Elliott Wave Technical Analysis: British Pound/Australian Dollar - Thursday, March 27

GBPAUD Elliott Wave Analysis – TradingLounge

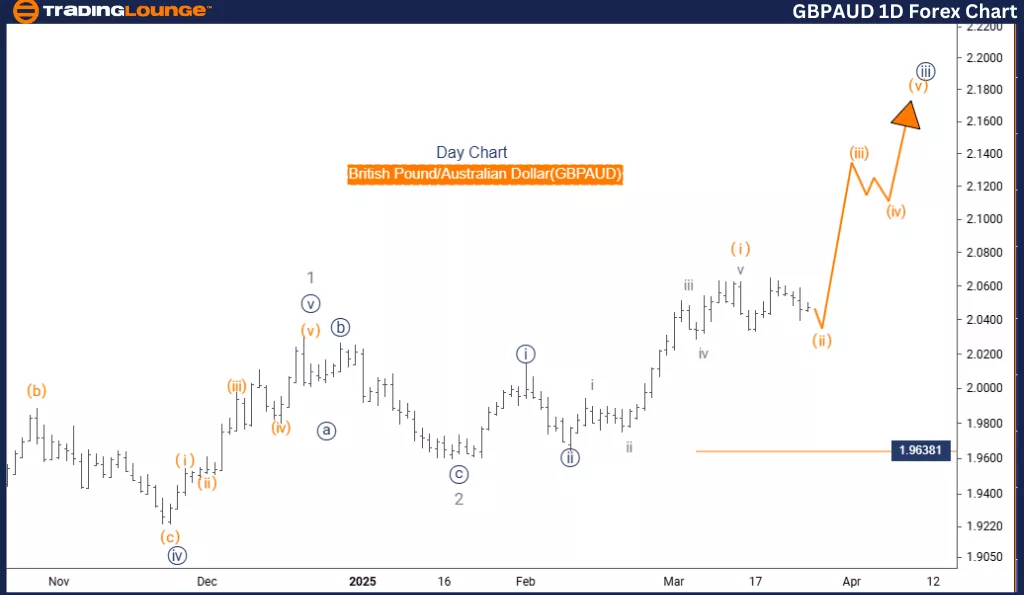

British Pound / Australian Dollar (GBPAUD) Daily Chart

GBPAUD Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Orange Wave 2

- Position: Navy Blue Wave 3

- Next Higher Degree Direction: Orange Wave 3

- Wave Cancel Invalid Level: 1.96381

The GBPAUD daily chart outlines a detailed Elliott Wave analysis for the British Pound against the Australian Dollar. The pair is currently within a counter-trend correction, focusing on orange wave 2, which is forming as part of the broader navy blue wave 3.

Orange wave 1 appears completed, and now orange wave 2 is developing as a corrective phase. This retracement is expected to be a temporary move before the next upward leg—orange wave 3—takes shape.

Key Level to Watch

-

Invalidation Level: 1.96381

-

A move above this would challenge the current wave structure and may require re-analysis.

-

This analysis gives traders a broader market context, highlighting that the current pullback is part of a larger uptrend. Once this correction completes, the bullish momentum of orange wave 3 is anticipated to resume.

Understanding the wave relationships is essential. The development of orange wave 2 reflects both a mid-term retracement and a segment of the longer-term navy blue wave 3. Traders should look for classic corrective patterns—like three-wave structures or sideways consolidation—that typically form during such corrections.

Trading Insight

This framework can help traders make informed decisions during this correction. It's essential to watch price behavior near the invalidation level and assess it within the larger bullish outlook shown on the daily chart.

British Pound / Australian Dollar (GBPAUD) 4 hour Chart

GBPAUD Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Orange Wave 2

- Position: Navy Blue Wave 3

- Next Higher Degree Direction: Orange Wave 3

- Wave Cancel Invalid Level: 1.96381

The 4-hour chart of GBPAUD reveals a counter-trend view, where the currency pair is undergoing a correction within an overall bullish structure. The main focus is on orange wave 2, which is unfolding as part of the larger navy blue wave 3 pattern.

Orange wave 1 has completed with a strong upward impulse. The market is now in the process of forming orange wave 2, a corrective move before the next rally.

Key Level to Monitor

-

Invalidation Level: 1.96381

-

If the price breaches this point, it would invalidate the current wave count, signaling a need for reassessment.

-

This corrective phase appears to be temporary and part of a larger bullish movement. Once wave 2 concludes, the analysis expects orange wave 3 to resume the uptrend. The 4-hour chart offers an ideal view for tracking short-term trading opportunities.

Wave degree relationships are crucial here. Orange wave 2 serves as both a short-term correction and a key leg within the larger navy blue wave 3. Traders should watch for typical corrective formations such as three-wave patterns or sideways movements that usually emerge in such setups.

Trading Insight

This setup offers valuable clues for traders aiming to enter long positions after the current pullback ends. Close attention should be paid to the invalidation level to ensure disciplined risk management. The 4-hour chart can assist in capturing potential bullish momentum once the correction completes.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Forecast: Block, Inc.

Elliott Wave Technical Analysis: Caterpillar Inc. - Wednesday, March 26

Elliott Wave Technical Analysis: New Zealand Dollar/U.S. Dollar - Wednesday, March 26

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more