Fed Wrecking Ball

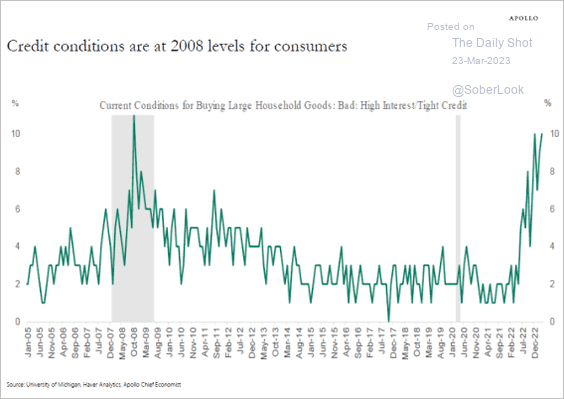

With consumer credit conditions already as tight as the 2008 financial crisis (shown below courtesy of The Daily Shot), yesterday, the US Fed hiked its overnight rate 25 bps to the highest level since September 2007 (4.75 to 5%). After insisting in 2021 that the Fed would not even consider raising rates in 2022, yesterday, Chair Powell reiterated their intention for more monetary tightening through 2023.

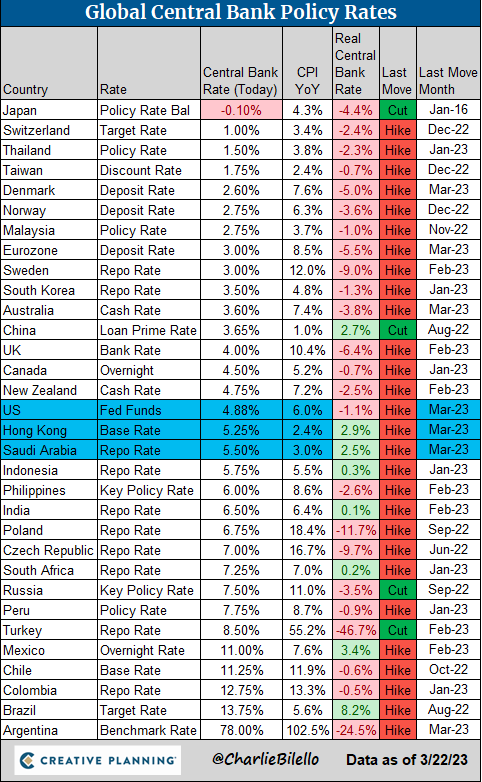

With the lion’s share of global commodities and debt transacted in US dollars, the Fed leads the world in monetary policy. Other countries try to follow to support their currencies and maintain paying power against the USD. As shown below, courtesy of Charlie Bilello, only four countries have cut rates. This wrecking ball is global.

So much work, evolution, and sober investment are needed to transition to sustainable societies. I’m relieved to see interest rates back to levels that incentivize saving and rational investment decisions over-borrowing, mindless consumption, and reckless speculation. But after twelve years of the latter, the abrupt policy reversal is hitting the masses hard, and the economic and wealth contraction threatens to be fugly.

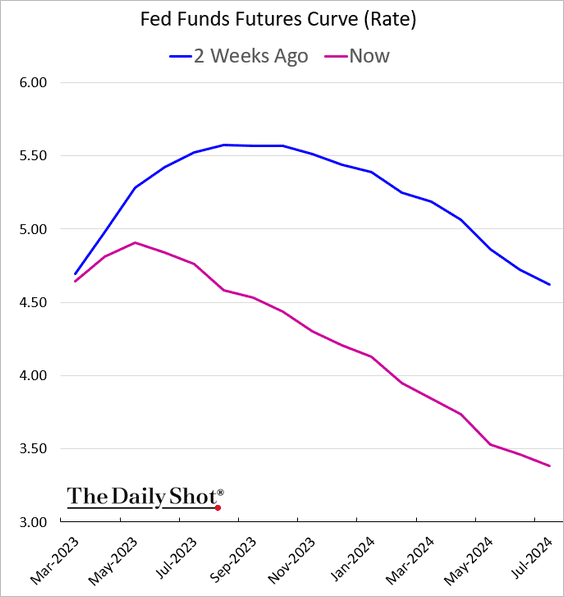

Two weeks ago, Fed futures markets expected the Fed funds rate to peak above 5.5% by August and hold there through the end of 2023. Today (as shown below), it is pricing a peak by May with 140 bps of cuts between June and December. Even if that happens, as with tightening, easing efforts filter through the economy at a lag of 12 to 24 months.

In the meantime, government bonds see a Fed pause and have been rebounding sharply year to date. This will help to repair unrealized losses on held-to-maturity bond allocations (part of what is driving the recent banking contagion). The mortgage-backed securities purchased when mortgage rates were sub 2 percent may prove tougher losses to solve.

More By This Author:

Fed Today And Done?

Cash Crunch Intensifies

Backstops For Depositors, Not Risk Markets