Daily Market Outlook - Wednesday, June 4

Image Source: Pixabay

Asian equities rebounded for the first time in four days as data showed resilience in the US labor market, easing fears that Trump’s tariff policies are pushing the global economy toward a slowdown. The Asian regional benchmark rose, while South Korea’s Kospi Index surged 2.5% following the election of a new president, ending six months of political instability. The Dollar dipped , and the 10-year Treasury yield declined by 1 basis point to 4.44%. US equity-index futures remained mostly flat, while European stock futures edged up 0.2%. Meanwhile, Asian semiconductor stocks rallied alongside their US counterparts, buoyed by a recovery in AI-driven commerce. Ahead of the US payrolls report, an unexpected rise in job vacancies boosted market sentiment, lifting both the S&P 500 and Nasdaq 100. Those gains helped offset investor worries after the OECD cautioned that Trump’s aggressive trade policies are slowing global economic growth, with the US among the most affected. In corporate developments, Toyota shares plunged as much as 13%—the steepest drop in nine months—after announcing a privatisation deal. The plan faced heavy criticism from investors and analysts, who argued it undervalues the company significantly. Separately, Trump escalated steel and aluminium tariffs to 50% from 25%, fulfilling his pledge to support domestic manufacturers. The move, effective at 12:01 AM Washington time on Wednesday, was framed as essential for national security. In commodities, oil prices stabilised after two consecutive days of gains.

Yesterday’s shift in market sentiment appears partly driven by stronger news on U.S. job openings yesterday. The job openings rate increased to 4.4% of employment from 4.3%, signalling higher demand for labour. However, this should be viewed alongside a 0.1 percentage point rise in the job layoff rate to 1.1% and a 0.1 percentage point decline in the quits rate to 2.0%. A lower quits rate suggests fewer opportunities for employees to switch jobs for better pay, indicating a cooling in labor market mobility. These figures, reflecting April data, largely exclude the impact of firms' responses to the subsequent economic disruptions caused by tariffs. Even so, the unemployment-to-job openings ratio continues to point to a tight labor market. Among Federal Reserve speakers overnight, Cook noted that tariffs are likely to weaken employment but emphasised that price stability remains the primary concern in policy decisions. Similarly, Bostic cautioned that more significant progress on inflation is needed before considering any rate adjustments. The Fed appears to be facing a challenging trade-off between conflicting trends in employment and inflation.

The UK government will publish its Spending Review next week, outlining departmental budgets for 2026-27 to 2028-29 and capital spending for an additional year. While typically less impactful for markets than budgets, this review may draw investor attention due to fiscal constraints. The IFS projects average real terms spending growth of 1.2% annually, but prioritisation of health and defence could lead to cuts in other areas. Market sensitivity may increase if political backlash arises, with potential opinion poll pressure or government infighting complicating the upcoming Autumn Budget.

Today's macro slate features: Final May services PMIs, US ADP employment data, ISM services report, the Beige Book, comments from Fed’s Bostic, and the Bank of Canada's rate decision.

Overnight Headlines

- Germany Plans €46B Corporate Tax Breaks To Revive German Economy

- Germany’s Auto Lobby: China Rare Earth Curbs Risk Halting Production

- OECD: Trump Tariffs Expected To Dampen Global Growth

- Fed’s Goolsbee: Tariffs May Boost Infl. Faster Than They Slow ECN

- Bureau Of Labour Statistics To Correct Minor Errors In April Jobs Data

- Australia’s GDP Growth Stalls At 1.3% Y/Y In Q1, Misses Estimates

- BoC Likely To Hold Rates As Uncertainty Mounts

- Trump Orders 50% Steel, Aluminium Tariffs To Begin On June 4

- UK Races To Secure US Steel Tariff Deal Before Levies Double

- UK Chancellor Defends Investment Blitz Against Cuts Narrative

- Israel Aid Plan Unravels As Troops Fire On Palestinians

- Nvidia Surpasses Microsoft To Become Most Valuable Company

- Palantir Shares Surge On Trump Momentum Despite Tech Gloom

- Dollar General Raises Outlook After Tariff Reassessment

- HPE Raises Fiscal-Year Profit Forecast On Tariff Exemption

- CrowdStrike Shares Sink After Sales Forecast Underwhelms

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1140 (650M), 1.1190-00 (3.7BLN), 1.1250 (1.1BLN)

