Euro Parity And Risk Management

For the first time since 2002, the euro has traded below parity with the U.S. dollar. While it has rebounded along with other risk assets back above a few times, concerns about the economic impact of the war in Ukraine pushed the euro down to its lowest levels in 20 years.

While euro/dollar parity may have important psychological implications, we know definitively that currency performance can have a significant impact on U.S. investor total returns in foreign markets.

Since the introduction of the euro on January 1, 1999, the currency provided positive returns in 10 out of23 years (43.47%). Over the same time frame, equities in the region had positive performance in 14 out of 23 years (60.87%). On one hand, equities seem to trend higher over time. On the other, developed market1 currencies can either appreciate or depreciate as they mean-revert toward fair value. Below, we examine four scenarios that try to separate equity risk from currency risk to try to understand which risks may be worth taking.

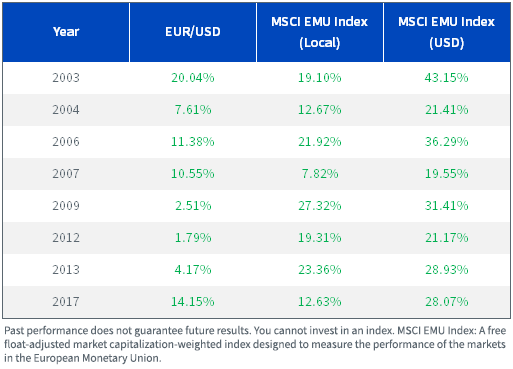

Scenario 1: Positive Calendar Year Returns for MSCI EMU Index and the Euro

When risk has been “on,” the euro and stocks have historically tended to appreciate together. This has had the added benefit of magnifying gains for U.S.-based investors. While the magnitude of gains has also been significantly higher for equities than EUR/USD, four out of eight years saw a double-digit appreciation for the euro. On its face, it seems that if an investor is bullish on European stocks, they should also be bullish on the currency.

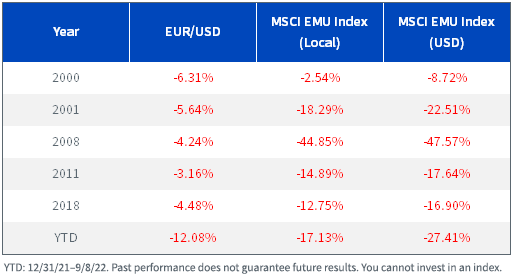

Scenario 2: MSCI EMU Index and EUR down

However, it seems that positive correlation can cut both ways. In years where European equities were down, the euro also tended to be down, thus magnifying losses for U.S. investors. In years with double-digit corrections in equities, the euro depreciated on average by 5.1% per year. During more modest corrections, the euro depreciated by 6.3% per year. In terms of risk management, it seems currency hedging could be one way to potentially dampen drawdowns relative to an unhedged benchmark.

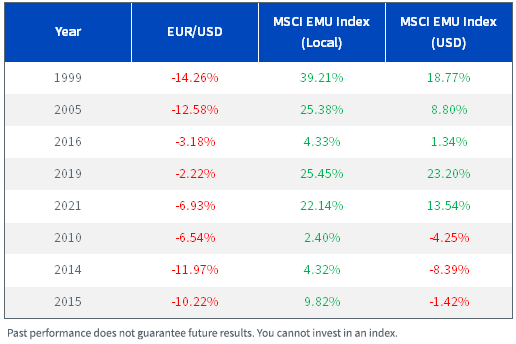

Scenario 3: MSCI EMU Index (Local) Up, EUR Down

In the most classic case for currency hedging foreign equities (years when stocks are up, but currencies are down), we see that at least one-third of the time, currency losses completely outstrip the gains in equities. Put another way, an investor can get the call right on equities, but still end up losing money.

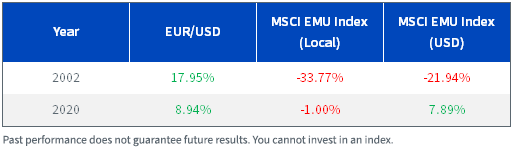

Scenario 4: MSCI EMU Index Down, EUR Up

While anything is possible, when risk has been off, EUR has seldom been a safe haven, with the exception of 2002 and 2020. In these instances, a currency-hedged strategy underperformed in a down market.

FX-Hedged Exposure

For investors who don’t have a view on the direction of the euro or think the dollar will continue to strengthen, a hedged option may be more suitable.

The WisdomTree Europe Hedged Equity Fund (HEDJ), which seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Europe Hedged Equity Index, was launched in 2012 and provides exposure to dividend-paying companies with an exporter tilt in the eurozone. The Fund hedges exposure to fluctuations in the euro by investing in one-month forward currency contracts.

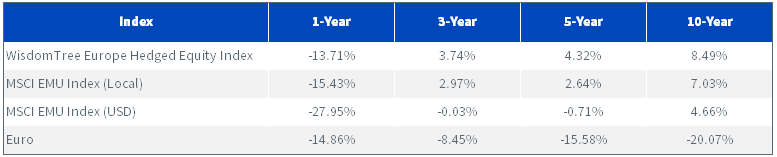

Returns

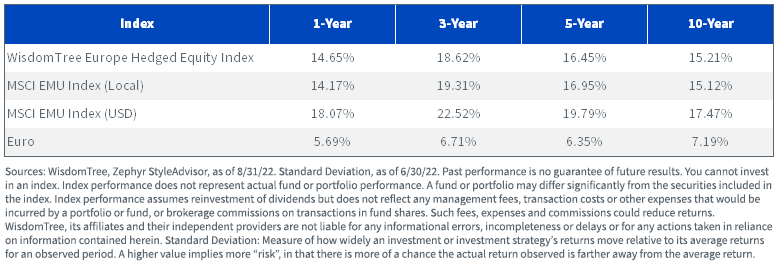

Standard Deviation

Additional Index information is available here.

More By This Author:

We Need Energy Storage...And Companies Are RespondingQ3 2022 Economic and Market Outlook in 10 Charts Or Less

Fed Watch: Back-To-Back in the History Books