Brent Oil Falters Amid Surprising Inventory Growth And Geopolitical Developments

Image Source: Pixabay

Brent crude oil has seen a decline to 77.07 USD a barrel on Wednesday, influenced by unexpected shifts in U.S. energy inventories and ongoing geopolitical developments. The analysis of Brent prices highlights key factors contributing to this downturn.

The market has had to adjust its risk assessment following a recent increase in U.S. crude oil stocks, contrary to the anticipated decrease. According to the American Petroleum Institute (API), inventories rose by 0.347 million barrels, whereas analysts had forecast a reduction of 2.800 million barrels. This update has fueled bearish sentiments among traders, marking the second inventory increase in the last eight weeks, impacting the broader commodities analysis as well.

Geopolitically, the situation in the Middle East remains a critical focus. Although Israel has agreed to a proposal to resolve tensions with the Gaza Strip, the absence of a full ceasefire keeps the regional stability fragile and continues to impact global oil supply fears. This geopolitical uncertainty has also influenced Brent signals, adding to the complexity of forecasting future price movements.

Additionally, economic signals from China are exerting fundamental pressure on oil prices. The persistent economic struggles in China, a major global oil consumer, are dampening demand expectations and consequently affecting oil prices. As a result, Brent forecasts remain cautious, with analysts watching closely for any shifts in economic indicators that could influence demand.

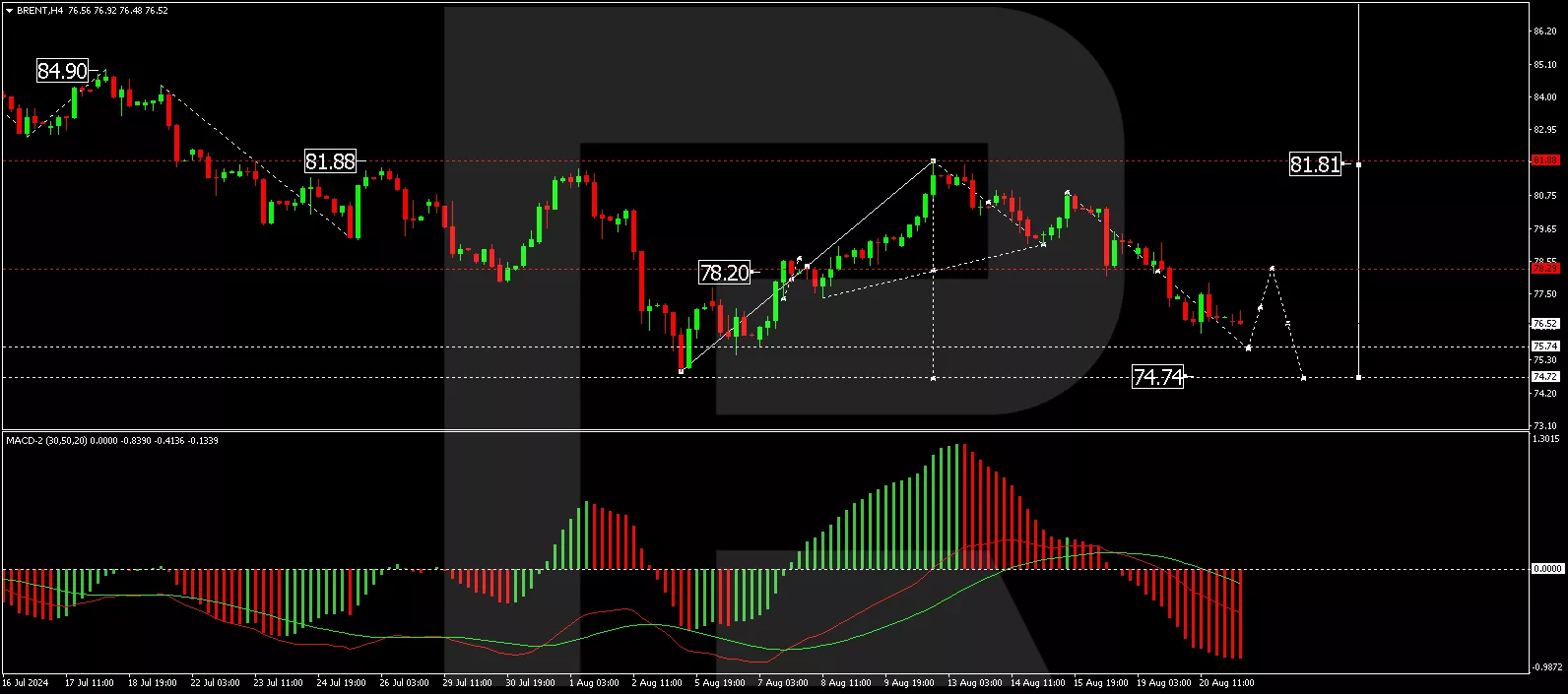

Technical analysis of Brent

(Click on image to enlarge)

The market has established a consolidation range at approximately 78.20 USD, from which a downtrend towards 74.74 USD is currently developing. This market analysis suggests that while there is potential for further decline, there could also be a reversal if certain conditions are met. Growth targets of 81.81 USD and possibly extending to 88.80 USD may emerge if the upper resistance level is breached. This bullish scenario is technically supported by the MACD indicator, whose Brent signal line is positioned below zero but poised for an upward shift, suggesting a possible change in momentum.

