Fed Confirms A Slower And Shallower Rate Cut Story For 2025

Image Source: Pexels

We got another 25bp policy rate cut from the Fed, but updated projections and Chair Powell’s press conference confirms that the Fed is going to be much more cautious next year with sticky inflation and President Trump’s policy mix meaning a higher hurdle is required to justify rate cuts in 2025.

25bp from the Fed, but less in 2025

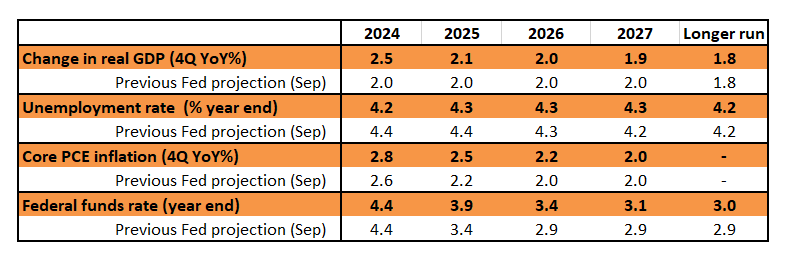

The Federal Reserve has cut rates 25bp, as expected. This brings us to 100bp of cumulative cuts since September, but the Fed is indicating a much slower, more gradual series of rate cuts in the future. 50bp of cuts is now their baseline for 2025 based on the median of their individual forecast submissions, versus the 100bp that they were projecting in September. The change of view is on the back of higher inflation forecasts predominantly – the core PCE deflator is now expected to end 2025 at 2.5% rather than 2.2% as previously thought and isn’t expected to get down to 2% until 2027. It also has to be viewed in the context whereby the economy is still growing robustly, the jobs market cooling, but not collapsing and equity markets at all-time highs.

Federal Reserve forecasts versus September projections

Source: Federal Reserve, ING

Trump's plans for 2025 to determine how far the Fed can cut

50bp of policy rate cuts for 2025 was what the market was pricing ahead of time so reaction shouldn't have been that huge, but less confidence on inflation slowing sufficiently and the fact we had one FOMC member dissenting – Cleveland Fed President Hammack preferring no change – means markets aren’t fully pricing another cut until July with only 35bp now priced for 2025 in total. January’s FOMC is almost certainly going to see the Fed hold rates steady, but we will have a much clearer understanding of President-elect Trump's tariff, tax and spending intentions at the March FOMC meeting.

The Fed has previously suggested that they are not going to pre-empt those proposals and only take them into account when they are implemented. Nonetheless, given his policy thrust of immigration controls and tariffs, which could result in higher inflation, plus cuts to regulation and tax cuts designed to juice growth, we expected the Fed signals a shallower, slower path of easing through 2025. Ahead of time we were forecasting three 25bp rate cuts next year rather than the two 25bp the Fed suggest, but there is a huge amount of uncertainty given a lack of clarity on how far and how fast President Trump will go on policy, plus how quickly the jobs market is actually cooling and what this means for inflation. As such, we will keep our forecasts unchanged for now.

The recalibrated market discount for the funds rate exposes the 10yr rate as still too low here

The 25bp cut itself was expected, but the big news is the larger-than-expected upward shift in the dot plot. The Fed now pitches the funds rate at 3.875% next year. That’s up 50bp from what they had before. In fairness though, the market’s discount had changed dramatically too in the past couple of months. Still, the market reaction is higher rates along the curve. Looking at the 2yr now at over 4.3%, it’s likely overreacted to the upside. While the 10yr rate is back to the 4.45%, back to where it was just post the Trump re-election. Little reason for this to collapse back lower based on what we know.

Noteworthy here is the upside shift in the market expectation for the effective fund rate for end-2025. This is now up to almost 4%. In other words the market is questioning whether the Fed delivers a final 25bp cut to get the funds rate below 4%. That pitches the implied “floor” for longer tenor rates at or about 4% (or just under). Contrast against that where the 10yr SOFR rate is now, at 3.95%. That’s essentially flat to the expected landing area for the funds rate. Something is mis-priced here. Either the Fed is going to cut by more than that. Or, and more likely, longer tenor rates are too low. As a call for 2025, we still see 4.5% for 10yr SOFR and 5%+ for the 10yr Treasury yields as viable targets.

The Fed also made an important technical adjustment to the overnight reverse repo rate (cut by 30bp), and now flat to the new Fed funds floor at 4.25% (cut by 25bp). This was broadly anticipated. It reduces the compensation obtainable at the reverse repo window, and should prompt less use of that window at the margin. Having a 5bp cushion made sense when the funds rate floor was a zero (to prevent a zero print). Now there is no cushion, but also no need for one. The effective funds rate should not be impacted in the sense that it should remain c.8bp above the floor. Although there can by a mild bias lower if anything.

Fed fires up the next leg of the dollar rally

Instead of quietly slipping into year-end, FX markets have been given a wake up call today that the Fed is looking at a higher inflation and interest rate profile over a multi-year horizon. Short-dated US swap rates have jumped 8bp on the news and pushed dollar rate differentials close to the widest levels of the year.

While a stronger dollar is very much a consensus (and our own view) for 2025, today’s bearish flattening of the US curve – telling us the Fed will not be providing as much monetary stimulus as first thought – is a clearly bullish factor for the dollar. It is also a bearish factor for the more pro-cyclical currencies in Europe and Asia and will weigh on commodity currencies – already under pressure on faltering Chinese growth and the prospect of Donald Trump’s trade agenda.

Expect EUR/USD to continue defying seasonal buying pressure – and we think 1.02/1.03 is possible over coming weeks. USD/JPY risks surging through 155 – although today’s hawkish Fed event makes it a little more likely that the Bank of Japan surprises with a rate hike tomorrow. And as above the commodity complex should stay under pressure. This is especially so for the Canadian dollar, which now has domestic turmoil to deal with as well.

Today’s event risk is going to prove a further headache for the People’s Bank of China as they try to hold onshore USD/CNY below 7.30 – even though USD/CNH can push well above that level. And bearish flattening of the US curve is bearish for most emerging currencies and especially the Brazilian real – which is off another 2% today. This heaps pressure on the Lula administration to deliver much needed fiscal consolidation – it cannot solely depend on the local central bank to save the real.

More By This Author:

Rates Spark: Long-End Rates Look Too Low Post The FOMCA Perfect Storm For The Canadian Dollar

FX Daily: Cautious Fed Cut Shouldn’t Interfere With Strong Dollar

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more