Elliott Wave Technical Analysis Day Chart: New Zealand Dollar/U.S. Dollar

Image Source: Pixabay

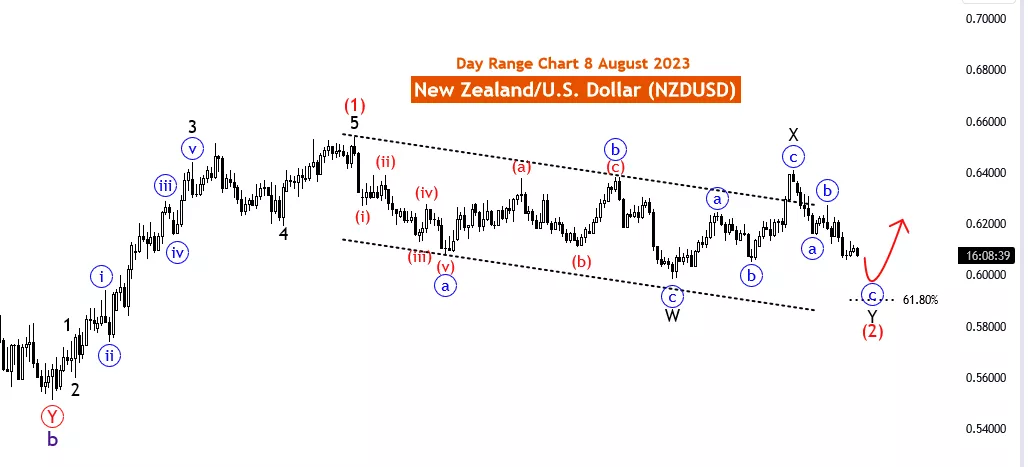

NZDUSD Elliott Wave Analysis Trading Lounge Day Chart, 8 August 2023

New Zealand Dollar/U.S.Dollar (NZDUSD) Day Chart

NZDUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag in subwave Y

Position:Y of Red Wave 2

Direction Next Higher Degrees:after last downside expected move new trend will start

Details:Main corrective wave 2 likely to end at fib level 61.80 .Wave Cancel invalid level: 0.62263

On 8th August 23, the day chart of the New Zealand Dollar/U.S. Dollar (NZDUSD) pair is subjected to Elliott Wave analysis, indicating a counter-trend movement with a corrective mode. The function of the price movement is identified as counter-trend, while the mode is characterized as corrective.

The current structure is recognized as a Zigzag pattern within subwave Y, with the position of the price wave designated as Y of Red Wave 2. The projected direction for the next higher degrees indicates the anticipation of a new trend starting after the completion of the last downside movement.

The analysis provides further details, suggesting that the main corrective wave 2 is likely to end at the Fibonacci retracement level of 61.80. Traders and investors are advised to closely monitor the market, as the completion of the corrective wave 2 will mark a potential turning point in the price movement.

It is essential to note that the wave count provided will lose its validity if the NZDUSD price exceeds the level of 0.62263.

As of the specified date, 8th August 23, traders in the NZDUSD market should closely observe the counter-trend corrective movement and anticipate the completion of the main corrective wave 2. Counter-trend trading involves higher risks, and traders should exercise caution and implement effective risk management practices.

The analysis also suggests the potential for a new trend to emerge after the completion of the corrective wave. Traders should be alert for potential trend reversal signals and confirmation of the new uptrend before considering long positions.

While Elliott Wave analysis offers valuable insights into potential market patterns and price movements, traders should supplement it with other technical indicators and fundamental factors to create a comprehensive trading strategy. Market conditions can change rapidly due to various factors, including economic data releases, geopolitical events, and shifts in market sentiment. Therefore, traders should remain attentive and adaptable to changing market conditions.

Proper risk management practices are essential in all trading endeavors to protect capital and manage potential losses. By staying informed and utilizing a well-rounded approach to trading, traders can make more informed decisions and enhance their trading performance in the dynamic foreign exchange markets.

More By This Author:

Elliott Wave Technical Analysis: Texas Instruments, Monday, Aug. 7

Elliott Wave Technical Analysis: Polkadot/U.S. Dollar (DOTUSD)

Nasdaq Technical Analysis: Wave 4 Completion In Sight, Traders Prepare For Opportunities

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817