From Dollar Dominance To Hyperinflation

Image Source: Unsplash

America’s on the edge of a debt crisis.

Will the dollar save us? Or will the mighty dollar make it worse?

Last week, the Wall Street Journal warned “All that stands between the US and debt-market freakout” is the dollar’s reserve currency status. Adding -- darkly -- that reserve status is not the “unbreakable shield” many assume

The problem is not only is dollar dominance a breakable shield. It can turn a dollar crisis into a catastrophe.

So reserve currency status is when your currency is the main one used in the world.

For a long time it was the British Pound, and before that it was the Spanish, Dutch, and the hard-money city-state of Florence, Italy.

But since World War 2 the undisputed reserve currency is the US dollar. Originally because it was gold-backed. Then, post Nixon, because the Fed was seen as relatively hard-money.

Now, reserve currency status is cool because it means you can print mountains of green paper and trade them for toasters and fidget spinners.

We get cool stuff, they get paper.

It is, as one grumpy French Foreign Minister called it, an exorbitant privilege. Money for nothing.

And it protects you because even if you’re printing mountains of green paper to, say, bail out Wall Street, foreigners dutifully soak them up. Saving them in vaults where they don’t leak into inflation.

So it looks like a free lunch: We print paper, foreigners absorb the inflation and give us free stuff on top.

Reserve Currency as Stored Inflation

But here’s the problem: Think of all the dollars in the world like a giant reservoir with rivers of freshly printed dollars pouring in. Some from the Fed, some from Wall Street banks lending dollars into existence with fractional reserve — the true exorbitant privilege.

The reservoir doesn’t overflow with inflation because foreigners are siphoning dollars out the other end and sitting on them.

But what happens if you print too much -- say, you’re running permanent 2 trillion deficits. Or slashing interest rates to spark an artificial boom to win the next election.

Easy: As inflation rises, foreigners stop seeing dollars as safe places to park their savings. They start dumping the dollars.

The siphons reverse.

All those Fed and Wall Street dollars are still pouring in but the siphons are now running in reverse. Pouring in 81 years worth of overseas dollars.

So reserve currency status hides the pain. It delays the crisis. But it means when the crisis hits it is catastrophic.

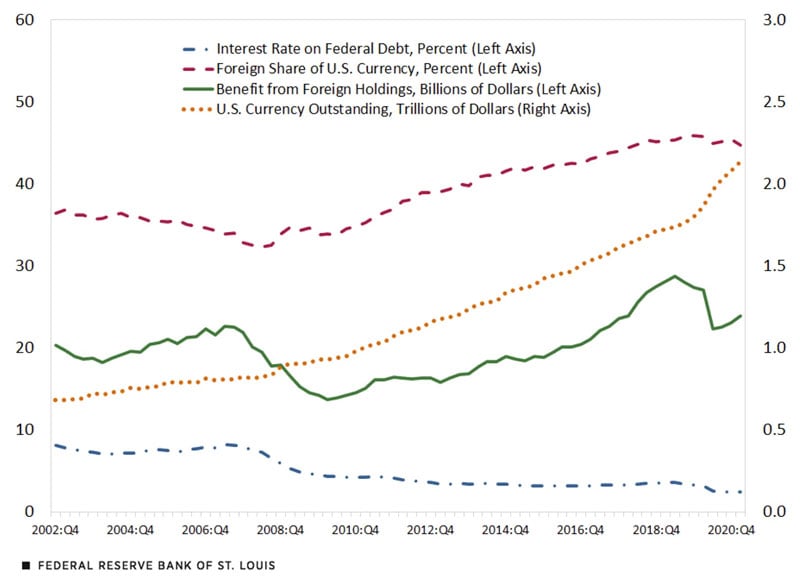

So how much money are we talking about?

Hilariously, nobody knows how many dollars exist -- the Bundesbank tried counting years ago and gave up.

We have a general sense how many dollars are in the US, which is about 22 trillion in M2 money supply.

But overseas dollars -- the ones that would come flooding back -- are only guesses, running from 7 trillion to 15 trillion to Federal Reserve estimates of roughly as many dollars abroad as in the US.

If the dollar loses its hard-money privilege, those dollars start flooding back.

Which could nearly double domestic prices as they dilute dollars already circulating in the US — dramatically more dollars chasing the same amount of goods.

What’s Next

The one thing saving the dollar is while the Fed’s bad at inflation, other countries are even worse.

The European and Japanese economies are sustained by even larger endless streams of money-printed stimulus. Canada or Australia are almost as bad plus their currencies are too small to be liquid.

Switzerland bowed out during the European financial crisis, intentionally devaluing the franc to promote exports to the EU.

(Click on image to enlarge)

As for China, the yuan isn’t even freely traded, while the much-hyped Brics currency degenerated from gold-backed juggernaut to currency basket joke.

In other words, the dollar remains the cleanest dirty shirt. Among paper currencies, anyway.

However, remarkably, the yellow metal just passed the dollar in sovereign holdings.

If that accelerates -- which it is -- and foreigners dump their dollars, 81 years of reserve currency status will turn from a shield to a time-bomb.

More By This Author:

Christmas Eve Eve Gold Rush: $4,500 Gold, $70 Silver, And A New Monetary Regime

All Precious Metals Zooming Sharply Higher... What Is Happening?

Gold Standard Explained: 7 Fiat Myths Debunked