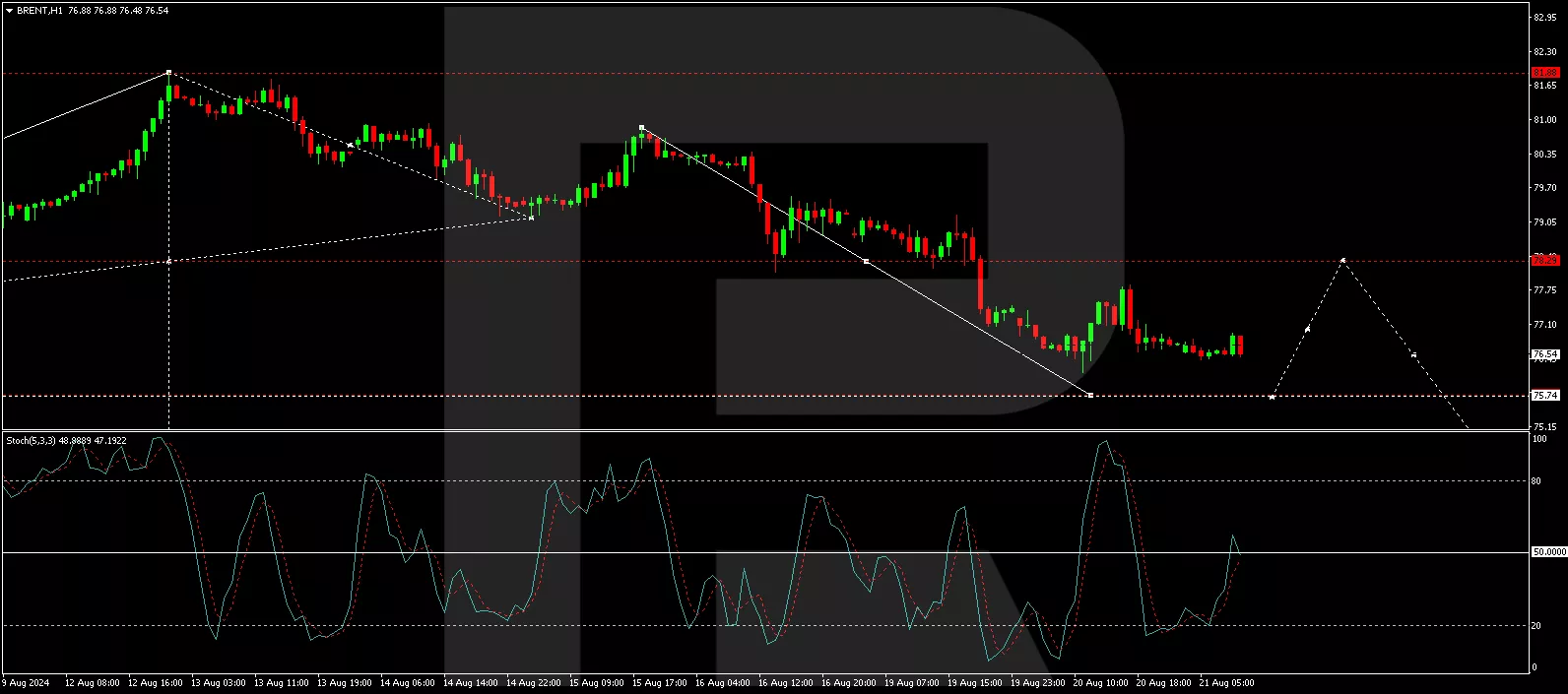

(Click on image to enlarge)

On the hourly chart, Brent analysis indicates the commodity is progressing through a bearish phase towards 75.75 USD. Once this target is reached, a retracement to 78.20 USD could occur before further declines towards 74.74 USD. This outlook is corroborated by the Stochastic oscillator, with its Brent signal line currently hovering around the 50 mark and directed downward, reinforcing the short-term bearish trend.

In summary, Brent forecast suggests that the market is facing a period of volatility, with the potential for both short-term declines and longer-term bullish reversals depending on how global events and economic indicators unfold.

More By This Author:

EUR/USD Holds Near Seven-Month High Amid Speculation On Fed Rate Cuts

Gold Nears Record Highs Amid Geopolitical Uncertainty And Fed Speculations

AUD/USD Climbs As RBA Maintains Firm Stance On Interest Rates

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more