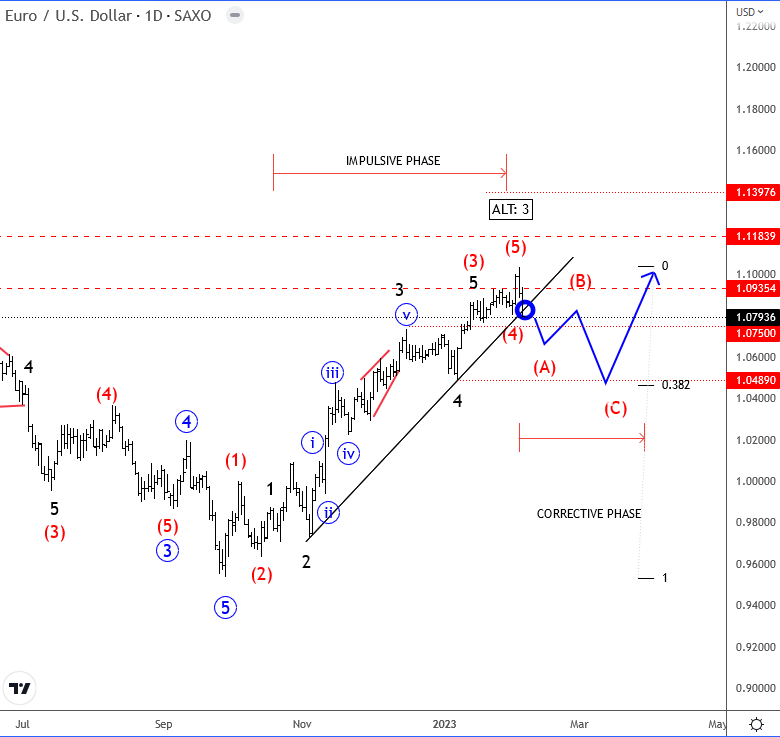

EURUSD Is Turning South After The ECB; Pair Now Making An Elliott Wave Correction

Photo by Ibrahim Boran on Unsplash

ECB raised rates by 50bps to 2.5%, and already highlighted another 50bps increase for March, while the further hikes, after March, will depend on the data. So it appears that the EURUSD reversal down came after “buy the rumor sell the news impact” which has been technically expected as we saw prices in a fifth wave of an Elliott wave pattern. We also saw large speculators moving into extremely long positions on the euro, so it’s not a surprise to see this reversal happening, since we know that the market moves in a cycle form pessimism to optimism and vice versa.

From an Elliott wave perspective, we see a broken trendline after the pair failed to break above the 1.1 resistance. 200 and 100 W SMA also held as resistance in that fifth wave rally. Normally when there is a pullback, the correction can cause a retracement back to 50W SMA; ideal support would then be at 1.05, at the former wave four.

For a more detailed analysis check our recording of the webinar:

Video Length: 00:42:37

More By This Author:

Aussie Found A Temporary Resistance

Binance Coin Confirms Bullish Trend

USDNOK Is Showing Bearish Pattern

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only. Visit www.wavetraders.com for more ...

more