EUR/USD Holds Gains At Multi-Week Highs On US Dollar's Weakness

- EUR/USD remains bid near two-month highs at 1.1700, favored by US Dollar weakness.

- A dovish Fed monetary policy statement sent the US Dollar tumbling on Wednesday.

- Market concerns about an AI bubble are weighing on risk appetite.

EUR/USD is ticking higher on Thursday, and has returned to the 1.1700 area at the time of writing, after bouncing from session lows near 1.1680. A dovishly tilted monetary policy statement by the Federal Reserve (Fed) keeps the US Dollar under pressure, although the cautious market mood amid renewed concerns about an AI bubble is acting as headwind for the Euro.

Sales and revenue forecast released by the cloud computing giant Oracle on Wednesday missed market expectations. The company has made significant investments in AI technology, including a $300 billion deal with OpenAI, and plans to build AI data centers, and these figures bring to the focus the difficulties of turning investment into revenue.

The risk-averse sentiment has provided some support to the safe-haven US Dollar, which had tumbled against most currency peers, following a less hawkish-than-expected monetary policy decision by the Fed on Wednesday. The US central bank cut interest rates by 25 basis points, as expected, but hawkish dissent was weak, and Chairman Jerome Powell showed more relaxed about inflation, which hints at further rate cuts in 2026.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.05% | 0.10% | -0.06% | 0.09% | 0.44% | 0.21% | -0.24% | |

| EUR | 0.05% | 0.15% | -0.02% | 0.14% | 0.49% | 0.26% | -0.19% | |

| GBP | -0.10% | -0.15% | -0.15% | -0.01% | 0.33% | 0.10% | -0.34% | |

| JPY | 0.06% | 0.02% | 0.15% | 0.14% | 0.50% | 0.24% | -0.18% | |

| CAD | -0.09% | -0.14% | 0.01% | -0.14% | 0.36% | 0.10% | -0.33% | |

| AUD | -0.44% | -0.49% | -0.33% | -0.50% | -0.36% | -0.23% | -0.68% | |

| NZD | -0.21% | -0.26% | -0.10% | -0.24% | -0.10% | 0.23% | -0.44% | |

| CHF | 0.24% | 0.19% | 0.34% | 0.18% | 0.33% | 0.68% | 0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily Digest Market Movers: Risk aversion halts the Euro's rally

- The Euro jumped on US Dollar weakness following Wednesday's Fed decision, but bulls have been halted above 1.1700 amid the risk-averse market. If sentiment remains sour, the Euro is likely to struggle. Downside attempts, however, are likely to remain limited amid the dovish Fed message.

- The Federal Reserve cut rates by 25 basis points to the 3.50%-3.75% range on Wednesday, and the dot plot signalled only one further rate cut in 2026. The absence of a more hawkish divergence, with only two votes calling for steady rates, and Chairman Powell's comments ruling out rate hikes, are keeping investors confident that the bank will cut rates at least two more times next year, as reflected on the CME Group FedWatch tool.

- Beyond that, the market is also pricing the replacement of Jerome Powell by a more dovish Kevin Hassett at the end of his term in May. Hassett, the White House economic adviser, affirmed earlier this week that there is "plenty of room" to cut interest rates further.

- The Fed also announced a bond-buying program starting on December 12 with an initial round of $40 billion, aiming to support market liquidity, which took investors by surprise and added pressure on the USD.

- In Europe, the European Central Bank (ECB) President, Christine Lagarde, stuck to her usual rhetoric while talking at the Financial Times Global Boardroom Conference in London on Wednesday. She reiterated that the bank's monetary policy remains in good shape and suggested that ECB officials might lift the region's growth forecasts again, adding to evidence that the easing cycle has reached its end.

- The European economic calendar is void on Thursday, while in the US, Initial Jobless Claims data will be observed with interest to confirm whether the previous week's decline was due to the Thanksgiving holiday or it was a signal of some improvement in the labour market.

