Elliott Wave Technical Analysis: New Zealand Dollar/U.S. Dollar - Tuesday, May 13

NZDUSD Elliott Wave Analysis Trading Lounge

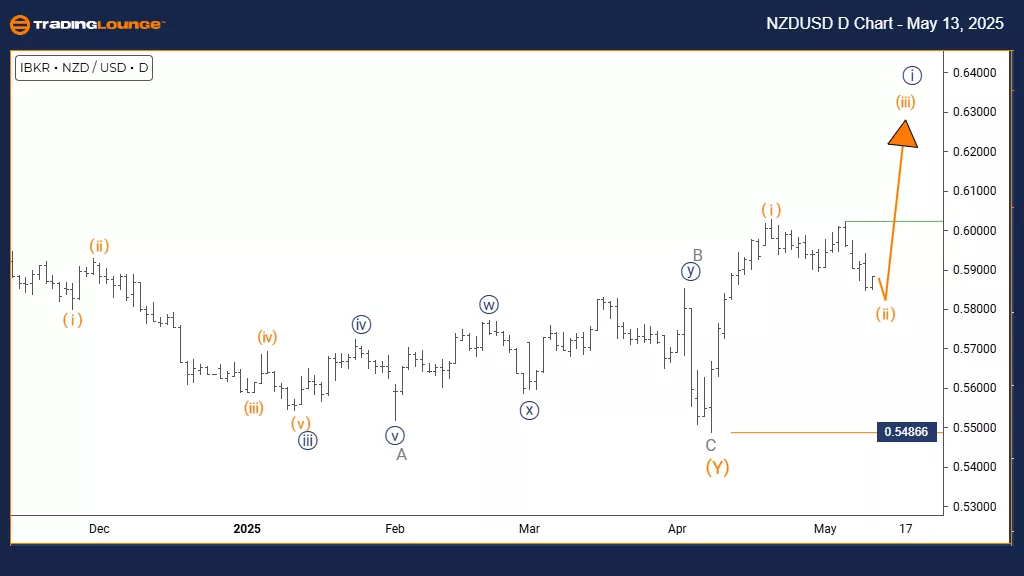

New Zealand Dollar/ U.S. Dollar (NZDUSD) Day Chart

NZDUSD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange wave 1 appears to be completed; orange wave 2 is currently active.

Wave Cancel Invalid Level: 0.54866

The NZDUSD daily chart reveals a counter-trend move within a broader bearish structure. Presently, the price action is in a corrective phase marked as orange wave 2, following the completion of the downward orange wave 1. This retracement typically shows sideways or modest upward movements before a potential continuation lower in orange wave 3.

The chart confirms that orange wave 1 has finalized, shifting the focus to orange wave 2's corrective nature. Once this correction concludes, the anticipated orange wave 3 should take over, pushing the pair lower. A key invalidation level stands at 0.54866; breaching this could challenge the current bearish wave setup and suggest a more complex correction or possible trend reversal. Despite minor upward corrections, the overall structure remains bearish unless this level is exceeded.

This analysis delivers key insight into NZDUSD's placement within a larger downtrend. Orange wave 2 signals a temporary relief before bearish continuation. Traders should closely observe the price action for signs of wave 2’s end and monitor the invalidation level. This framework supports a counter-trend trading strategy with caution for a potential shift back to bearish momentum.

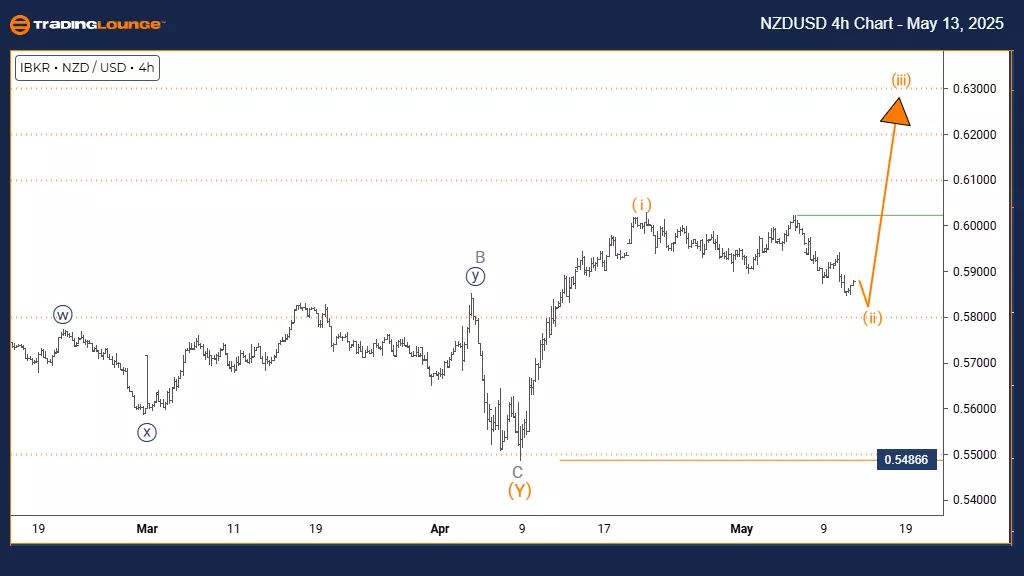

New Zealand Dollar/ U.S. Dollar (NZDUSD) 4 Hour Chart

NZDUSD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 2

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3

DETAILS: Orange wave 1 appears completed; orange wave 2 is underway.

Wave Cancel Invalid Level: 0.54866

The NZDUSD 4-hour chart indicates a counter-trend movement with corrective behavior. Orange wave 2 is currently progressing as part of the broader bearish structure known as navy blue wave 1. The chart implies that orange wave 1 has finished and the pair is now experiencing a corrective retracement before potentially resuming the downward trend.

This analysis confirms that orange wave 1 has ended, initiating orange wave 2’s corrective phase. The next move in higher degree waves is expected to be orange wave 3, which should carry forward the bearish momentum once wave 2 completes. The key invalidation level at 0.54866 serves as a critical benchmark—if breached, it may suggest a more intricate correction or a reversal. Despite the temporary upward move, the broader structure supports further downside unless this level is broken.

Traders should watch for signs that orange wave 2 is ending, which could provide setups for a move lower with wave 3. This structured outlook helps clarify NZDUSD’s placement in a broader bearish context, stressing the invalidation level’s role in managing trading approaches.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Ethereum Crypto Price News For Tuesday, May 13

Unlocking ASX Trading Success: Car Group Limited - Monday, May 12

Elliott Wave Technical Analysis: Mastercard Inc. - Monday, May 12

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more