Daily Market Outlook - Tuesday, May 13

Image Source: Pixabay

Most Asian stock markets experienced gains, buoyed by a surge in US equities, as optimism surged that the US-China trade agreement signals the conclusion of a full-scale tariff conflict.

Japanese stocks led the region’s increases, with the Topix rising for the 13th consecutive day, while major indexes in Australia and Taiwan also saw advances. Meanwhile, the Hang Seng Index declined alongside US stock futures after both had surged on Monday. Treasuries gained slightly in Asia, while the dollar weakened. The widespread return of risk appetite follows a Monday announcement by trade negotiators from the world's two largest economies that indicated a decrease in tariffs. In a meticulously coordinated joint statement, the US reduced duties on Chinese goods from 145% to 30% for a period of 90 days, while Beijing lowered its tax on most products to 10%. The optimism surrounding the US-China discussions led to the S&P 500 Index soaring by 3.3% on Monday, surpassing its level prior to President Donald Trump’s announcement of extensive tariffs on April 2. A spike in large tech stocks pushed the Nasdaq 100 back into a bull market, just about a month after it had declined 20% from its previous peak. Nonetheless, the effects of Trump’s trade conflict are expected to continue influencing global markets for an extended time. In Japan, Prime Minister Ishiba remarked on Monday that his administration would not accept any initial trade deal with the US that omits a resolution regarding automobiles. In China, the initial relief appears to be waning, as some investors now view the agreement as lessening the likelihood of increased economic stimulus from Beijing. Others are beginning to reassess the economic repercussions of the forthcoming tariffs. The Hang Seng China Enterprises Index fell by as much as 1.9% after a 3% increase on Monday, while the CSI 300 Index showed little change in its early response to the trade agreement.

The latest ONS report on the UK labour market initially seemed reassuring for the MPC, concerned with inflationary wage growth. In March, private sector pay growth was 5.6% 3m/y, slightly below the May MPR estimate. However, HMRC data for April, reflecting the National Living Wage increase, showed median pay growth rising to 6.4% y/y. Meanwhile, payroll employment fell by 33k in April after a 47k decline in March, with the hospitality sector hit hardest due to National Insurance changes. This highlights a divergence between employment and pay growth, mirroring the MPC's split on rate decisions. Taylor emphasises employment risks, while Lombardelli focuses on wage growth. With ongoing data quality issues, the labour market outlook remains uncertain.

Today's macro highlights: US CPI and NFIB, speeches from UK Chancellor Reeves, BoE's Bailey and Pill, ECB's Escriva and Makhlouf, and the German ZEW report.

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1000 (742M), 1.1010-20 (338M), 1.1060 (448M)

- 1.1100-05 (448M), 1.1145-50 (1.5BLN), 1.1175 (295M)

- 1.1200 (366M), 1.1225 (695M), 1.1290-00 (2.4BLN), 1.1325 (650M)

- USD/JPY: 143.00 (2BLN), 145.50 (351M), 146.00-10 (528M)

- 146.75 (567M), 147.00 (251M)

- USD/CHF: 0.8235 (469M). EUR/GBP: 0.8405 (686M), 0.8695 (580M)

- GBP/USD: 1.3080-90 (344M), 1.3200 (930M)

- AUD/USD: 0.6235-40 (1.16BLN), 0.6400 (318M), 0.6425-30 (487M)

- 0.6545 (1.4BLN). NZD/USD: 0.5955 (496M)

- USD/CAD: 1.3870-80 (1.33BLN), 1.3885 (577M), 1.3895-00 (546M)

CFTC Data As Of 9/5/25

- Speculators raised their net short position in CBOT US Treasury bonds futures by 10,233 contracts to a total of 95,789. They also increased their net short position in CBOT US Ultrabond Treasury futures by 13,381 contracts, bringing it to 264,775.

- In addition, speculators elevated their net short position in CBOT US 2-year Treasury futures by 14,416 contracts, resulting in a total of 1,220,793. The net short position for CBOT US 5-year Treasury futures went up by 3,952 contracts to 2,296,496. The net short position for CBOT US 10-year Treasury futures increased by 81,631 contracts, reaching 953,168.

- Equity fund managers reduced their net long position in the S&P 500 CME by 13,088 contracts, bringing it to 813,162. Meanwhile, equity fund speculators raised their net short position in the S&P 500 CME by 6,469 contracts, totaling 255,931.