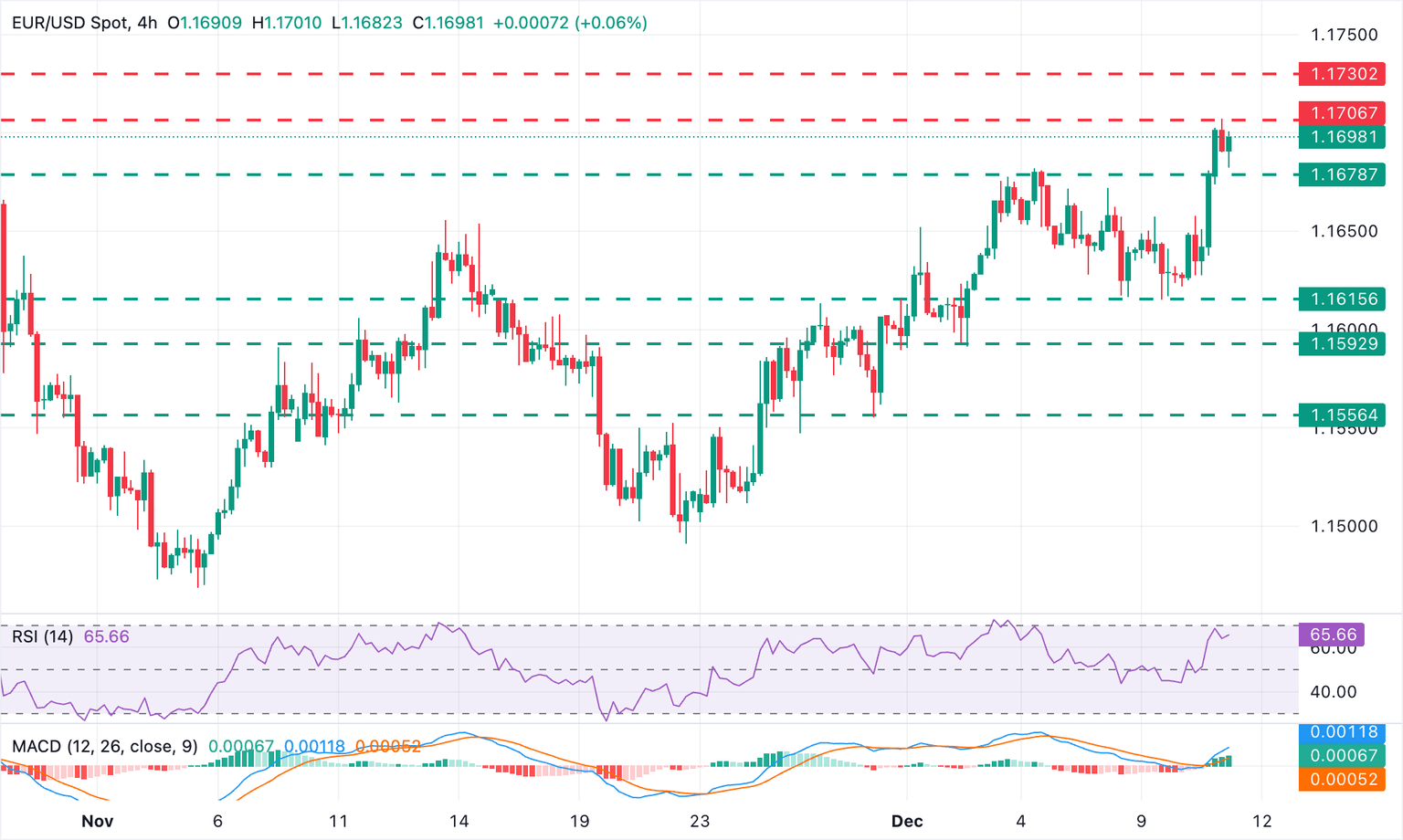

Technical Analysis: EUR/USD is pushing against resistance at the 1.1700 area

(Click on image to enlarge)

EUR/USD 4-Hour Chart

The EUR/USD technical picture has turned positive after breaking resistance at the 1.1680 area. The 4-hour Moving Average Convergence Divergence (MACD) is printing green bars, showing a strong bullish momentum, and the 4-hour Relative Strength Index (RSI) is in positive territory, still below overbought levels. In this context, and with the US Dollar Index depressed, further appreciation is on the cards.

Immediate resistance is at the intraday high, at 1.1705, ahead of the October 17 high, near 1.1730, and the October 1 high around 1.1780. On the downside, the December 4 high, near 1.1680, is providing support ahead of the December 9 low, at 1.1615, and the December 1 and 2 lows, around 1.1590.

More By This Author:

Japanese Yen Bears Seem Hesitant Amid Rising BoJ Rate Hike Bets

AUD/USD Remains Depressed After Mixed Aussie Jobs Data; Holds Above Mid-0.6600s

Japanese Yen Struggles To Build On Intraday Gains As Traders Await Fed Decision

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more