- 1.1300 (436M), 1.1325-35 (1.4BLN), 1.1350-60 (2.2BLN)

- 1.1370-75 (1.2BLN), 1.1380-85 (622M), 1.1400 (1.3BLN)

- 1.1450 (1.8BLN), 1.1500 (810M)

- USD/JPY: 140.00 (1.4BLN), 141.25 (300M), 143.50 (698M)

- 144.15-25 (1.02BLN), 145.00 (897M). EUR/JPY: 163.50 (684M)

- USD/CHF: 0.8120-25 (770M), 0.8175 (296M), 0.8200 (260M)

- 0.8225 (350M)

- EUR/GBP: 0.8325 (338M), 0.8370 (201M)

- AUD/USD: 0.6415-25 (339M), 0.6435-45 (842M), 0.6450-60 (1.8BLN)

- 0.6465-70 (330M)

- NZD/USD: 0.5725 (600M), 0.5900 (402M), 0.6100 (351M)

- USD/CAD: 1.3630 (300M), 1.3725 (275M), 1.3740 (629M)

- 1.3745-50 (1.33BLN, 1.3765 (424M), 1.3800 (632M)

CFTC Data As Of 30/5/25

- The net long position in Japanese yen stands at 164,012 contracts, while the euro net long position is at 79,474 contracts. The British pound holds a net long position of 35,379 contracts. Conversely, the Swiss franc indicates a net short position of -25,483 contracts, and Bitcoin shows a net short position of -2,274 contracts.

- Equity Fund Managers have reduced their net long position in the S&P 500 CME by 17,892 contracts, bringing it down to 854,528 contracts. Moreover, Equity Fund Speculators have decreased their net short position in the S&P 500 CME by 39,763 contracts, resulting in a total of 257,465 contracts.

- Speculators have also cut their net short position in CBOT US Treasury bonds futures by 18,143 contracts, which now stands at 53,890 contracts. Similarly, CBOT US Ultrabond Treasury futures' net short position has been lowered by 12,663 contracts to 233,472 contracts. The net short position for CBOT US 2-Year Treasury futures has been trimmed by 147,428 contracts to reach 1,119,903 contracts. Additionally, the net short position for CBOT US 10-Year Treasury futures has been reduced by 81,827 contracts to 769,604 contracts. On the other hand, speculators have increased their net short position in CBOT US 5-Year Treasury futures by 57,296 contracts, leading to a total of 2,333,237 contracts.

Technical & Trade Views

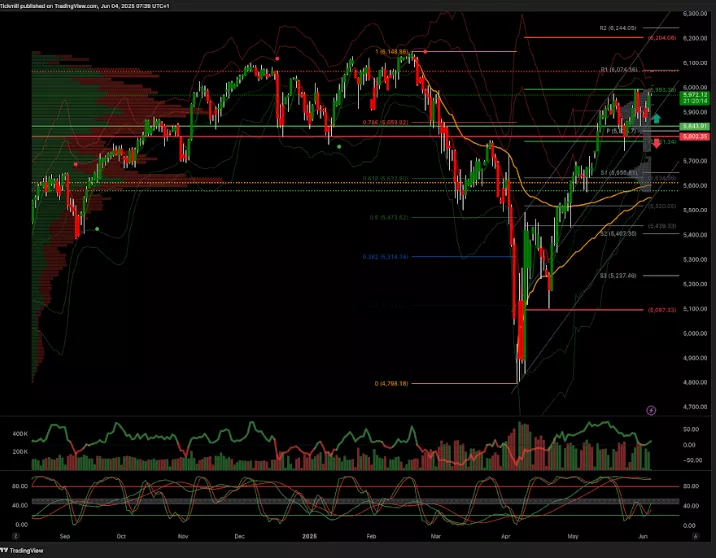

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5610

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.1060 target 1.09

(Click on image to enlarge)

GBPUSD Pivot 1.3290

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.3290 target 1.38

- Below 1.32 target 1.31

(Click on image to enlarge)

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 3400 target 3600

- Below 3365 target 2981

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, June 3

Daily Market Outlook - Tuesday, June 3

The FTSE Finish Line - Monday, June 2