EUR/USD Awaiting U.S. Inflation Data For Direction

Image Source: Pixabay

The EUR/USD pair stabilised around 1.1658 on Tuesday, following a period of volatility over the preceding two sessions.

Market focus remains firmly on the forthcoming US inflation data, which is expected to provide crucial clarity on the future path of Federal Reserve policy. Currently, the market is pricing in two rate cuts this year, with the first anticipated in June. However, any upside surprise in inflation could significantly temper expectations for policy easing.

Supporting a more dovish outlook was last week’s disappointing Non-Farm Payrolls (NFP) report for December, which revealed weaker-than-expected job growth.

Investors are also monitoring developments in the US Supreme Court, which is expected to rule on the legality of President Donald Trump’s tariff policy as early as Wednesday.

Earlier this week, the US dollar faced additional headwinds following reports that Fed Chair Jerome Powell could face scrutiny over his congressional testimony related to a building renovation project. This has raised concerns, albeit limited, regarding the perceived independence of the Federal Reserve.

Technical Analysis: EUR/USD

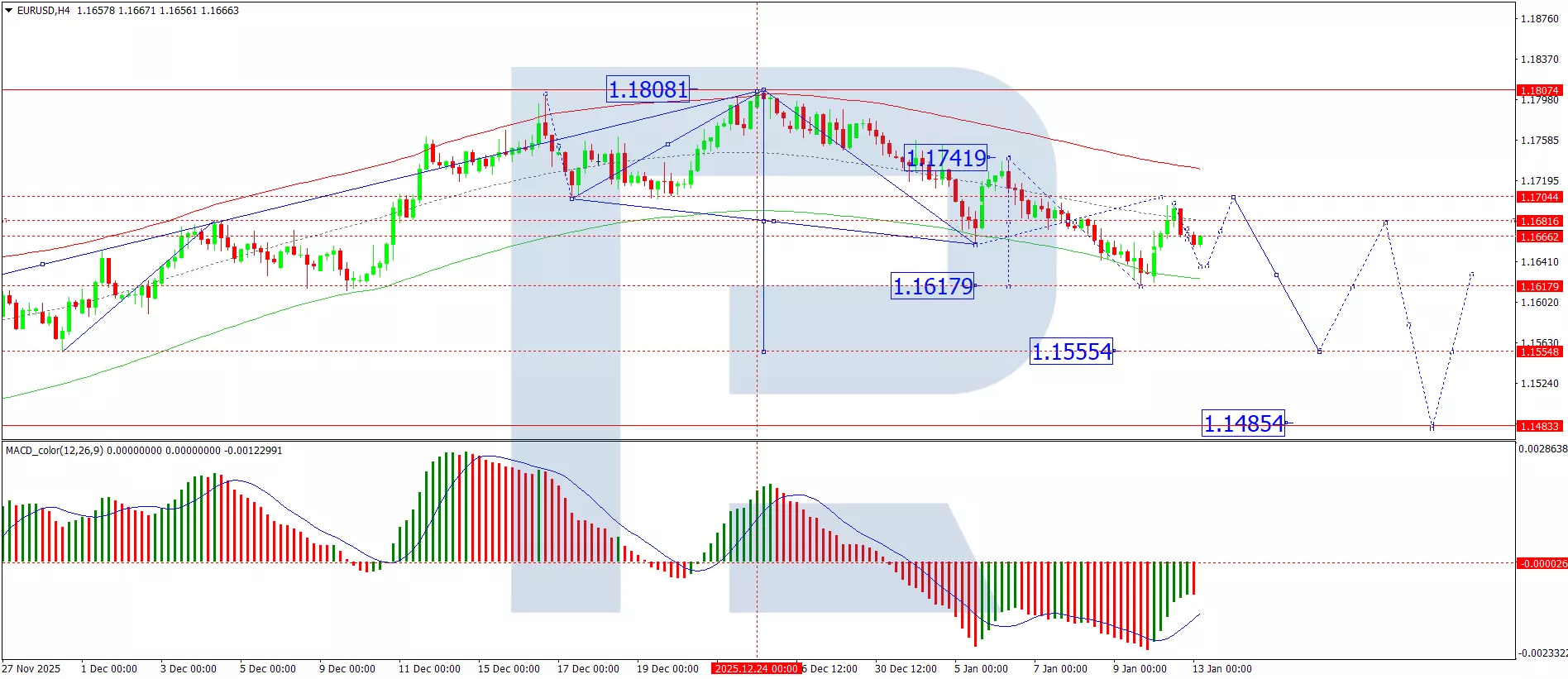

H4 Chart:

(Click on image to enlarge)

On the H4 chart, the pair is forming a corrective retracement within the context of the second downward impulse. The immediate corrective target stands at 1.1700. Once this correction concludes, we anticipate the resumption of the downtrend, with the next bearish target at 1.1555. This scenario is supported by the MACD indicator, whose signal line is below zero and pointing decisively downward, reinforcing the ongoing bearish momentum and potential for further downside.

