46 profile

- The turmoil in eurozone markets in June did not translate into any sort of volatility in EUR/DKK, and Danmarks Nationalbank continued to steer away from FX intervention.

- Our economics team is still expecting 50bp of easing by the ECB this year, and there are no reasons to expect Danmarks Nationalbank to diverge from the ECB’s plans.

- We are keeping our EUR/DKK profile unchanged at 7.46 in the near and long-term.

Source: Refinitiv, ING forecasts

USD/CAD: Cannot exclude a July BoC cut

- Our latest forecast saw Bank of Canada cuts in September, October and December. But the latest hiring contraction and rise in unemployment to 6.2% has put a July cut on the table.

- Markets are pricing in 16bp of easing for July: we think the deciding factor will be the June inflation report on 16 July, after May’s figures came in a bit higher than expected.

- Still, market pricing for total BoC easing in 2024 looks conservative: 55bp versus our call for 75bp. There is therefore ample room for dovish repricing along the way. We think CAD will continue to underperform other commodity currencies due the domestic story and its lower sensitivity to a decline in USD rates.

Source: Refinitiv, ING forecasts

AUD/USD: Rally can extend this summer

- Higher chances of Trump winning in November spell trouble for the China-sensitive AUD in the longer run. But the tactical picture hinges much more on US macro and domestic central banks.

- The RBA is perhaps facing the worst inflation issue in G10, with consistently hot monthly CPI prints taking it closer to another hike. 31 July will be the decisive day: 2Q CPI data are out, and if they surprise on the upside, we think the RBA will hike in August.

- Even if another hike can be averted, the prospect of cuts is increasingly remote. Given our view that markets will reward currencies with hawkish central banks, AUD still has room to run this summer, before the US election becomes too close to ignore.

Source: Refinitiv, ING forecasts

NZD/USD: RBNZ less hawkish, but cuts fully priced in

- The Reserve Bank of New Zealand surprised with a dovish shift in its July statement, showing greater confidence on disinflation and rising concerns on activity weakness. This probably points to two rate cuts this year, which are – however - fully priced in.

- We cannot exclude that the RBNZ took a peek at 2Q CPI before the July meeting, but based on our estimates, non-tradable CPI should print above the 5.3% RBNZ estimate.

- The RBNZ dovish tilt means NZD may lag AUD. However, with rates at 5.50%, more than two cuts already in the price for this year (60bp), potential upside surprises in service and marked undervaluation, we remain bullish on NZD/USD this summer.

Source: Refinitiv, ING forecasts

More By This Author:

Softer-Than-Expected June Inflation Continues To Bolster The Case For Easing In China

Philippines Trade Deficit Is Steady In May

FX Daily: Powell Fails To Revamp FX Volatility

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more