Daily Market Outlook - Wednesday, May 14

Image Source: Unsplash

Asia's main stock index increased, driven by the technology sector, as investors anticipated earnings reports from major Chinese tech companies this week. A gauge of regional tech stocks gained for the fourth consecutive day following a spike in US chipmakers on Tuesday, after Nvidia Corp. and Advanced Micro Devices Inc. announced they would provide semiconductors for a $10 billion data-center project with a Saudi Arabian AI firm. US equity futures remained mostly stable. Tencent Holdings Ltd., China's most valuable company, is set to release its earnings on Wednesday, while Alibaba Group Holding Ltd. will follow on Thursday. These results may shed light on how the foremost companies in the sector are managing amidst a volatile geopolitical landscape and indicate whether Chinese tech stocks might continue to recover. Chinese shipping and port stocks rose amid optimism that the easing of the trade conflict between the US and China will lead to a resurgence in shipping demand and freight rates. Ningbo Marine, Nanjing Port, and Ningbo Ocean Shipping all surged to the 10% daily limit.

Equity indices have generally performed well following the recent de-escalation in the US-China trade war. Since Liberation Day at the beginning of April, financial markets have shown varied performance. Notably, the S&P 500 has increased by approximately 4.5% since April 1. In the commodities sector, there has been a partial reversal of the initial reactions that occurred after Liberation Day, although it is not complete. Gold, for example, is about 7% below its mid-April peak but remains roughly 4% higher since the start of April. The reduction in tariff rates has contributed to these trends, although we haven't returned to pre-Liberation Day levels. This suggests that gold's gains reflect both inflation concerns and risk aversion due to ongoing uncertainties.

In the foreign exchange market, the Dollar has rebounded by about 3% from its April lows but is still down roughly 3% from its opening level in April. This aligns with the notion that, despite some rollback of tariffs, the overall episode has weakened demand for USD assets. In the bond market, the theme of curve steepening persists, particularly with US Treasuries experiencing a bear steepening move. This, along with signals from the FX market, indicates softer demand for long-term US bonds, reflecting a less optimistic view on US assets. Real yield movements, not changes in breakeven inflation, drive this, leaving the 30-year US Treasury yield above 4.90%. A potential test of the 5% mark could attract broader market attention.

April's US consumer price report showed a slight downside surprise, with the headline at 0.22% m/m compared to a 0.3% estimate, reducing the y/y rate to 2.31% from 2.39%. Core inflation was slightly better at 0.24% m/m and 2.78% y/y. The decline was mainly due to softer transport prices, with no clear tariff impacts visible. Despite reduced tensions in the China tariffs issue, overall tariff levels remain high (around 16-17%), discouraging businesses and consumers from making changes. Importers face a stagnant period for the next 90 days. The Fed seeks clarity on how firms will manage the tariff shock, whether it leads to a one-time price increase or further effects, which will take time to determine.

Today's Macro Highlights: Key speakers include BoE's Breeden, ECB's Nagel, Cipollone & Holzmann, and Fed's Waller, Daly & Jefferson. Additionally, we will release the Riksbank minutes and Spain's final April CPI.

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1150 (916M), 1.1160-65 (1.1BLN), 1.1175 (1.6BLN)

- 1.1200 (952M), 1.1250 (511M)

- USD/CHF: 0.8450 (235M). EUR/CHF: 0.9310 (410M), 0.9325-30 (281M)

- GBP/USD: 1.3170-75 (547M), 1.3300 (230M)

- AUD/USD: 0.6475 (1.3BLN), 0.6500 (1.5BLN)

- NZD/USD: 0.5855 (375M), 0.5875 (382M)

- USD/CAD: 1.3860 (441M), 1.3910 (441M), 1.4000 (543M)

- USD/JPY: 145.10 (900M), 148.00-05 (457M), 148.50 (640M)

CFTC Data As Of 9/5/25

- Speculators raised their net short position in CBOT US Treasury bonds futures by 10,233 contracts to a total of 95,789. They also increased their net short position in CBOT US Ultrabond Treasury futures by 13,381 contracts, bringing it to 264,775.