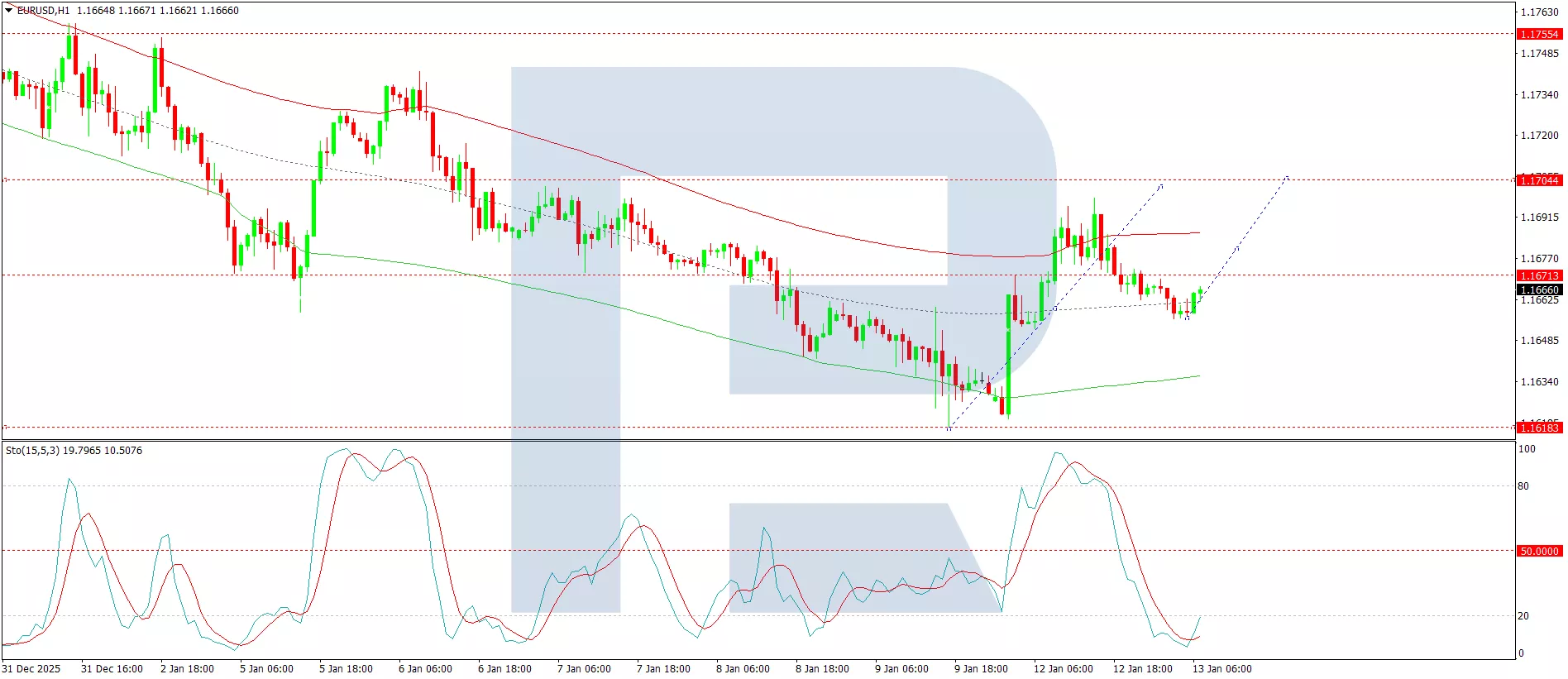

H1 Chart:

(Click on image to enlarge)

On the H1 chart, the market has completed a decline to 1.1655 and is now forming an upward corrective impulse towards 1.1700. Upon reaching this level, we expect a renewed wave of selling pressure to emerge. The Stochastic oscillator aligns with this view, as its signal line is currently below 20 but is turning upward towards 80, indicating room for a short-term rebound before the next potential decline.

Conclusion

The EUR/USD pair is in a holding pattern ahead of key US inflation data, which will likely dictate the near-term direction of the pair. While the technical structure remains bearish, a corrective bounce towards 1.1700 appears likely before sellers potentially regain control. A stronger-than-expected inflation print could reinforce the dollar’s strength and accelerate the move towards 1.1555.

More By This Author:

USD/JPY Stalls Near One-Year High

XAG/USD: After Hitting Fresh Highs, Silver Tumbles Over 15%

XAU/USD: Markets Unmoved By US GDP Strength

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more