Daily Market Outlook - Wednesday, May 7

Image Source: Pixabay

Equity-index futures climbed overnight as news of trade negotiations between China and the US boosted optimism that tensions between the world’s two largest economies might ease. Futures for the S&P 500 and Nasdaq 100 rose 0.6% after it was announced that US and Chinese officials would meet this week in Switzerland. European stocks were set to gain, while Asian markets edged up 0.1%, having earlier risen as much as 0.7%, supported by China’s decision to cut its policy rate to stimulate economic growth. Meanwhile, the dollar index rebounded, breaking a three-day losing streak, and gold fell 1.4%. The Indian rupee weakened by 0.2%, and Mumbai stocks dipped 0.1% as investors shifted attention from military tensions between India and Pakistan to global trade talks. On Tuesday, India and the UK concluded a major trade deal, while Pakistan’s stock market plunged more than 6%. The forthcoming US-China meeting marks the first formal trade discussions since President Donald Trump imposed sweeping tariffs last month, primarily targeting China. While the easing of trade tensions has provided a temporary lift to markets ahead of the Federal Reserve's rate decision on Wednesday, any sustained market rally will depend on the outcome of these talks.

On the macro slate today Fed’s Powell is expected to reiterate ‘wait and see’ stance from April Chicago speech The Federal Reserve is widely anticipated to maintain the Fed Funds target rate at 4.25-4.50% following the conclusion of its April meeting. With no updates to economic projections or the ‘dot plot,’ attention will centre on any changes to the statement and Powell’s press conference messaging. It is likely that the statement will be revised to reflect the Q1 GDP contraction, replacing the current phrasing that ‘activity has continued to expand at a solid pace.’ Additionally, adjustments will acknowledge the implementation of the reduced pace of quantitative tightening (QT) approved during the previous meeting. However, the broadly worded ‘guidance’ section may remain unchanged. Powell’s press conference could face distractions from questions regarding the controversy sparked by Trump’s remarks about potentially removing him. Nonetheless, when discussing the policy outlook, Powell is expected to echo the themes of his April 16 Chicago speech. Specifically, he will likely emphasize that the Fed is ‘well positioned to wait for greater clarity before considering any adjustments to our policy stance’ and reiterate that ‘without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans.’ This approach suggests Powell may lean more hawkish than market expectations, which currently assume three 25-basis-point rate cuts by the end of the year.

On the micro side of the slate, Novo Nordisk shares are expected to open under pressure this morning. The company has revised its full-year sales and profit projections downward because of lower-than-anticipated U.S. market penetration for its GLP-1 drugs, even though it reported operating profits in Q1 that exceeded expectations. The Danish pharmaceutical company is now forecasting sales growth of 13-21% and operating profit growth of 16-24% for 2025, which have both been adjusted from earlier estimates.

Overnight Newswire Updates of Note

- US And Chinese Officials To Meet Amid Trade War

- US Stock Futures, Dollar Rise On China-US Talks

- Bitcoin Rises As US-China Trade Talks Spark Bullish Crypto Bets

- Fed To Hold Rates Steady As Pressures Mount

- JPM: US Is ‘Not A Good Place To Hide’ In A Slowdown

- Bessent: US Could Announce Deals With Some Countries This Week

- UK And US In Intensive Talks On Economic Deal To Reduce Tariffs

- China Cuts Key Interest Rates To Buoy Economy

- China Newspaper: New Tool To Help Yuan Internationalisation

- RBNZ: US Tariffs Likely To Cause Slowdown In Major Economies

- AMD Will Take $700M Hit From Chip Restrictions To China

- Super Micro Issues Weak Guidance, Cites ‘Uncertainty, Tariff Impacts’

- EV Maker Rivian Cuts 2025 Production Target On Tariff Turmoil

- XAU Retreats Sharply Amid US-China Trade Talks Optimism

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD:1.1340-45 (387M), 1.1350-60 (1BLN), 1.1375 (270M), 1.1400 (1.7BLN)

- EUR/CHF: 0.9400 (261M). EUR/GBP: 0.8550 (480M), 0.8680 (760M)

- GBP/USD: 1.3345-50 (233M), 1.3375 (357M)

- AUD/USD: 0.6400 (693M), 0.6420 (208M), 0.6500 (306M)

- AUD/NZD: 1.0750 (210M). NZD/USD: 0.6000 (270M)