- In addition, speculators elevated their net short position in CBOT US 2-year Treasury futures by 14,416 contracts, resulting in a total of 1,220,793. The net short position for CBOT US 5-year Treasury futures went up by 3,952 contracts to 2,296,496. The net short position for CBOT US 10-year Treasury futures increased by 81,631 contracts, reaching 953,168.

- Equity fund managers reduced their net long position in the S&P 500 CME by 13,088 contracts, bringing it to 813,162. Meanwhile, equity fund speculators raised their net short position in the S&P 500 CME by 6,469 contracts, totaling 255,931.

- The net long position for the Japanese yen stands at 176,859 contracts, the euro at 75,719 contracts, and the British pound at 29,235 contracts. The Swiss franc has a net short position of -23,574 contracts, and Bitcoin's net short position is -1,781 contracts..

Technical & Trade Views

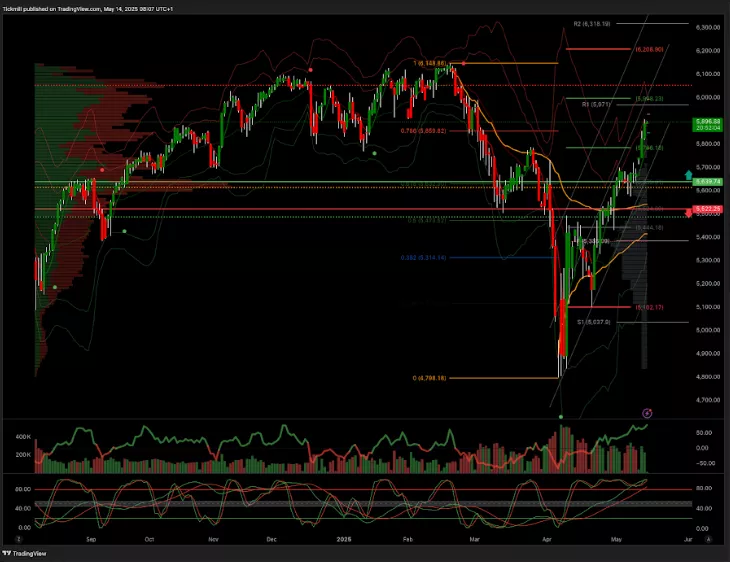

SP500 Pivot 5750

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5790 target 5900

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

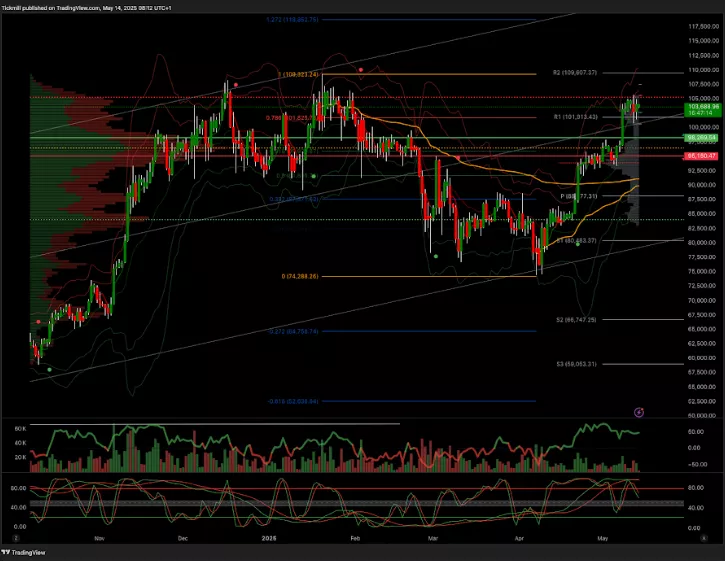

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, May 13

Daily Market Outlook - Tuesday, May 13

The FTSE Finish Line - Monday, May 12