- The net long position for the Japanese yen stands at 176,859 contracts, the euro at 75,719 contracts, and the British pound at 29,235 contracts. The Swiss franc has a net short position of -23,574 contracts, and Bitcoin's net short position is -1,781 contracts..

Technical & Trade Views

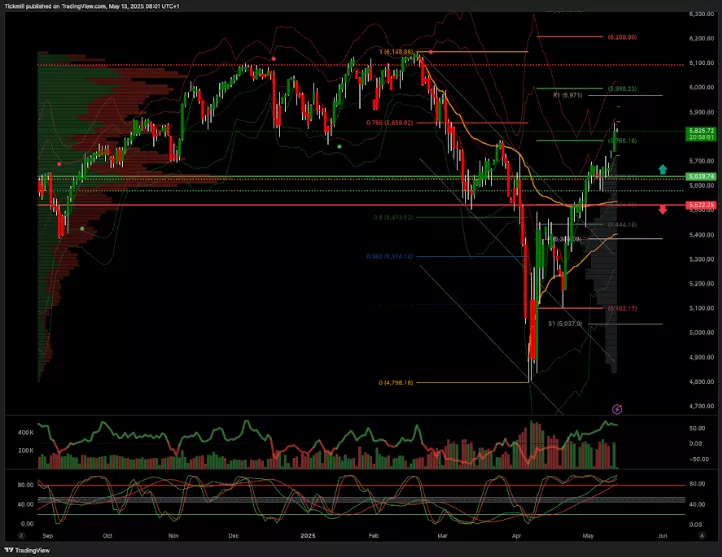

SP500 Pivot 5750

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5790 target 5900

- Below 5500 target 5385

(Click on image to enlarge)

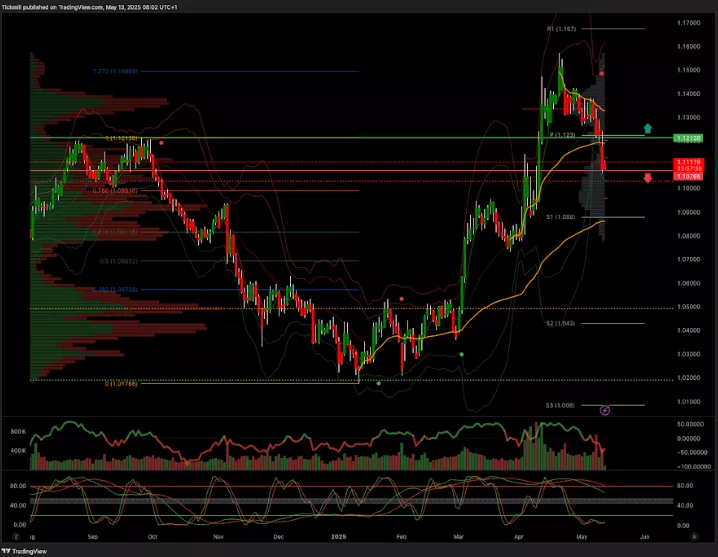

EURUSD Pivot 1.11

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

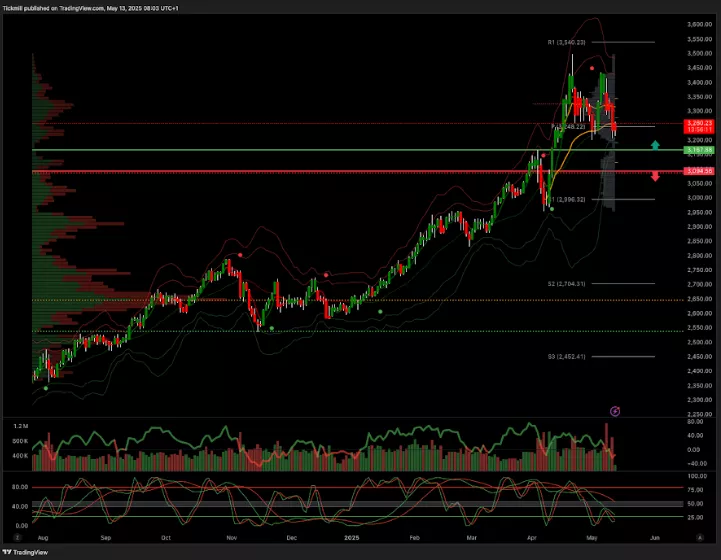

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 96.7k

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, May 12

S&P 500 Weekly Action Areas & Price Targets - Monday, May 12

Daily Market Outlook - Monday, May 12