- USD/CAD: 1.3775-80 (1.1BLN), 1.3800 (633M)

- USD/JPY: 140.00 (1.4BLN), 140.70 (600M), 141.00 (750M), 141.25-35 (711M)

- 142.50 (1BLN), 143.00 (750M), 143.20 (1BLN), 143.75 (792M), 145.00 (1.1BLN)

- AUD/JPY: 92.00 (933M), 95.00 (645M)

CFTC Data As Of 2/5/25

- Equity fund managers have increased their net long position in S&P 500 CME by 18,407 contracts, bringing the total to 826,250. Meanwhile, equity fund speculators have reduced their net short position in S&P 500 CME by 10,014 contracts, now totaling 249,462.

- Speculators have also decreased their net short position in CBOT US Treasury Bonds futures by 22,131 contracts, which now stands at 85,556. Conversely, speculators have raised their net short position in CBOT US Ultrabond Treasury futures by 3,792 contracts, reaching 251,394. The net short position in CBOT US 2-year Treasury futures has been trimmed by 91,618 contracts, totaling 1,206,377. Additionally, there has been an increase in the net short position for CBOT US 5-year Treasury futures by 101,110 contracts, now at 2,292,544. Speculators have also cut their net short position in CBOT US 10-year Treasury futures by 34,569 contracts, down to 871,537.

- The net long position for Euro stands at 75,797 contracts, while the Japanese yen's net long position is 179,212 contracts. The Swiss franc holds a net short position of -24,314 contracts, and the British pound has a net long position of 23,959 contracts. Lastly, Bitcoin's net short position is -1,231 contracts.

Technical & Trade Views

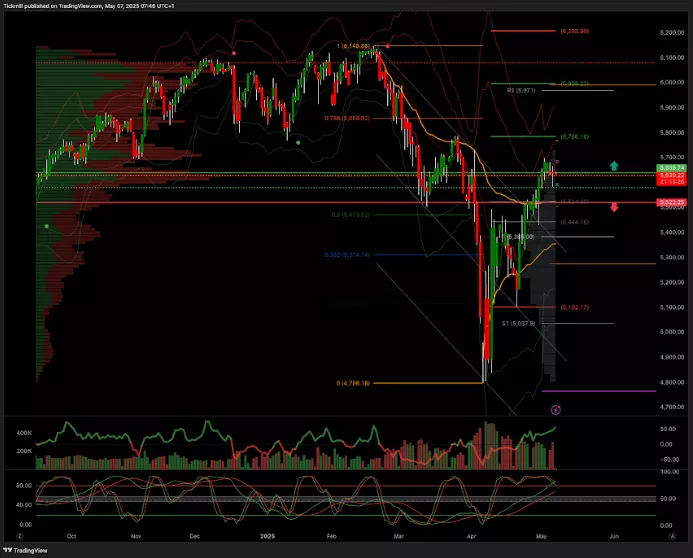

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5640 target 5790

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

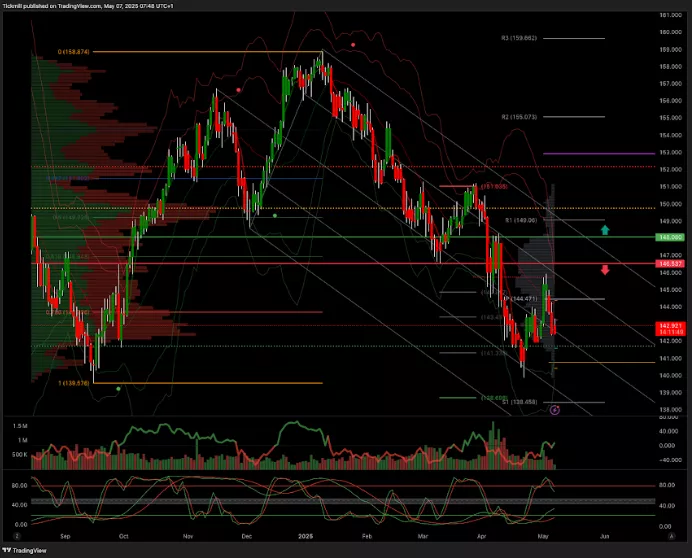

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, May 6

The FTSE Finish Line - Thursday, May 1

Daily Market Outlook - Thursday, May 1