EUR/USD Hits New Yearly High As The US Dollar Faces Significant Pressure

Image Source: Unsplash

The EUR/USD pair has surged to levels not seen since December 2023, with the US dollar under intense strain. Discover more insights in our analysis as of August 22, 2024.

EURUSD Forecast: Key Trading Highlights

- EUR/USD Continues Its Upward Momentum

- US Dollar Weakens Rapidly Due to Dovish Federal Reserve Tone and Mixed Employment Data

- EUR/USD Forecast for August 22, 2024: Target Levels at 1.1195 and 1.1073

Fundamental Analysis

On Thursday, the EUR/USD rate surged to 1.1105, reaching levels last seen in December 2023. The primary driver behind the US dollar's decline is the Federal Reserve's increasingly dovish outlook. Additionally, recent signs of a weakening employment market further weigh on the USD, as investors now anticipate the Fed will move towards easing monetary policy.

The latest minutes from the Federal Reserve’s July 30-31 meeting revealed a growing inclination among policymakers to lower interest rates, with some members favoring immediate action. The tone of the meeting was notably softer than expected, reinforcing expectations of potential rate cuts.

Further adding to the dollar's troubles, data released by the Department of Labor yesterday showed fewer jobs were created than previously reported, exacerbating concerns about the US economy.

According to the CME FedWatch tool, markets are pricing in a 62% chance of a 25-basis-point rate cut at the Federal Reserve’s next meeting, with the likelihood of a larger 50-basis-point cut rising to 38%, up from 33% just a day earlier. Despite this, the EUR/USD forecast remains stable.

EUR/USD Technical Analysis

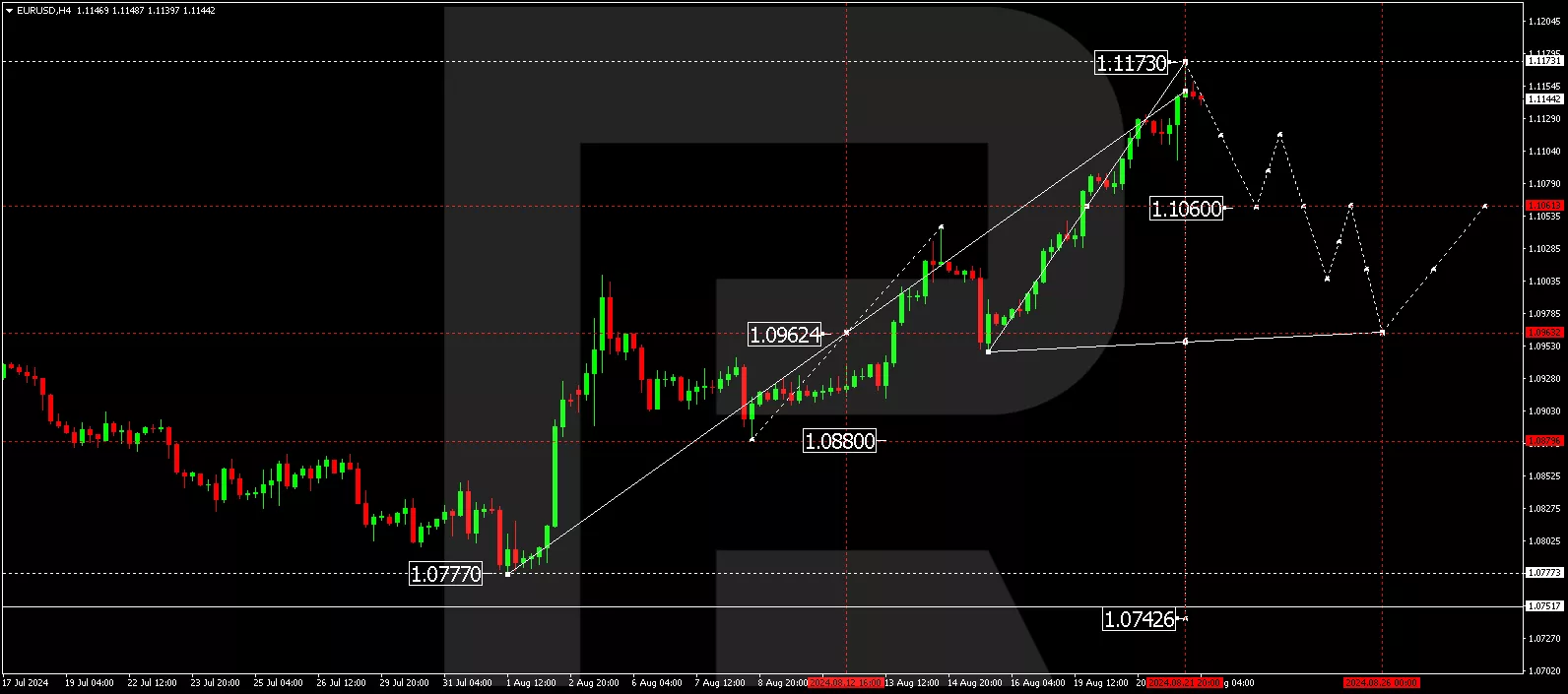

On the H4 chart, EUR/USD has broken above the 1.1135 level and completed a growth wave, pushing the rate up to 1.1173. The pair is expected to retest the 1.1135 level from above today, August 22, 2024. If this support level fails, it could lead to a decline towards 1.1073. However, a breakout above this range could open the door to further growth, with the next target set at 1.1195. After reaching this level, a reversal towards 1.1073 is anticipated, potentially extending the downward trend towards the next target of 1.0980.

(Click on image to enlarge)

Summary

The EUR/USD pair continues to rise, reaching new highs in 2024. Current technical indicators suggest that the upward momentum could extend to 1.1195, signaling the completion of this growth phase. A subsequent downward correction towards 1.1073 is likely, with the potential for further declines ahead.

More By This Author:

Brent Oil Falters Amid Surprising Inventory Growth And Geopolitical Developments

EUR/USD Holds Near Seven-Month High Amid Speculation On Fed Rate Cuts

Gold Nears Record Highs Amid Geopolitical Uncertainty And Fed Speculations

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more