Softer-Than-Expected June Inflation Continues To Bolster The Case For Easing In China

China’s CPI inflation slowed to a 3-month low of 0.2% YoY in June on softer-than-expected non-pork food prices but remained in positive territory for the fifth consecutive month.

| 0.2% YoY |

China's June CPI inflation |

| Lower than expected | |

China's inflation remained barely in positive territory in June

(Click on image to enlarge)

Inflationary pressures remained subdued

China's June CPI inflation edged down to 0.2% YoY, down slightly from 0.3% YoY, and coming in weaker than forecasts for a slight uptick to 0.4% YoY. Inflation has been very flat in the last four months, fluctuating between 0.1-0.3% YoY. In month-on-month terms, June's CPI inflation dropped to -0.2%, and inflation has now seen two consecutive months of decline.

This month's slightly softer read came on the back of several factors:

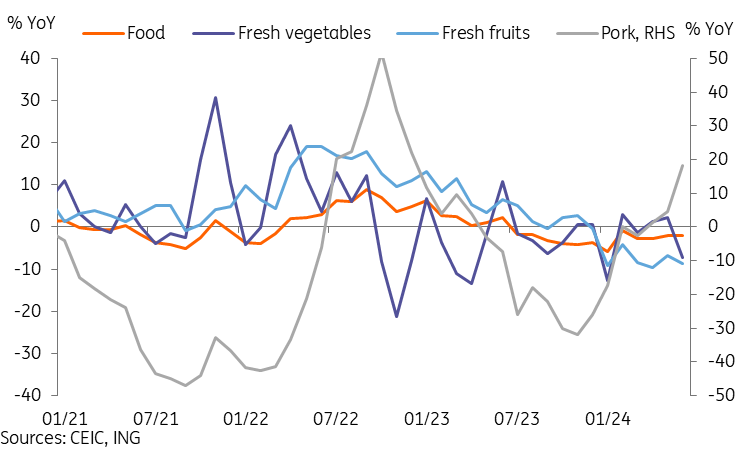

- Food prices (-2.1% YoY) saw a sharper-than-expected decline in June. This was due to a larger drag from fresh vegetables (-7.3%), fresh fruits (-8.7%), as well as beef (-13.4%) and mutton (-7.1%), which offset a strong recovery of pork prices (18.1%). The pork cycle is largely proceeding as expected, but the drag from other food prices has lingered.

- Non-food inflation (0.8% YoY) continued to see drags from several categories. Vehicles (-5.3%), household appliances (-1.3%), and communications devices (-1.5%) continued to drag inflation, while rents (-0.2%) fell further into negative territory as well.

Weak consumer confidence continues to drive consumption in the direction of seeking better value-for-money purchases, and competition in the EV sector continues to drive prices down, suppressing overall inflation.

PPI inflation showed a slightly more favourable read, with a smaller contraction of -0.8% YoY, up from -1.4% YoY in May, and reaching a 17-month high. Producer prices have remained in deflation since September 2022, but should exit deflation in the second half of the year if the current trajectory holds.

Food prices continued to be suppressed despite a strong uptick of pork prices

(Click on image to enlarge)

Inflation may see a moderate increase in the second half of the year, conditions remain ripe for more monetary easing

Through the first half of the year, China's CPI inflation is barely positive at 0.1% YoY, as the -2.7% YoY drag from food prices in the year to date weighed heavily on the headline level. While non-food inflation has fared relatively better at 0.8% YoY through the first half of the year, inflation remains well short of the typical 2% inflation target.

Moving forward, we expect inflation to trend gradually higher in the second half of the year. Recent data has indicated this process could be a little slower than previously anticipated.

Soft inflation and weak credit data are presenting a compelling case for further monetary policy easing from the PBOC in the coming months. The PBOC may prefer to first utilise another required reserve ratio (RRR) cut, but the February RRR cut showed this policy tool is seeing diminishing returns and effectiveness. We continue to see real interest rates as too high for the current state of the economy and believe the economy would benefit more from rate cuts. While we believe the PBOC has likely held back on cuts in order to avoid adding to RMB depreciation pressure, we expect to see 1-2 rate cuts in the second half of the year, with a stronger case for cuts if the Fed begins its rate cut cycle.

More By This Author:

Philippines Trade Deficit Is Steady In May

FX Daily: Powell Fails To Revamp FX Volatility

The Commodities Feed: TTF Under Further Pressure

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more